At a Glance

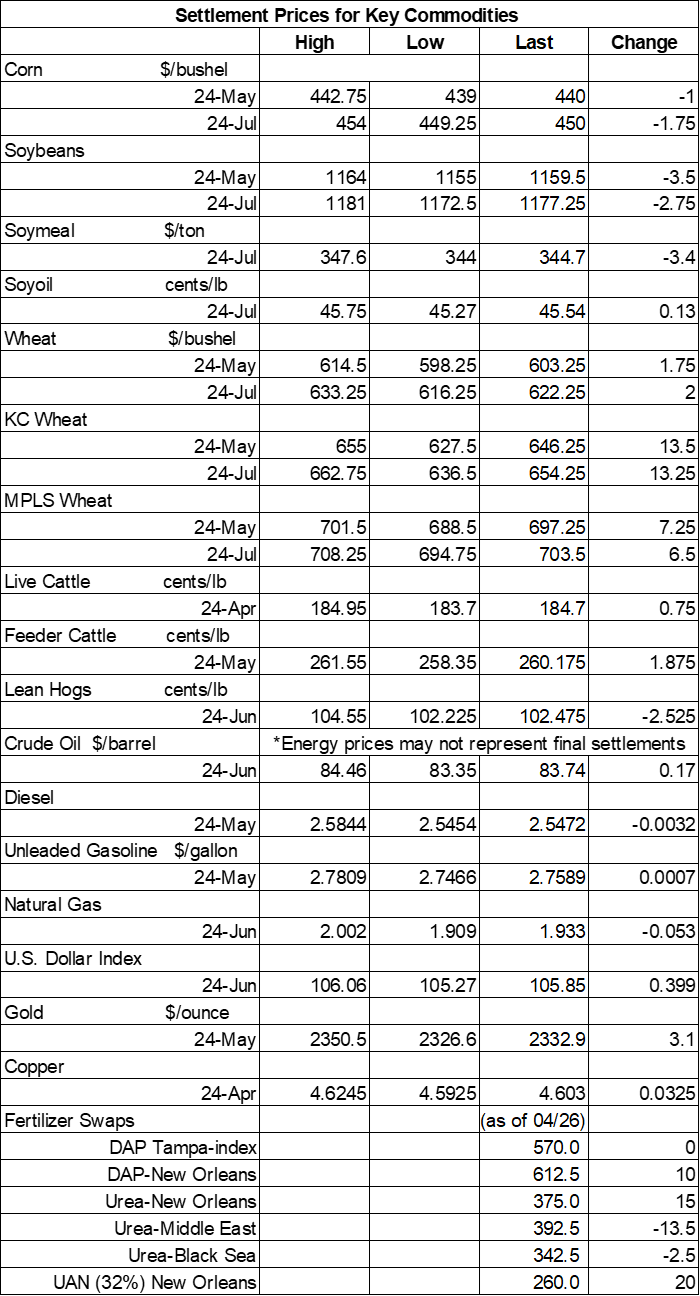

- Corn and soybean prices each close with losses of around 0.25%

- Wheat prices capture variable gains ranging between 0.25% and 2%

- Plus: What are this week’s “7 ag stories you can’t miss”?

The current wheat rally captured gains for the seventh consecutive session on Friday as traders continue to mull over adverse weather conditions affecting several key global production regions, including Europe and Russia. Corn and soybeans failed to follow suit, meantime, closing with modest losses after some net technical selling occurred today.

Ample wet weather – particularly in a band stretching from Louisiana all the way up through northern Minnesota and Wisconsin – will deliver between 1” and 2.5” to a large section of the central U.S. between Saturday and Tuesday, per the latest 72-hour cumulative precipitation map from NOAA. Later on, NOAA’s new 8-to-14-day outlook predicts more wet weather for parts of the Midwest and Plains between May 3 and May 9, with warmer-than-normal temperatures like for the entire central U.S. during this time.

On Wall St., the Dow shifted 183 points higher to 38,268 on a flurry of strong corporate earnings reports. Energy futures also made modest inroads on Friday, with crude oil up 0.25% to 0.5% this afternoon Diesel found fractional gains, while gasoline tracked 0.5% higher. The U.S. Dollar firmed moderately.

On Thursday, commodity funds were net buyers of corn (+3,000), soyoil (+500) and CBOT wheat (+3,000) contracts but were net sellers of soybeans (-1,500) and soyoil (-1,000).

Corn

Corn prices faded slightly lower after a round of technical selling on Friday, which was partly spurred by spring planting progress. However, wet weather over the weekend and into early next week could create delays in some areas. May futures slid a penny lower to $4.40, with July futures down 1.75 cents to $4.5025.

Corn basis bids remained steady across the central U.S. on Friday.

French farm office FranceAgriMer reported that 26% of the country’s 2024 corn crop has now been planted through April 22, up from 13% a week ago. However, wet conditions have kept plantings well below the prior five-year average of 51%. France is Europe’s top grain producer.

Ukraine’s grain exports during the 2023/24 marketing year are trending slightly below last year’s pace. Exports through April 26 include corn sales totaling 874.0 million bushels, plus another 565.9 million bushels of wheat sales. Ukraine is among the world’s top exporters of both commodities.

Algeria purchased at least 1.2 million bushels of animal feed corn and 30,000 metric tons of soymeal from optional origins in an international tender that closed earlier this week. The grain is for shipment by May 20.

Are you interested in capitalizing on a potential summer rally? Naomi Blohm, senior market adviser with Stewart Peterson, says there are several steps you can take now to prepare. That includes getting cash target price orders working to sell your remaining old crop corn, considering how you’re going to protect unpriced bushels of new crop corn and more. Blohm offers more details in today’s Ag Marketing IQ blog – click here to learn more.

Corn settlements on Thursday were for 495,558 contracts.

Soybeans

Soybean prices incurred minor losses of around 0.25% as South America’s harvest moves closer to the finish line, and with U.S. plantings just getting started. May futures dropped 3.5 cents to $11.5925, with July futures down 2.75 cents to $11.77.

The rest of the soy complex was mixed. May soymeal futures eroded more than 1% lower, while May soyoil futures found modest gains of less than 0.25%.

Soybean basis bids held steady across the central U.S. on Friday.

Argentina’s Buenos Aires grains exchange is contemplating whether to further trim its estimates for the country’s 2023/24 soybean production, which is currently at 1.874 billion bushels. That’s due to “below average” yields from initial harvest results in the country’s northern provinces. Total harvest progress has reached 22.5% so far, which is significantly below the prior five-year average.

Weather experts in South America are predicting that future El Niño and La Niña events will be more frequent – and more extreme. “The pattern has changed a lot," said Yolanda Gonzalez Hernandez, director of CIIFEN. “Where before there was no significant impact of the El Nino phenomenon, now they are occurring with more intensity. We are permanently breaking records at the local, national and global level in temperature anomalies.” Increased climate volatility in South America would obviously have market-moving effects on the grain market.

Soybean settlements on Thursday were for 329,453 contracts.

Wheat

Wheat prices finished Friday’s session with modest to moderate gains after traders engaged in a round of technical buying for the seventh consecutive session. May Chicago SRW futures added 1.75 cents to $6.04, May Kansas City HRW futures rose 13.5 cents to $6.4550, and May MGEX spring wheat futures gained 7.25 cents to $6.9825.

French farm office FranceAgriMer reported that 63% of the country’s current soft wheat crop is rated in good-to-excellent condition through April 22. That’s one point down from a week ago and noticeably below year-ago results of 94%. Ratings are also at the lowest level for this time of year since 2020.

A new report from USDA-FAS estimates that Moroccan wheat exports could reach 275.6 million bushels in the 2024/25 marketing year, due to difficult growing conditions this season that could lead to record low production. The report also suggests that Morocco could import an additional 68.9 million bushels in 2024/25.

And finally, if you haven’t visited FarmFutures.com in several days, our Friday feature “7 ag stories you can’t miss” is one easy way to quickly catch up on what’s been happening recently in the ag industry. The latest edition includes an update on when the Port of Baltimore could reopen, a look at nitrogen application timing and more. Click here to get started.

CBOT wheat settlements on Thursday were for 173,170 contracts.

About the Author(s)

You May Also Like