Editor’s note: This ninth essay discussing how to use options to enhance your grain marketing was written after the close Monday, April 25, 2022.

Last week’s put discussion ended with the question, “Was the $11 September wheat put out-of-the-money or in-the-money on the close Monday, April 25 with September wheat at $10.71¼?”

To determine if the $11 put was in-the-money or out-of-the-money, ask yourself:

If that put option is exercised (exchanged for futures positon), would the resulting futures position have a profit or a loss?

A put with a strike price of $11.00, if exercised, would be a short (sold) position at the strike price of $11.00.

If the futures price was $10.71¼, would a short (sold) position at $11.00 have a profit?

Yes! Sold at $11.00 and the market is at $10.71¼ = 28¾ cents profit.

What was paid for the option or what the option is presently worth have nothing to do with the determination if the option is in-the-money or out-of-the-money.

The in-the-money value of an option is also called intrinsic value. Since the $11.00 put option was 28¾ cents in-the-money, the option has to be worth at least 28¾ cents, even if it was the expiration day. But the September option does not expire until August 26, so it must have time value also. What is the time value of the that $11.00 put option’s premium?

The premium on the close Monday for the September $11.00 put was an even 90 cents. The time value of an in-the-money option is:

Premium minus intrinsic value = time value

So, for $11.00 September wheat put on Monday time value would be calculated as follows:

Premium (value) of 90 cents minus 28¾ cents in-the-money (aka intrinsic value) = 61¼ cents of time value.

The time value of an option’s premium is determined by, believe it or not, how much time remains in the life of that option. It is also a function of the volatility of the futures contract.

It is easy to understand that if the futures contract is moving 15 to 35 cents up and down most days; it is more difficult to assess its price projection for the next many days, weeks and especially months. Therefore, that difficulty of projecting the price projection means the option will cost more, regardless of whether it has any intrinsic value or not.

When the futures are quiet and moving in a relatively consistent trend, the volatility factor is diminished and that reduces the time value of an option.

Today, September Wheat was up 21¼ cents. The put options values should have decreased and the $10 put did move from 53 1/8 cents on Monday to 46 7/8 cents today, down 6¼ cents. The delta indicates the premium should have declined 7¼ cents. Nothing is 100% in this business.

A trader with a short September futures contract lost $1,062.50 (21¼ cents times 5,000 bushels per futures contract); a trader with the $10 put lost $362.50 (6 ¼ cents times 5,000 bushels per option contract). When the market futures price moves against you, one loves to own options rather than futures.

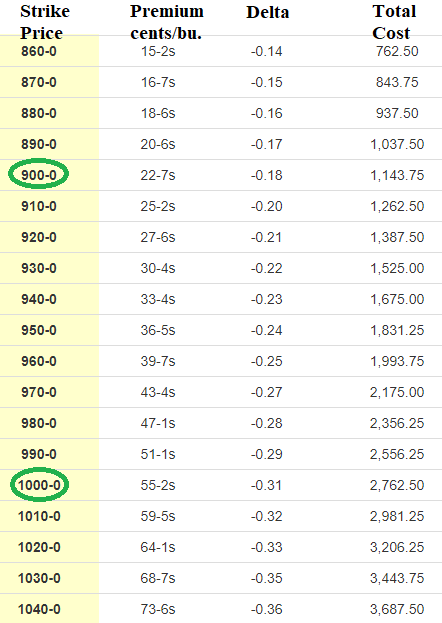

Below is the settlement prices and deltas of some of the September 2022 CBOT wheat puts.

This is part nine in a series. To learn more, read:

Part one: Put options add value to your cash grain sales

Part two: Hedge your crops with no margin calls

Part three: Enhance profit opportunities with put options

Part four: Put options and no margin calls

Part five: When does a put option have no potential value?

Part six: Why are put options so expensive?

Part seven: Use puts to manage grain marketing risk

Part eight: What is time value of an option?

Part ten: Use puts with Hedge-to-Arrive to increase farm income

Part eleven: Sample timeline to explain how wheat puts work

Wright is an Ohio-based grain marketing consultant. Contact him at (937) 605-1061 or [email protected]. Read more insights at www.wrightonthemarket.com.

No one associated with Wright on the Market is a cash grain broker nor a futures market broker. All information presented is researched and believed to be true and correct, but nothing is 100% in this business.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like