Editor’s note: This is part 13 in a series discussing how to use options to enhance your grain marketing.

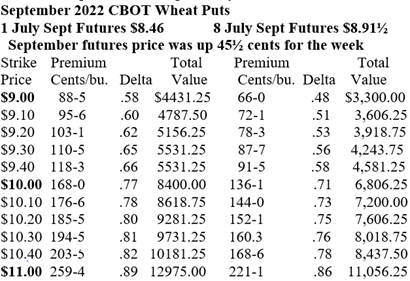

CBOT September 2022 wheat was up 45½ cents the week ending July 8. Since the futures price was up, the puts with strike prices within a few dollars of the futures price decreased in value.

Why? The higher the futures price moves, the less value a put has.

For example, on July 1, September wheat settled at $8.46. The $9 put gives the buyer of the option the right to sell September wheat futures at $9.00. When the futures price is $8.46, the $9.00 put was 54 cents in-the-money, meaning if the option was exercised (exchanged for a futures contract sold at $9.00), the resulting futures position would have 54 cent profit. But on July 8, with September wheat at $8.91½, the put was just 8½ cents in-the-money.

Most people would rather own an option 54 cents-in–the-money than an option 8½ cents in the money. What about you?

Below are some September put options and their values on July 1 when September wheat was at $8.46 on the left, and on the right, the same puts and values on July 8 when September wheat was at $8.91½.

Option values are called “premiums” and they are listed in cents per bushel down to an eighth of a cent. A premium of 88-5 is 88 and five-eighths cents per bushel of option. There are 5,000 bushels in one option, the same as a futures contract, which makes sense since options are the right to buy or sell a futures contract.

A hedge in one’s own hedging account or as an HTA with a merchandiser, each 5,000-bushel contract lost $2,725 this past week. The value of the wheat in the bin or in the field gained about the same – plus or minus basis. That is text-book how a hedge works.

Sept $9.00 put lost 22-5 cents per bushel and $1132.5 per option.

Sept $10.00 put lost 31-7 cents, $1,593.75 per option.

The $10 put lost more premium than the $9 put because its strike price of $10 was closer to the futures price than the $9.00 put. One could say the $10 put was more sensitive to price changes than the $9.00 put. That sensitivity is measured by the delta. The delta of each option is in the chart.

If an option had a delta of .48, that means the price of the option is expected to change 4.8 cents for each ten cent change in the futures contract price. However, as you know, nothing is 100% in this business. The futures price and the option price are both derived independently of each other by an auction.

In this series of put lessons, we have several example farmers using different combinations of marketing tools to price their 2022 wheat:

Dan contracted wheat at $11.00 on a HTA and bought the $9 and $10 puts for 29 cents each.

Joe contracted wheat at $11.00 on a HTA and bought the $10 and $11 puts for 59 cents each.

Don, who did not sell the futures, but bought a $9 put for 29 cents and then, when the futures gained a dollar, he bought a $10 put for 29 cents.

Junior, who did not sell futures, but bought the $10 put for 59 cents and then bought the $11 put for 59 cents.

Dan and Joe are using the HTA as their primary marketing tool and the puts as a price enhancer. Don and Junior are using the put options as the primary marketing tool. Can they use the HTA also? Yes, but will they? What could happen that would motivate them to use an HTA?

This is part 13 in a series. To learn more, read:

Part one: Put options add value to your cash grain sales

Part two: Hedge your crops with no margin calls

Part three: Enhance profit opportunities with put options

Part four: Put options and no margin calls

Part five: When does a put option have no potential value?

Part six: Why are put options so expensive?

Part seven: Use puts to manage grain marketing risk

Part eight: What is time value of an option?

Part nine: How to calculate time value of an option

Part ten: Use puts with Hedge-to-Arrive to increase farm income

Part eleven: Sample timeline to explain how wheat puts work

Part twelve: Put options compliment futures contracts

Wright is an Ohio-based grain marketing consultant. Contact him at (937) 605-1061 or [email protected]. Read more insights at www.wrightonthemarket.com.

No one associated with Wright on the Market is a cash grain broker nor a futures market broker. All information presented is researched and believed to be true and correct, but nothing is 100% in this business.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like