Up to now, my marketing tips have focused on storage and post-harvest marketing strategies. The start of a new year tells me it is time to turn our attention to pre-harvest marketing strategies and pricing new crop grain. Let’s meet Justin Price, the first of a handful of characters who focuses on pre-harvest marketing.

Justin Price only pays attention to prices, with an objective of pricing 80% of his expected production with four “scale-up” sales before harvest, each representing 20% of his total crop. Justin is price-driven because he knows his costs, and his initial price target is consistent with his break-even cost of production.

The final three price targets are set at progressively higher levels. He makes no pre-harvest sales if new crop futures do not reach break-even, something that has occurred in 5 corn years and 4 soybean years since 1989, most recently 2020.

Here’s an example

In late September, he established 2022 new crop corn targets of $4.60, $4.95, $5.30, and $5.60 per bushel in the December futures contract. For soybeans, Justin set targets at $10.50, $11.20, $11.90, and $12.50 per bushel in the November futures contract. Prices have been strong, and he had 80% of his 2022 corn and soybean crops priced within three weeks of his November 1, 2021 start date.

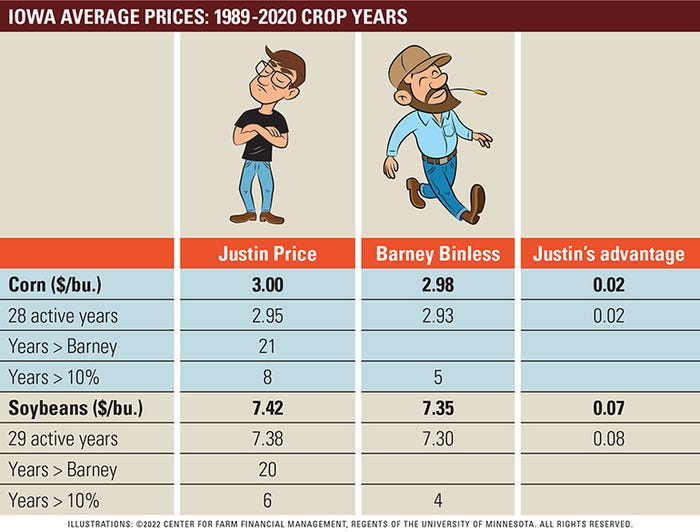

Let’s take a hard look at Justin’s performance relative to Barney and his harvest price over the past 33 years. Are you, like me, just a little less than impressed? Justin’s price-driven approach to pre-harvest marketing has garnered him an advantage of 2 and 7 cents per bushel, respectively, in corn and soybeans. And, yes, he beats Barney in nearly 2 of 3 years and he has a modest advantage in years with a price advantage of more than 10%.

These are positive but less than awe-inspiring results. What’s the downside to this strategy?

Justin’s performance speaks to the shortcomings of a marketing plan that relies solely on price objectives. I agree with his use of break-even production costs as a starting point. It is the other three “scale-up” price objectives that hold him back. Think about the years that offer good, but not great, pre-harvest pricing opportunities. Since 1989, there have been 19 years in the corn market and 14 years in soybeans when Justin made one or two sales at good prices but no more, because prices never reached his highest targets.

Lofty ambitions are admirable, but price targets that are too high might lead us to pass on some profitable opportunities.

Justin is price-focused and a little too stubborn. He needs to mix in some decision dates, or dates when he takes action despite a price that falls short of his loftiest price goals.

Meet the rest of the crew:

Up next: Aunt Tilley makes pre-harvest sales regardless of price

Ed Usset is a grain market economist at the University of Minnesota, and author of the book “Grain Marketing Is Simple (It’s Just Not Easy).” Reach Usset at [email protected].

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like