At a Glance

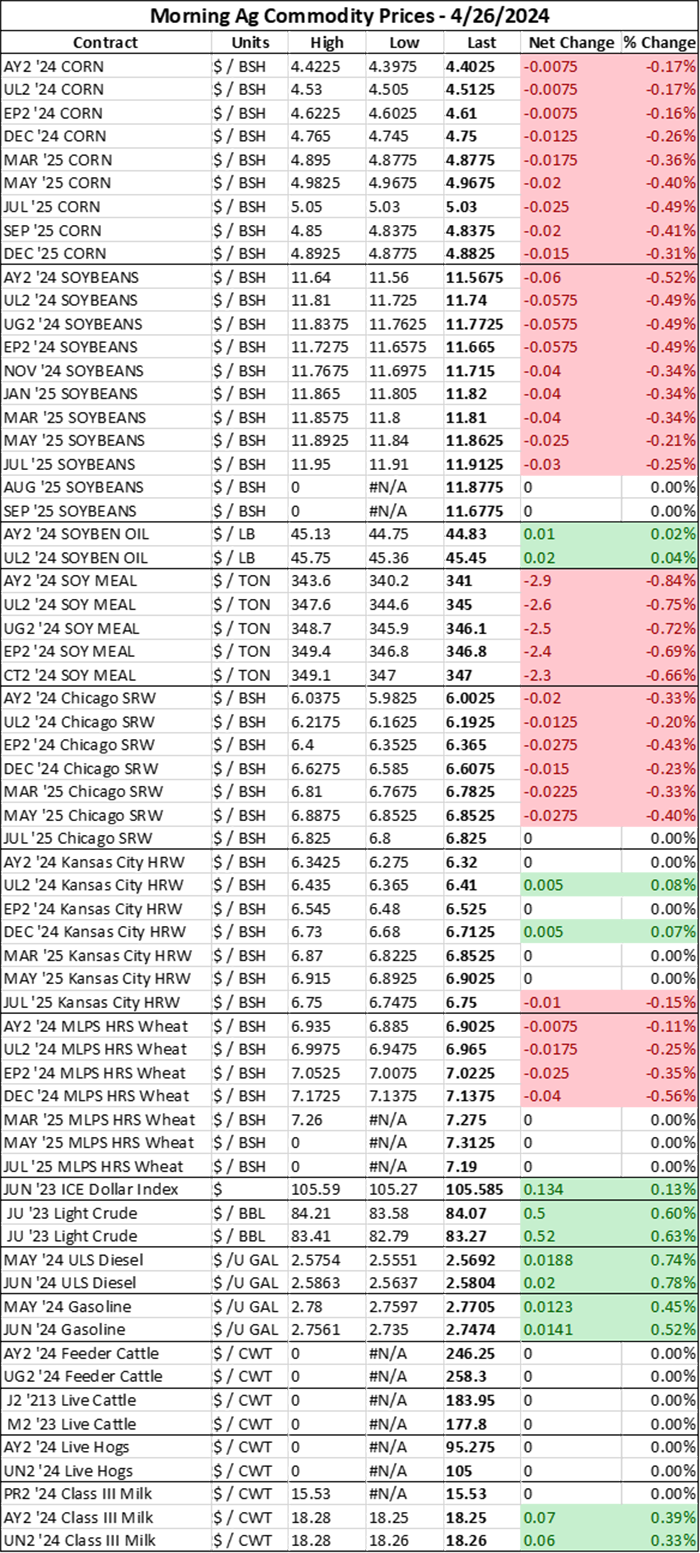

- Corn down 1-2 cents

- Soybeans down 2-6 cents; Soyoil up $0.05/lb; Soymeal down $3.20/ton

- Chicago soft red winter wheat down 1-2 cents; Kansas City hard red winter wheat up 1 cent

Prices updated as of 6:55am CDT.

Corn

Corn prices edged $0.01-$0.02/bushel lower this morning, signaling that yesterday’s stronger-than-expected export sales reports were not enough to offset planting gains during the overnight trading session.

Nearby May24 futures traded flat at $4.41/bushel amidst the market sentiments, while most actively traded Jul24 contracts fell to $4.5175/bushel at last glance. New crop Dec24 prices fell to $4.7575/bushel.

Corn and soybeans also continue to face stiff export competition from Brazil that is limiting gains from export prospects. Planting progress over the next week or so will be a key driver of price activity for both crops.

And with heavy showers expected for the Midwest and Upper Plains through the majority of the weekend, this morning’s losses could be short-lived. Depending on how much rain we get this weekend and how low temperatures stay, I could be writing a different headline for corn prices on Monday!

Soybeans

Soybean prices fell $0.01-$0.06/bushel during the early morning hours, dropping nearby May24 futures to $11.58/bushel. Most actively traded Jul24 contracts fell to $11.75/bushel while new crop Nov24 prices dropped to $11.725/bushel.

Wheat

Even though wheat prices wavered within a couple cents of gains and losses this morning, prices are still going to close the week up as much as 9% after a surge in investor short-covering after dry weather intensified in key growing regions in top global wheat exporter Russia, as well as in the U.S. Southern Plains.

Wheat markets are also recovering from yesterday’s selloff in the financial markets after a lackluster U.S. GDP report was published for the first quarter of 2023.

Dry weather continues to linger over the Southern Plains, keeping fears about U.S. winter wheat crop conditions alive and well in the market this morning. Yesterday’s Drought Monitor update saw a jump in dry conditions in the High Plains, where D1-D4 conditions have increased from 15.70% to 21.49% over the span of the past two weeks.

Showers over the next couple days could help, though the accumulation in the Plains is expected to be significantly less than the rain volumes falling in the Upper Midwest through this weekend.

Traders are also expecting Southern Russia to receive beneficial showers within the next week. That could help mitigate the increasingly dry conditions facing key export supplies, which are currently in peak grain fill development.

That means that weather forecasts in the Black Sea will likely cause substantial market activity over the next few weeks. "For southern Russia and eastern Ukraine, recent dryness is becoming more of a concern," Rabobank analysts said in report, as noted by Reuters this morning. "Should dryness continue in May, we could begin to see significant estimate downgrades."

Northern Hemisphere production worries continue to provide somewhat of a price floor for international wheat markets. Yesterday, the European Commission downgraded its 2024/25 wheat production estimate to a four-year low. A soggy fall limited planted acreage in the bloc, while crops conditions are struggling amid dry weather in Eastern Europe.

Feedback from the Field

Corn planting is off to a slow start, but farmers across the Heartland have shared that soybean sowings are likely advancing ahead of corn plantings early in the growing season, according to the most recent responses in Farm Futures’ Feedback from the Field series.

Our latest Feedback from the Field article highlights the scant corn planting progress made throughout the Corn Belt and features anecdotes from farmers across the Heartland. Check it out for all the latest insights!

Feedback from the Field is an open-sourced, ongoing farmer survey of current crop and weather conditions across the Heartland. If you would like to participate at any time throughout the growing season, click this link to take the survey and share updates about your farm’s spring progress. I review and upload results daily to the FFTF Google™ MyMap, so farmers can see others’ responses from across the country – or even across the county!

Weather

Expect a wet weekend across the Heartland over the next couple days. Rain and thunderstorms will stretch along the Plains today, pushing into the Upper Midwest by this afternoon and into the Eastern Corn Belt by this evening.

As one system stretches east, another system will follow closely in its footsteps as a storm system develops over the Central Rockies. So even as skies might try to clear tomorrow afternoon, by Sunday morning more rain and thunderstorms will be headed across the Plains and into the Upper Midwest, according to NOAA’s short-term forecasts.

And we’re not talking light showers either. Over the next 24 hours, NOAA expects that the Upper Midwest and Mississippi River Valley will see up to an inch of accumulation. The Plains will likely see lighter showers, with total accumulation not likely to top more than a half inch during that time.

Temperatures will struggle to reach above the 50-degree benchmark in the Northern Plains over the next few days, which could significantly slow planting activities in the region.

Gross.

Temperatures will continue to run above average as the month of May begins, according to NOAA's 6-10-day outlook. But chances for rain will also continue to run higher than normal across the Plains and Upper Midwest during that time as well.

Warm temperatures will continue to stick around the Heartland through next weekend in NOAA’s 8-14-day forecast. Thankfully, showers are showing a chance of retreating by that time though chances for rain will still run slightly above average.

Financials

S&P 500 futures rose 0.75% this morning to $5,120.25, with the index set to cap off a week of strong gains amid favorable first-quarter earnings reports from the tech sector, but especially from Microsoft and Alphabet (Google). There is likely also some profit-taking at play following yesterday’s selloff.

GDP data published yesterday showed that economic activity in the first quarter slowed as inflation remains stubbornly high. More inflation data – specifically the Federal Reserve’s preferred metric, the personal-consumption expenditures (PCE) index – will be dissected today.

There is one headline troubling me today – a presidential candidate is trying to figure out how to make the Federal Reserve less independent, which would give the executive branch more control over interest rates.

This is a very dangerous economic proposition. It should serve as a reminder that economics and politics are not the same thing, and it is very dangerous to mistake the two as being sympathetic with one another.

The worry is that “chiseling away at unwritten norms around keeping politics at arm’s length from Fed decisions could backfire, particularly if political interference leads investors to conclude that the central bank is willing to tolerate higher inflation,” Andrew Restuccia, Nick Timiraos, and Alex Leary wrote for the Wall Street Journal overnight.

“That could raise long-term interest rates, including rates on mortgages, credit cards and auto debt, when the U.S. government has to roll over trillions of dollars in debt annually.”

High interest rates aren’t fun for anyone (except maybe bankers). But persistently high inflation has been even more challenging for average consumers and lowering interest rates before inflation has been wrangled could create more financial destruction in our economy over the next several years.

Just some food for thought.

What else I’m reading at www.FarmFutures.com this morning:

Analyst emeritus Bryce Knorr explains why farm profits cannot be salvaged from higher yields in times of low prices. A La Niña weather rally could help push prices back up, but Knorr expects gains will be limited by massive old crop supplies.

Indiana farmer Kyle Stackhouse is fighting pest resistance early this spring – before planting even starts!

When will soy crush demand pick up? Naomi Blohm advises farmers to be ready for take advantage of spring rallies to ensure 2023/24 soybean profits.

Content producer Rachel Schutte shares tips from farmers on how to customize a successful farm succession plan.

About the Author(s)

You May Also Like