Some of the most considerable negative impacts on agricultural production are from extreme weather events. Extreme weather events include prolonged drought, record-breaking floods, and extreme temperatures. Scientists predict that extreme weather events will occur more frequently and more intensely. Drought is particularly concerning because water is already a limited resource in many regions of the United States, and the cost of accessing water can prohibit irrigation. The immediate impacts of drought can include water restrictions, brush fires, loss of recreation days due to low lake levels, and economic losses in the crop and livestock sectors. Drought does not just impact agricultural producers. It impacts the entire local community to different degrees.

From 2011 to 2013, the Southern United States, including parts of Texas, Louisiana, Arkansas, Mississippi, Alabama, Georgia, South Carolina, North Carolina, Florida, and Oklahoma, experienced severe to exceptional drought conditions. Severe drought (D3) is defined as dryland crops being severely reduced, stressed pasture, stressed cattle, and burn bans. As conditions worsen, drought is categorized as extreme (D4) or exceptional (D5). Exceptional drought is characterized by cracking ground, failed and abandoned crops, high costs of hay and water, scarce input supplies, herd liquidation, and increased burn restrictions.

Producers feel drought losses first in crop and forage losses, livestock stress, and income loss. These losses affect businesses that provide agriculture with inputs or use agricultural production to make food for animals and people. When the drought outlook is unfavorable, crop and livestock producers may not spend as much on inputs to their operation, such as seed, water, machinery, and custom harvesting. During drought, producers may not need workers. Agribusinesses like local grain elevators or cotton gins may not run as many hours. Consequently, employment and income in supporting sectors will be negatively affected. Drought effects are also felt by downstream businesses, like feedyards and wheat mills. These outcomes eventually result in higher consumer prices at the grocery store. When these effects are combined, there are substantial losses to the value of agricultural sales, employment, and profits for businesses in the economy. However, disaster relief payments or crop insurance payments can mitigate some of these effects. These payments allow producers to pay off operating lines, purchase inputs for the next season, and patronize local businesses.

Crop insurance use is higher today than ever, going back to the establishment of federal crop insurance programs in the 1930s and even immediately following crop insurance reform in the 1980s and 1990s. In recent years, the share of eligible US crop acreage enrolled in federal insurance has been 80% or higher for most crops. Federally authorized multi-peril crop insurance (MPCI) covers the loss of crop revenues or yields resulting from drought, damaging wind or rain, deep freezes, and other natural causes is common in more drought-prone areas. MPCI also helps offset the losses for agricultural producers. But how effective are these crop insurance payments at reducing producer losses and, more generally, local economic losses due to drought or other extreme weather events?

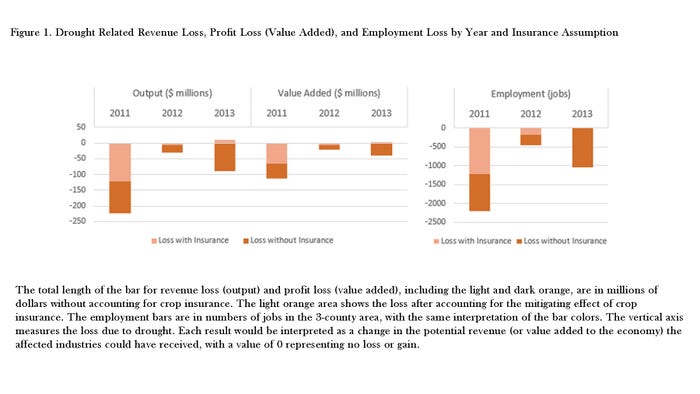

This case study estimates drought impacts for Tillman County, Harmon County, and Jackson County, Oklahoma. These three rural, farming-dependent counties experienced exceptional drought (D5) from 2011 to 2013 and 2022. Over the 2011 to 2013 drought period, there was a total loss of $209 million in agricultural revenue or output value. The economic loss includes reduced crop acres harvested, reduced crop yields on acres that were harvested, and reduced value of livestock herds, reflecting significant culling. After accounting for the loss to sectors that provide inputs to and purchase outputs from the impacted agricultural sectors, the total revenue loss increases to $343 million. These three counties alone experienced a loss of 3,699 full-time equivalent jobs due to drought over this period. The job losses could have occurred in several ways. For someone who works a second job seasonally in the cotton gin, that seasonal job may not be available to supplement their annual income. This translates into a loss of economic activity in the local community of 172 million dollars of value added to the economy.

What impact does crop insurance have on the 3-county area? These indemnity payments moderated drought impacts by 65% in agricultural output value, 62% in employment, and 58% in value-added over the entire period. Crop insurance significantly reduced economic damages for the farmers in the area, reducing the drought agricultural output value loss to 121 million dollars. For the local economy, the job loss was also reduced by more than half to 1,400 jobs. While the cotton gin may not run the additional shift, the local supply store may still be able to keep their employees at full employment. Participation in crop insurance also reduced the losses to the local economy overall, moderating losses to 71.5 million dollars for that same period. Even with insurance, these rural, agriculture-dependent areas still experienced reduced profits, jobs, and local economic activity due to drought. However, insurance policies protect against the worst drought outcomes as it is designed to do.

What else can a producer do to protect themselves? Other management strategies beyond crop insurance can reduce drought loss severity. Producers who diversified their production activities garnered more protection against loss in addition to protection provided by crop insurance. For example, in 2012, Oklahoma experienced a bumper wheat crop. Higher crop yields on harvested acres helped offset other crop and livestock losses. For livestock producers, 2013 brought record-high cattle prices due to the smallest national cattle herd since 1951. Of course, we broke those cattle price and inventory records again in 2023 after another drought. The ability to counter losses in one farm business activity with higher revenue in another activity highlights the potential value of whole farm risk management plans that include but are not limited to crop insurance. Consider the bars shown in Figure 1, where the relatively lower drought impacts are shown in 2012 and 2013 when other sources of income offset drought production losses compared to 2011. However, the largest driver of loss reduction was from the indemnities paid out by crop insurance. Graphically, this is the decrease from the dark orange (potential loss without insurance) to the light orange (total loss with insurance indemnities). While this was a case study for only three counties and policy effectiveness likely varies over the southern region, crop insurance is shown to be vital to American producers in cases of drought.

Source: Southern Ag Today

Read more about:

Federal Crop Insurance ProgramAbout the Author(s)

You May Also Like