Editor’s note: This is part 15 in a series discussing how to use options to enhance your grain marketing.

This article continues the discussion on how to use put options to make more profit through better marketing. Previous articles were educational and focused on:

what are commodity options,

how their values change in relation to the underlying futures contract,

how put options can be used as the primary grain marketing tool or as a secondary marketing tool to add value to an HTA or forward contract.

This week we shift to the process of how to liquidate the put option position at optimum value. Let’s take a look at how the options’ values changed the week ending last Friday, July 22, 2022 September CBOT after September wheat settled at $7.59, down 17¾ cents for the week:

$9.00 put $1.40-5, up 15-2 cents for the week

$10.00 put $2.42-7, up 19-5 cents for the week

$11.00 put $3.41-3, up 18-1 cents for the week

Our four mythical farmers all added value to their 2022 wheat last week because the puts increased in value. As of July 22, their HTA values were:

Dan: $14.25. Not a bad price considering he sold HTA at $11 and the contract high was $12.85. He bought the $9 and $10 puts for 29 cents ($11.00 + $1.40 + $2.43 - $0.29 - $0.29)

Joe: $15.66. Not a bad price considering he sold HTA at $11 and the contract high was $12.85. He bought the $10 and $11 puts for 59 cents ($11.00 +$2.43 +$3.41 - $0.59 - $0.59).

Don: $10.84 as Don did not lock-in a futures price, he only bought the $9 and $10 puts for 29 cents each ($7.59 + $1.40 + $2.43 - $0.29 - $0.29).

Junior: $12.25 like Don, did not lock in the futures price, but he bought the $10 and $11 puts for 59 cents per bushel each ($7.59 + $2.43 + $3.41 - $0.59 - $0.59).

Here’s the procedure

Now, let’s move to the procedure to get the these puts sold for maximum value. It is a lot easier to pick a price near the bottom of a future market’s annual range than the top. As you know, grain prices do not stay near the top more than a few days. That creates big stress for owners of call options trying to pick a price near the top. But futures will stay near the bottom of the range for weeks and often months. That is sweet for owners of puts.

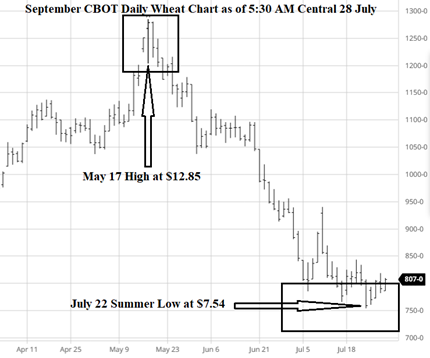

In the chart below, you can see September wheat futures price was above $12.00 only eight days and settled above $12.00 only four days. The contract high was $12.85 on May 17.

Since then, September wheat traded below $8 on July 6th and a total of eleven days below $8. It settled below $8 four days so far this month. With the Northern Hemisphere wheat harvest going full bore, the seasonal trend being sideways to lower for another month, world’s leading wheat exporter, Russia, in the midst of harvesting its largest crop ever and Ukraine’s old and new wheat about to be loaded (supposedly) on ships with a great spring wheat crop coming on in North America, the wheat futures price is unlikely to have much of a rally between now and when September options expire in four weeks. Picking a futures price near the low should be as easy catching fish in barrel with a net. By the way, before the war started, September wheat was trading for several months between $7.50 and $8.00, so there is major technical support at the $7.50 level.

That is, no doubt, a major reason why the low this month for September wheat is $7.54. Here is the September 2022 CBOT wheat chart as of yesterday morning:

The task at hand is to pick a futures piece as close to the low as reasonably possible between now August 26th. The good news is the options have time value to be captured. The bad news is time value makes picking the day to sell the puts more difficult as the time value erodes quickly these last few weeks of trading. That is what we will discuss next week.

This is part 15 in a series. To learn more, read:

Part one: Put options add value to your cash grain sales

Part two: Hedge your crops with no margin calls

Part three: Enhance profit opportunities with put options

Part four: Put options and no margin calls

Part five: When does a put option have no potential value?

Part six: Why are put options so expensive?

Part seven: Use puts to manage grain marketing risk

Part eight: What is time value of an option?

Part nine: How to calculate time value of an option

Part ten: Use puts with Hedge-to-Arrive to increase farm income

Part eleven: Sample timeline to explain how wheat puts work

Part twelve: Put options compliment futures contracts

Part thirteen: Put options: Understand premium and delta

Part fourteen: Find the best combination of marketing tools

Wright is an Ohio-based grain marketing consultant. Contact him at (937) 605-1061 or [email protected]. Read more insights at www.wrightonthemarket.com.

No one associated with Wright on the Market is a cash grain broker nor a futures market broker. All information presented is researched and believed to be true and correct, but nothing is 100% in this business.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like