Editor’s note: This is part 10 in a series discussing how to use options to enhance your grain marketing. It was written after the close Monday, April 25, 2022.

On April 27, 2022, September wheat settled at $10.89¾, down 2¾ cents. The $10 September put settled at 49½ cents, up 2 5/8 cents.

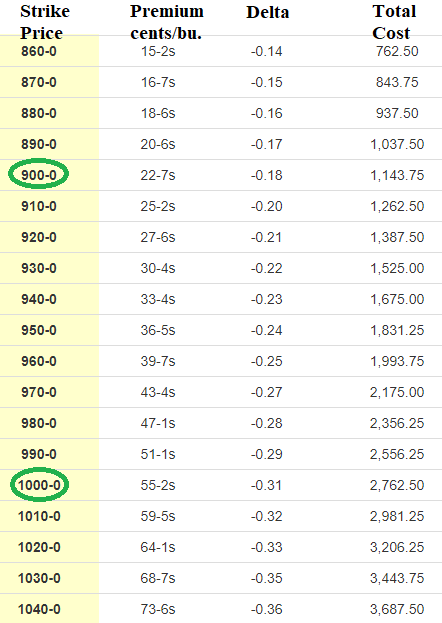

With the price change in both the futures and the put option at 2+ cents, one would think the delta was near 1, which does happen when an option is very deep in-the-money. But the $10 put is not in-the-money at all; at today’s close, the $10 put was 89¾ cents out-of-the-money with a delta of .32, as you can see on the chart below.

To give you an example of a put with a delta near 1, the $17.00 September wheat put has a delta of .94! The September $17.00 wheat put is $6.10 in-the-money with the futures at $10.90.

That is an example of a deep-in-the-money option.

A person with a short September futures position would have made $137.50; the $10 put and the $9 both made $131.25; the $10 put should have gained several cents more than the $9 put because the $9 put is a dollar further out-of-the-money than the $10 put.

Do the math

Puts on wheat, corn, soybeans, oats, canola, rice – the math is the same. Here is how the math works in practical application:

Given: July wheat HTA at $7.00. Your merchandiser bought a $10 put at a cost of 50 cents a bushel.

Your merchandiser will attach that put and its expense to your $7.00 HTA. The $7.00 HTA becomes a $6.50 minimum price contract, meaning the worst that can happen to you is you will be paid an HTA price of $6.50. However, when that put is sold, if it is sold, the income from that sale will be added to the $6.50 HTA price. Examples:

The $10 put (bought for 50 cents) is sold when September wheat is at $6.50 on expiration day. Since it was expiration day, there would be no time value, but the intrinsic value would be the $10 strike price minus the futures price of $6.50 = $3.50; thus, $3.50 is added to the minimum price of $6.50 and the HTA becomes a $10 HTA. The net cash price paid for the wheat would be $10 plus or minus the basis.

The put can be sold any day. Let’s say you thought $7.20 on July 5 was the low for September futures, so you sold the put. The $10 put would be $2.80 in-the-money and, with about 50 days of life, there would be 10 or so cents of time value, to go with the $2.80 of intrinsic (in-the-money) value, grossing $2.90 on the sale of the put. That $2.90 gets added to the $6.50 minimum price and the HTA price would become $9.40.

If the put was sold for 10 cents, the HTA price would be $6.60.

If you had the HTA at your merchandiser and you bought the put in your own options account, the HTA would be treated as a “stand-alone” transaction and the put in your own option trading account would also be a “stand alone” transaction. Your books would show profit or loss on the put transaction as hedge gain (or loss) to (or from) the HTA price at the elevator. If the option expired worthless in your own option trading account, you would still be paid the HTA price ($7.00 in the example) when the wheat was delivered, but your books would show an income of $7 (+or- basis) a bushel minus a hedge loss of 50 cents.

This is part ten in a series. To learn more, read:

Part one: Put options add value to your cash grain sales

Part two: Hedge your crops with no margin calls

Part three: Enhance profit opportunities with put options

Part four: Put options and no margin calls

Part five: When does a put option have no potential value?

Part six: Why are put options so expensive?

Part seven: Use puts to manage grain marketing risk

Part eight: What is time value of an option?

Part nine: How to calculate time value of an option

Part eleven: Sample timeline to explain how wheat puts work

Wright is an Ohio-based grain marketing consultant. Contact him at (937) 605-1061 or [email protected]. Read more insights at www.wrightonthemarket.com.

No one associated with Wright on the Market is a cash grain broker nor a futures market broker. All information presented is researched and believed to be true and correct, but nothing is 100% in this business.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like