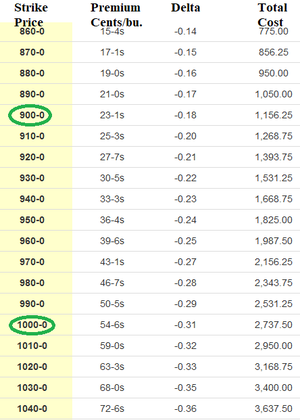

September wheat settled at $11.05 on April 19th, down 18¼ cents. the previous day, the wheat futures price was up 22¼ cents, so the premiums of the puts were down. So, the lower futures price increased the value of all puts. Why?

A put option gives the buyer the right to sell wheat futures at a set futures price, aka the strike price. As the futures price moves lower, every put option increases in value.

The September 2022 $10 put gained $237.50 of value on the 19th. If one had a short September futures position that day, he would have made $912.50. Which is better: making $237.50 or making $912.50?

The September 2022 $10 put gained $237.50 of value on the 19th. If one had a short September futures position that day, he would have made $912.50. Which is better: making $237.50 or making $912.50?

No brainer, but there are other factors to consider. The big one: the owner of a put will never be asked to add money to maintain his option positon. A short futures position could require an unlimited amount of additional money because each day the futures closes higher, that many cents per bushel is transferred from the futures account that sold futures (short position) to the futures account that bought futures (long position).

Let’s say the futures price goes to $25 the first week of June like spring wheat did in February 2008. From yesterday's settlement of $11.05 to $25 is $13.95 per bushel loss times 5,000 bushels per contract = $69,750 of loss that must be replaced in the futures account penny for penny every day all the way up if one maintains that short futures position.

You already know the buyer of a put will never have to add money to his options account to maintain his option position. What do you suppose the right to sell September wheat at $10 is worth when the September futures price is at $25 the first week in June?

Not much, as in zip zero because no one would expect wheat to decline below $10 by August 26th when the option expires. Someplace along the way, a farmer or his banker will decide the short September wheat position needs to be liquidated to stop the mounting losses and the margin calls. Let’s say liquidation is done as $15.05. So, the loss on the futures to whenever the futures position is liquidated at $15.05 is $5 per bushel or $25,000 for each futures contract.

If a wheat farmer had sold the futures and then liquidated at $15.05, he desperately wants the price of wheat to continue higher. The worst thing that could happen to him is he loses money all the way up in the futures market, liquidates his short position at a loss and then wheat futures price goes to $6, where he might be selling his cash (physical bushels of) wheat before it goes lower.

He then subtracts his futures loss from the cash price he received for his wheat and there will not be very much left over. A sad story indeed and that is why we never recommend buying back a HTA or a forward contract when a futures price is making multi-year highs. But sometimes, there is no choice. Grain merchandisers, as all futures traders know, it is possible for anyone to run out of money, including Cargill.

Ok, here is a question for you to ponder: if the September futures price goes to $25 in early June and then to $6 in late August, when did that $10 September 2022 wheat put option become absolutely, positively worthless?

This is part four in a series. For more, read:

Part one: Put options add value to your cash grain sales

Part two: Hedge your crops with no margin calls

Part three: Enhance profit opportunities with put options

Part five: When does a put option have no potential value?

Part six: Why are put options so expensive?

Part seven: Use puts to manage grain marketing risk

Part eight: What is time value of an option?

Part nine: How to calculate time value of an option

Part ten: Use puts with Hedge-to-Arrive to increase farm income

Part eleven: Sample timeline to explain how wheat puts work

Wright is an Ohio-based grain marketing consultant. Contact him at (937) 605-1061 or [email protected]. Read more insights at www.wrightonthemarket.com.

No one associated with Wright on the Market is a cash grain broker nor a futures market broker. All information presented is researched and believed to be true and correct, but nothing is 100% in this business.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like