In my last blog post, we met grain marketer Aunt Tilly. While her timed approach to pre-harvest pricing paid off, I struggled with her willingness to price grain that was, at times, lower than production costs. Could her performance improve if she stopped pricing grain below cost?

Terry Timer will help us answer this question. Terry Timer aims to price grain on the same days as Tilly — four sales of 20% in March, April, May, and June. Unlike Tilly, however, she will not act if the price opportunity is below production costs. With her “price be damned” approach, Tilly always gets to 80% priced by the end of June. Terry does not. In eight of the last 33 corn years (seven soybean years), Terry priced nothing before harvest, i.e., the price she saw in the spring was below her costs. In another six corn years (one soybean) she took partial action, getting 20-60% sold. In 19 of 33 corn years (25 soybean years) Terry got 80% of her corn priced before harvest.

Winning approach

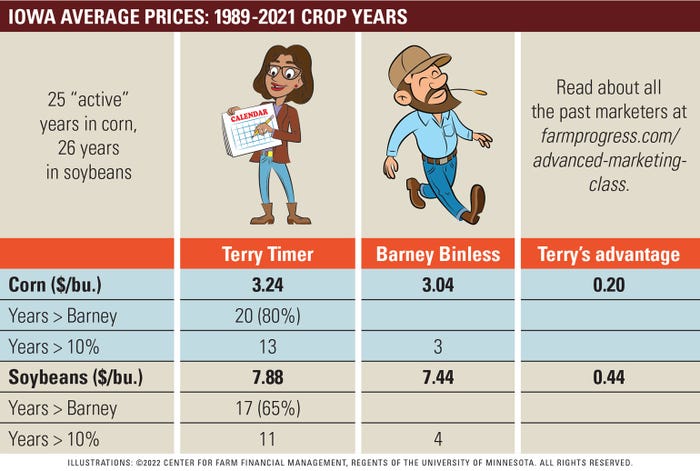

Terry Timer’s timed approach to pre-harvest marketing is a winner. Focusing solely on the 25 corn years when Terry priced new crop, she beat Barney’s harvest price in 20 years and by an average of 20 cents per bushel. She also delivered an advantage greater than 10% in 13 corn years. Looking at the 26 soybean years when Terry took action, she beat Barney’s harvest price in 17 years and by an average of 44 cents per bushel. She also delivered an advantage greater than 10% in 11 soybean years.

Now back to the question asked of Aunt Tilly. Could Tilly’s performance improve if she stopped pricing grain below cost? Terry’s results offer a resounding “yes!”

Terry’s average margin of victory over Barney is 20 and 44 cents, respectively, in corn and soybeans. Aunt Tilly’s average margin was 15 and 26 cents, respectively. The fact that Terry’s margin vs. Barney is greater than Tilly’s shows that Tilly’s aggressive approach to new crop pricing when prices are low reduced her overall performance, particularly in soybeans.

I agree with Aunt Tilly’s and Terry Timer’s focus on spring and early summer as an important time to pay attention to new crop pricing opportunities. But Terry’s performance tells me to be careful when new crop pricing opportunities are less than production costs.

By the way, it is worth noting that current new crop pricing opportunities are well above production costs. Terry Timer and Aunt Tilly are busy. How about you?

Meet the rest of the crew:

Ed Usset is a grain market economist at the University of Minnesota, and author of the book “Grain Marketing Is Simple (It’s Just Not Easy).” Reach Usset at [email protected].

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like