Last week we recommended our clients purchase September Soft Red Winter Wheat Put Options and most likely within the next two and half months, we will be recommending the purchase of December corn puts and November soybeans puts.

Why? In this blog we will present a series of educational explanations about put options.

Even though most of you do not grow wheat and did not buy wheat options, you need to understand how put options work and what they can do for you. Now is the time to expand your understanding of marketing tools.

Why buy puts? To make money; to add additional value to the HTA or cash price sales you have already made or will make.

Options are called “options” because the buyer of the option is buying opportunity, but not the obligation, to establish a futures position at a specific price for a defined length of time.

The buyer of a put option is buying the right, without the obligation, to sell a futures contract.

The fact there is no obligation to sell a futures contract is why the buyer of an option will never have to add more money to his or her option account if the market moves against you. After you pay for your option, no one will ever request more of your money to hold that option position; that is to say, no margin calls.

How it works

Our clients who bought $9.00 September SRWW puts bought the right to sell September SRWW futures at $9.00 any business day they wish to do so between the day they bought the put option until the close of trading on Aug. 26, 2022, which is the expiration date.

Some clients bought $10.00 September puts. They could have bought $9.10, $9.20, $9.30, etc., all the way up to $17.40 or all the way down to $3.20. These values are called strike prices.

The option’s market value, called its premium, trades in cents per bushel for 5,000-bu. contracts because the futures contracts are 5,000 bushels. The smallest price change (tic) of the premium’s value is one-eighth of a cent.

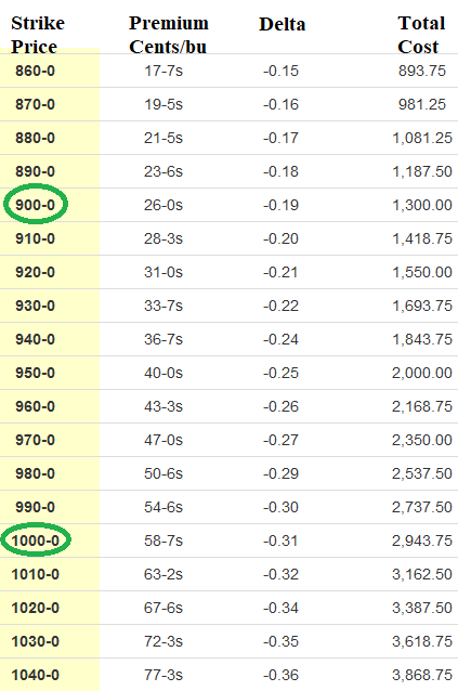

Below is the screenshot of September 2022 SRWW puts ranging from a strike price of $8.60 to $10.40 as of the close of business last week.

The $9.00 and $10.00 puts are circled. Note the column labels.

You can see the $9.00 put settled at 26-0; that means 26 and zero-eighths of a cent per bushel. The premium (cost, value) of the $9.00 put at the close was $1,300, which is 26 cents times 5,000 bushels.

Likewise, the $10.00 put settled at 58 and seven-eighths of cent per bushel for a total cost of $2943.75 per option.

September wheat futures settled at $11.01. Why would anyone pay 59 cents per bushel for the right to sell September wheat futures at $10.00 or 26 cents for the right to sell September wheat at $9.00?

Get comfortable with the vocabulary: premium, strike price, put option (aka: put), margin call, expiration date.

This is part one in a series. For more, read:

Part two: Hedge your crops with no margin calls

Part three: Enhance profit opportunities with put options

Part four: Put options and no margin calls

Part five: When does a put option have no potential value?

Part six: Why are put options so expensive?

Part seven: Use puts to manage grain marketing risk

Part eight: What is time value of an option?

Part nine: How to calculate time value of an option

Part ten: Use puts with Hedge-to-Arrive to increase farm income

Part eleven: Sample timeline to explain how wheat puts work

Wright is an Ohio-based grain marketing consultant. Contact him at (937) 605-1061 or [email protected]. Read more insights at www.wrightonthemarket.com.

No one associated with Wright on the Market is a cash grain broker nor a futures market broker. All information presented is researched and believed to be true and correct, but nothing is 100% in this business.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like