Editor’s note: This seventh essay discussing how to use options to enhance your grain marketing was written Saturday, April 23, 2022.

When the futures market opens Sunday evening, you can spend 30 cents a bushel for the right to lock-in an HTA price for your corn at $6.40 on December futures. December corn futures settled at $7.24 yesterday.

If a corn farmer buys corn puts to lock in a floor price for his corn, does he want those puts to make him money?

A floor price by definition is the lowest price a farmer will be paid for his grain. We all want to be paid more than the floor price for our grain. So, if a farmer paid 30 cents to lock in $6.40 HTA, he wants that price insurance policy to expire worthless, because, if it does, he will be selling his corn above the floor price.

I recently had a prospective client ask, “Do your clients with hedge accounts make money trading futures and options most years?” The truth is no, they don’t because the purpose of a hedge is to shift the risk of price change to somebody else. If a farmer buys puts in his hedge account every year to lock in a floor price, he wants to lose money every year in the hedge account.

A speculation account is where the trading profits are supposed to accumulate.

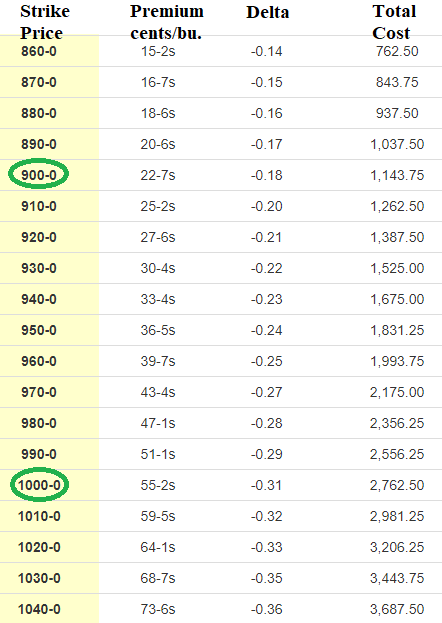

Yesterday, September wheat settled 2 cents lower at $10.73¼. Lower futures price means the puts should have increased in value. On the chart below, you can see the $10.00 September put settled at 58 and 1/8 cents. That was down 1 cent! The $9.00 put settled at 23½ cents, up 5/8 of a cent.

Don’t be thinking put options do not work. Remember this:

On expiration day, if September wheat is at $8.60, absolutely the $9.00 put will be worth 40 cents and the $10.00 put will be worth $1.40.

If September wheat on expiration day is at $9.42, absolutely the $9 put will be worthless and the $10 put will be worth 58 cents.

If that is not perfectly clear, ask yourself: If I had the choice to sell September wheat at $10.00 or $9.42 or $9.00, which price would I choose to sell wheat futures?

If one buys puts to lock in a floor price, he wants those puts to expire worthless.

On the other hand

However, if you buy puts and contract your crop with an HTA (or forward contract), then you absolutely want those puts to make money because the purpose was to enhance the HTA price. You want to sell the puts for more than you paid for them. If the puts expire worthless, the cost of the put is subtracted from the HTA price.

This is part seven in a series. To learn more, read:

Part one: Put options add value to your cash grain sales

Part two: Hedge your crops with no margin calls

Part three: Enhance profit opportunities with put options

Part four: Put options and no margin calls

Part five: When does a put option have no potential value?

Part six: Why are put options so expensive?

Part eight: What is the time value of an option?

Part nine: How to calculate time value of an option

Part ten: Use puts with Hedge-to-Arrive to increase farm income

Part eleven: Sample timeline to explain how wheat puts work

Wright is an Ohio-based grain marketing consultant. Contact him at (937) 605-1061 or [email protected]. Read more insights at www.wrightonthemarket.com.

No one associated with Wright on the Market is a cash grain broker nor a futures market broker. All information presented is researched and believed to be true and correct, but nothing is 100% in this business.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like