In the last column, you met Justin Price, a preharvest marketer whose actions are based on price targets. His performance was interesting but less than awe-inspiring. The problem? Lofty price ambitions are admirable, but the highest targets too often led Justin to pass on some profitable opportunities, like the type that tend to appear in spring and early summer.

Aunt Tilly shares Justin’s preharvest objective to get 80% of expected production (and insured bushels) priced before harvest. But beyond that, Tilly is the opposite of Justin. While Justin is price-driven, Aunt Tilly is all about the timing of her sales, with a focus on spring and early summer when new-crop pricing opportunities are often better.

Another difference is production costs. Justin knows his costs and will not price grain at less than breakeven. Aunt Tilly ignores her costs of production, taking steps regardless of low prices.

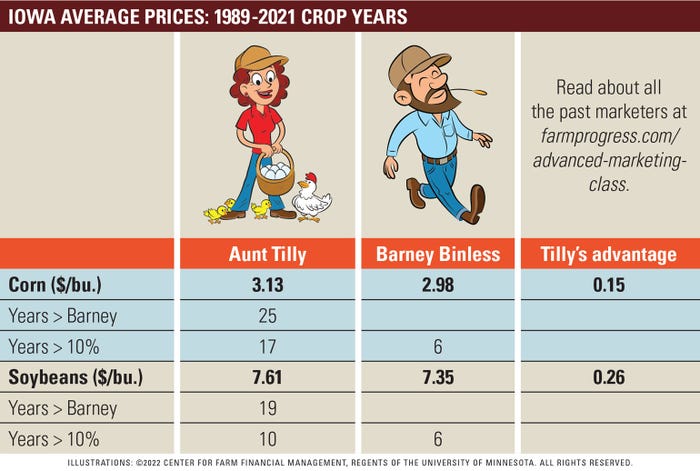

Aunt Tilly’s price is based on four equal sales of 20% of her crop in March, April, May and June, using December corn or November soybean futures on the Tuesdays between the fourth and 10th of each month. Basis is set (i.e., grain sold and hedge lifted) on the same Friday in October that Barney Binless sells grain. The rest of her crop — the 20% of uninsured bushels — are priced at Barney’s harvest price.

Barney’s corn price is set on the Friday between Oct. 12-18. His soybean price is set on the Friday between Oct. 5-11.

Aunt Tilly’s timed approach to preharvest marketing is better than Justin’s price-driven one. Her average price for corn and soybeans beat Justin’s (and Barney’s). Still, Tilly’s willingness to act at any price makes me uncomfortable. Do you recall those pandemic-induced low prices in spring 2020? Aunt Tilly marched forward, pricing new-crop grain with December corn and November soybean futures as low as $3.34 and $8.47 per bushel, respectively. These sales proved to be too early and too cheap, and well below her production costs.

I agree with Aunt Tilly’s focus on spring and early summer as a key time to pay attention to new-crop pricing opportunities. But I struggle with her insistence to act at any price. Tilly needs a minimum price objective.

Meet the rest of the crew:

Ed Usset is a grain market economist at the University of Minnesota, and author of the book “Grain Marketing Is Simple (It’s Just Not Easy).” Reach Usset at [email protected].

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like