Editor’s note: This is part 11 in a series discussing how to use options to enhance your grain marketing.

Very few people understand the relationship between the price change of a futures contract and the resulting price change of its options. For ten weeks, we explained how the daily price change of the 2022 September CBOT wheat futures contract impacted the value of its $9.00 and $10.00 put options. Now that we have explained the option vocabulary, the concept of options on futures contracts, and a detailed day by day explanation of price action, we will accelerate the process and explain five days of futures price changes and two of its options.

April 28

September wheat futures contract was down 5 cents today, so all puts should have increased in value. The $10 put settled at 51 5/8, up 2 1/8 cents. The $9.00 put settled at 20¼, up 2¾ cents.

Today, a September wheat futures hedge made $250, the $10 put made $106.25, and the $9 put made $137.50. Normally, because the $10 put is a dollar closer than the $9 to being in-the-money, the $10 put should have increased in value several cents more than the $9 put, but nothing is 100% in this business.

April 29

The September CBOT wheat futures price was down 15¾ cents today. A futures hedge made $787.50.

The $10 September put premium increased 10 cents, which is $500. The $9 September put premium increased 5 cents, which is $250.

About how much did the value of the cash wheat growing in the field change? Since cash wheat is hedged on the futures, cash wheat is worth about 16 cents less today than yesterday.

May 2

September wheat futures settled unchanged today at $10.58¼. Therefore, the intrinsic (aka in-the-money) value of all the September options was unchanged. What about the time value? The options lost one day of life, so the probability of the futures increasing the value is a bit less as well as volatility continues to calm down, further reducing the time value. The $10 put settled at 60¾ cents, down 7/8 cent. The $9.00 put settled at 25¼ cents, unchanged.

May 3

September wheat futures settled at $10.49½ today, down 8¾. All puts should have increased in value since the futures price was lower.

The $10 put gained 1 3/8 cent while the $9.00 put gain just an eighth of cent as another day of time was value lost. A short futures short position made $437.50 today, the $10 put made $87.50 and the $9 put gained $6.25. The wheat in the field or bin lost about $437.50, because cash price = futures plus basis.

May 4

September wheat futures settled at $10.79¼ today, up 29¾. All puts should have lost value since the futures price was sharply higher.

The $10 put lost 9¾ cents while the $9.00 put was unchanged at 25 3/8 cents. A short futures short position lost $1,487.50, the $10 put lost $487.50 and the $9 put lost nothing. The wheat in the field or bin gained about $1,487.50 because cash price = futures plus basis. Note the $9.00 put was so far out of the money ($1.49) before yesterday’s trading began, what does another 29¾ cents make? Obviously not enough to change the price of the $9 put.

It is unusual for futures price to move 30 cents and an option value does not change, but it happens. There is not a direct correlation between futures price change and option price change. Yes, we have the delta, but that is a computer-generated number as to what the price correlation should be between options and futures. But options are traded bid and ask, just like the futures and farm auctions. Sometimes, the auction price makes no sense.

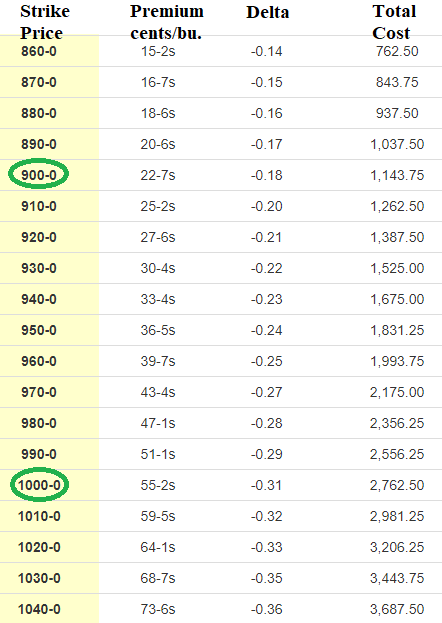

Here are the option prices after today action:

This is part 11 in a series. To learn more, read:

Part one: Put options add value to your cash grain sales

Part two: Hedge your crops with no margin calls

Part three: Enhance profit opportunities with put options

Part four: Put options and no margin calls

Part five: When does a put option have no potential value?

Part six: Why are put options so expensive?

Part seven: Use puts to manage grain marketing risk

Part eight: What is time value of an option?

Part nine: How to calculate time value of an option

Part ten: Use puts with Hedge-to-Arrive to increase farm income

Wright is an Ohio-based grain marketing consultant. Contact him at (937) 605-1061 or [email protected]. Read more insights at www.wrightonthemarket.com.

No one associated with Wright on the Market is a cash grain broker nor a futures market broker. All information presented is researched and believed to be true and correct, but nothing is 100% in this business.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like