In earlier issues, Peter Paperfarmer explored call-option re-ownership strategies in preharvest marketing. Covered Cal investigated the value in selling call options before harvest. This blog introduces Uncle Buck, who purchases put options, or the right to sell futures, to establish a minimum price on grain before harvest.

Like Terry Timer and her neighbor Peter, Buck likes a timed approach and makes four equal sales of 20% of his insured bushels in March, April, May and June. He shares their minimum price objectives that assume a pricing opportunity above production costs. Buck buys at-the-money put options on new-crop futures (December corn and November soybeans).

At harvest, Buck’s price will be the same as Barney’s, plus any profit or loss from buying at-the-money put options and selling them at harvest.

While Peter and Buck both establish minimum prices, the timing of their exit differs from an options position. Peter sells his calls in mid-September, while Buck holds his puts until the harvest date in October. That makes Buck’s average corn price less than Peter’s.

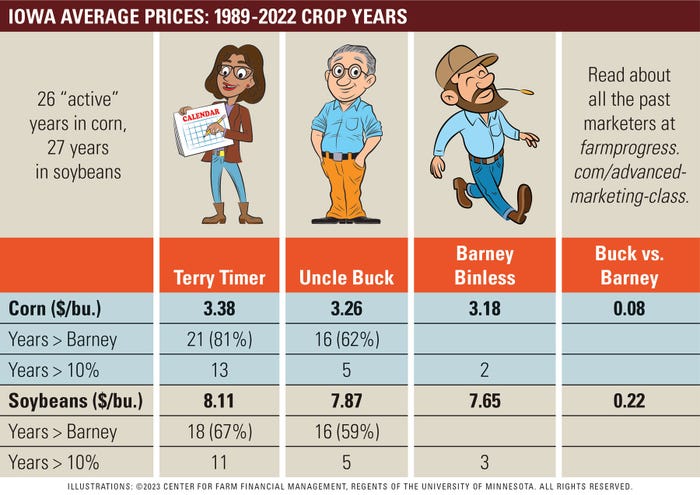

I’ll compare Buck’s results to Barney’s. As I did with Terry, I will focus on the 26 corn years and 27 soybean years when Terry and Buck were actively pricing grain before harvest (i.e., price opportunities were above production costs).

In corn, Buck received an average price 8 cents per bushel higher than Barney in 26 active years. He beat Barney in 16 of 26 years and enjoyed a 5-2 edge in “big” years with a price difference of 10% or more. In soybeans, Buck averaged 18 cents per bushel better than Barney in 27 active years. He beat Barney in 16 of 27 years and had a 5-3 edge in big years.

Most farmers have a paper farming strategy like Peter. Instead of selling futures like Peter, many combine a forward contract with call-option re-ownership. Should you use puts or calls to establish a minimum price? Your choice will be influenced by your storage plans after harvest. Paper farming with forward contracts and call options involves a delivery commitment; Buck and his put options do not.

Your choice will also be influenced by your opinion of basis. Paper farming with forward contracts and call options involves a basis commitment. Buck and his put options do not lock in the basis before harvest.

Lastly, if paper-farming with forward contracts, don’t price more than your insured bushels.

While Buck’s approach finds an advantage over the harvest price, options cost money. Be selective when using options.

Meet the rest of the crew:

Ed Usset is a grain market economist at the University of Minnesota, and author of the book “Grain Marketing Is Simple (It’s Just Not Easy).” Reach Usset at [email protected].

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

Read more about:

Grain StorageAbout the Author(s)

You May Also Like