Editor’s note: This is part 12 in a series discussing how to use options to enhance your grain marketing.

Last week’s comments compared put option value changes with the price change of the underlying futures contract over a four-week period. The obvious conclusion was a futures hedged position would make or lose money faster than an option, but an option would never require a farmer to make a margin call.

We recommend the HTA as the primary pricing tool and puts to add value to the HTA.

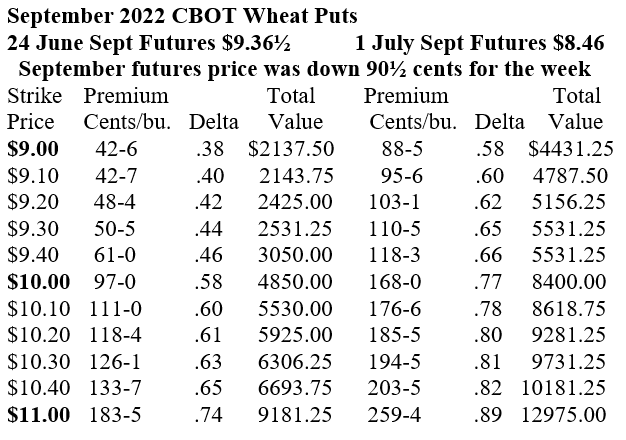

The week ending last Friday, July 1, saw September CBOT wheat down 90½ cents. Below is the chart that lists put prices on June 24 on the left and July 1 on the right.

Note the price changes of the $9.00, $10.00 and $11.00 puts. The “Total Value” column is 5,000 bushels per put option times the premium (cents per bushel).

The $9 put increased in value almost 46 cents per bushel.

The $10 put increased in value 71 cents per bushel.

The $11 put increased in value almost 76 cents.

We had recommended clients to sell wheat on HTA contract and place orders to buy puts at strike prices $1 higher for the same price per bushel as the first put if – and when – possible. We suggested folks start at 29 cents for the $9 put or 59 cents for the $10 put. With the war in Ukraine, wheat went high enough the 29 cent guys were able to buy the $9 and $10 puts for 29 cents each. The 59 cent guys were able to buy the $10 and the $11 puts for 59 cents.

To take profit on the puts, the object is to sell the puts when the futures are close to the bottom because that is when the puts are most valuable. The market spends a few days near the top and two to four months near the bottom. Therefore, it is lot easier to pick a futures price near the bottom than it is to pick a price near the top.

If one had decided to sell the puts on July 1, the 29 cent guys’ two puts made $1.98 net to add to their HTA price. The 59 cent guys’ two puts had a profit of $3.09 per bushel to add to their HTA price. That profit margin is simply the purchase price of the puts subtracted from the selling price of the puts and then adding the profit from both puts together.

Historically, $8.50 is a very good price for wheat, and pricing 2022 wheat at $8.50 was the right thing to do in November 2021. After all, we had not seen $8.50 wheat for ten years. If $8.50 was your HTA price, you sold $4.35 below the contract high of $12.85. Ouch!

We recommended our clients buy put options to make some of the money on the way down they did not make on the way up. The low cost 29 cent puts on July 1 could have made that $8.50 contract a $10.48 contract.

The expensive 59 cent puts on July 1 could have made that $8.50 wheat HTA an $11.59 contract. And that was before wheat futures dropped another 61 cents the first two days this week after the 4th of July holiday.

Think about those new crop corn and bean HTA contracts you. You could have bought a $7.00 December corn put for 25 cents. With December corn at $5.96 today, that $7.00 put is worth $1.26. Wouldn’t it be sweet to add a dollar a bushel to your 2022 corn price? Guess what: you may get another chance to buy that $7 put for 25 cents yet this month.

This is part 12 in a series. To learn more, read:

Part one: Put options add value to your cash grain sales

Part two: Hedge your crops with no margin calls

Part three: Enhance profit opportunities with put options

Part four: Put options and no margin calls

Part five: When does a put option have no potential value?

Part six: Why are put options so expensive?

Part seven: Use puts to manage grain marketing risk

Part eight: What is time value of an option?

Part nine: How to calculate time value of an option

Part ten: Use puts with Hedge-to-Arrive to increase farm income

Part eleven: Sample timeline to explain how wheat puts work

Wright is an Ohio-based grain marketing consultant. Contact him at (937) 605-1061 or [email protected]. Read more insights at www.wrightonthemarket.com.

No one associated with Wright on the Market is a cash grain broker nor a futures market broker. All information presented is researched and believed to be true and correct, but nothing is 100% in this business.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like