Editor’s note: This is a continuation of weekly articles about the use of put options on commodity futures as a primary marketing tool to lock-in a minimum price or as a price “enhancer” of forward contracts or HTA contracts.

The last article discusses the process to maximize the income from the sale of a put option, which is built upon in this article.

Since put options increase in value as the futures contract price declines, the first objective to maximize put income is to sell the put when the underlying futures contract price is as low as possible. That is much easier than picking the top because commodity prices usually spend one to three months near the low, but only one to four days near the top.

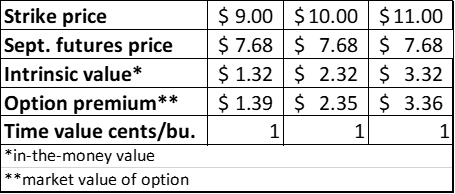

The last issue of this series was written Aug. 4. Here is the value of the options on Aug. 4, which we have been tracking since early April. September futures were at $7.68:

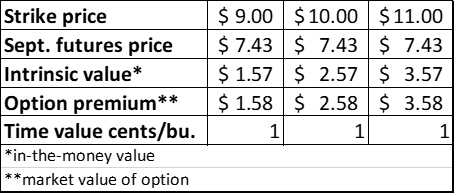

Here is the current information as of early morning Aug. 18 with September wheat at $7.43:

These three options all have the same time value of one cent this morning. That is because there is very little doubt that they will be in-the-money on expiration day on Aug. 26. Two weeks ago, there was more doubt, and that is why the time value was a bit more.

September futures price has declined 23 cents the past two weeks. The $9 put increased in value about 19 cents as it lost 6¼ cents of time value while gaining intrinsic value. The $10 put value gained 23 cents even though it lost 3½ cents of time value and the $11 put gained almost 22 cents as it lost 3¼ cents of time value.

Obviously, with the decline of more than 22 cents in the futures price, the gain of the intrinsic value of the options more than offset the loss of time value. Note, however, September wheat traded to $8.20¾ on Aug. 11, 77 cents above where it is this morning!

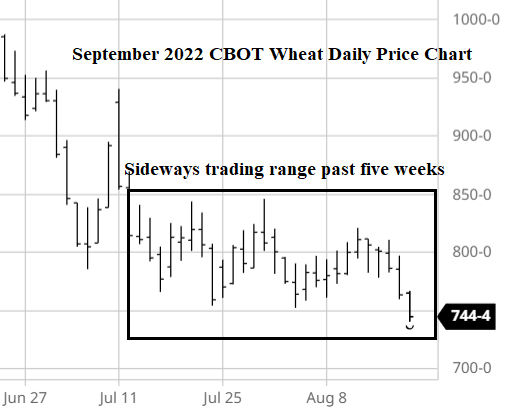

On these three puts, that was over $3,800 of value per 5,000 bushel option. The good news is commodity futures usually trade sideways near the low for one to three months. That makes it much easier to pick a price to sell the put than it is to pick a price to sell a call. Take a look at the September wheat daily price chart as of the morning of Aug. 18:

I love the length of time available to select a futures price reasonably close to the low to sell the puts. These options have a week of life left. The futures price could drop another buck; it also could rally a buck. That is a potential $10,000 swing, but futures will probably continue its sideways range through August.

If one grabbed the price available this morning, the $9.00 put was worth $7,900. Dan and Joe, our two example farmers, paid $1,450 for the $9.00 put. The $10 put is worth $12,900. Dan and Joe bought it for $1,450 after wheat rallied a dollar after they bought the $9 put. Don and Junior bought the $10 put for $2,950 put, so they have $9,950 of profit. After wheat futures rallied another dollar, they bought the $11 put for the same price as the $10 put, $2,950. The $11 put is now worth $17,900, a nice $14,950 profit on one option, which is 5,000 bushels.

To sell or not to sell this morning? That is the question for wheat put owners. It is the lowest September futures have traded since Jan. 18, but $7.43 is a high price for wheat from a historical perspective. Ukraine is now exporting wheat and Russia, the world’s top wheat exporter, is in the midst of harvesting its largest wheat crop ever.

Next week will be expiration day. We see how these puts works out.

This is part 17 in a series. To learn more, read:

Part one: Put options add value to your cash grain sales

Part two: Hedge your crops with no margin calls

Part three: Enhance profit opportunities with put options

Part four: Put options and no margin calls

Part five: When does a put option have no potential value?

Part six: Why are put options so expensive?

Part seven: Use puts to manage grain marketing risk

Part eight: What is time value of an option?

Part nine: How to calculate time value of an option

Part 10: Use puts with Hedge-to-Arrive to increase farm income

Part 11: Sample timeline to explain how wheat puts work

Part 12: Put options compliment futures contracts

Part 13: Put options: Understand premium and delta

Part 14: Find the best combination of marketing tools

Part 15: How to liquidate the put option for optimum value

Part 16: Maximize income from put option sale

Wright is an Ohio-based grain marketing consultant. Contact him at (937) 605-1061 or [email protected]. Read more insights at www.wrightonthemarket.com.

No one associated with Wright on the Market is a cash grain broker nor a futures market broker. All information presented is researched and believed to be true and correct, but nothing is 100% in this business.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like