It’s not easy to flip a switch and simply retire from farming. That’s a luxury found in other occupations.

My relationship with Gary, a retiring farmer, started when he called me after reading: “Why you should consider investing in off-farm real estate” in the November issue of Farm Futures. At the time, he was test driving a new pickup truck he said he only needed for tax reasons.

If you’ve been following this series, Gary is 85 years old, and bless his heart still actively farming. He wants to transition to his successor but income and self-employment taxes from his operation pose a difficult barrier. When I met Gary, he was paying income tax at the higher 32% federal bracket as a single taxpayer. He was also maxing out his self-employment contributions from his farm income at 15.3%. This was a combined tax rate of 47% on his farm income!

Fortunately, we identified a few overlooked strategies that Gary could implement.

Unused depreciation. We found unused depreciation from his late wife’s assets. Part 1 in this series: Could you cash in on a commonly overlooked tax strategy?

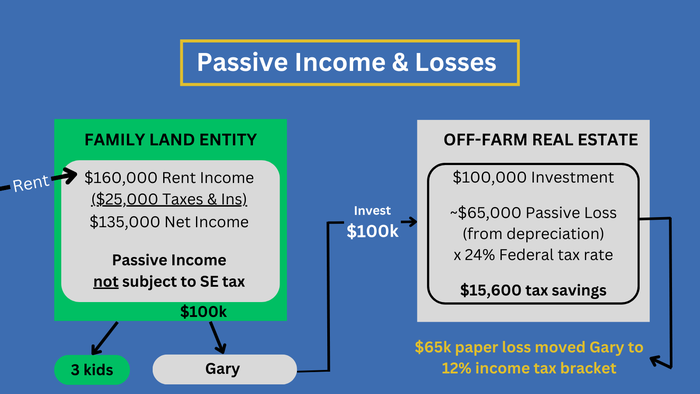

Passive rental income. We restructured how Gary’s farm income funnels to him, which now is as passive income through a family land-owning entity. Passive rental income is not subject to self-employment taxes. Part 2 in this series: Manage self-employment taxes with an eye on retirement.

Gifting strategies. He will likely continue to use some gifting strategies available to him, in particular, the gift of commodities which will keep 47% tax dollars in his pocket and transfer the income tax on some of his grain to his kids and grandkids who are paying at much lower rates if not zero. Part 3 in this series: Consider gifting options to reduce your taxes

Income tax planning

Though I’m not a certified tax professional, I often find myself brainstorming income tax strategies much more than estate taxes with my farm client’s and their respected tax advisors.

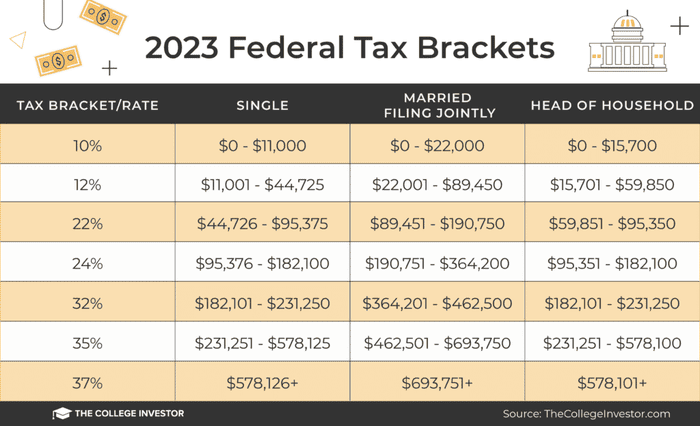

Here is a table showing the income tax brackets in 2023:

At this point, Gary was now down near $100,000 of taxable income and paying income tax at the 24% income tax level instead of 32%. He could easily buy that pickup truck which would slide him down to the 12% bracket, becoming a much more efficient taxpayer. However, Gary asked how investing in an off-farm financial opportunity could help him. He also liked the idea of diversifying, as he like many farmers was not well diversified.

.png?width=700&auto=webp&quality=80&disable=upscale)

Diversification versus depreciation

Buying a new pickup truck or tractor equates to a write-off through depreciation. These are assets which deprecate in value over time. He could buy another farm, but one disadvantage of land is it’s not depreciable.

However, investing in off-farm real estate, such as a limited partner in an apartment complex, flips the script when it comes to depreciation. Commonly, as much as 50% to 80% of the value of commercial real estate can come back to the investor as a paper loss through depreciation. This depreciation usually is accelerated to the first year from the allocated value of shorter lifespan assets such as buildings, structures, concrete, appliances, etc.

In addition to creating diversification, Gary also liked the fact it’s an investment that will increase in value over time while also returning passive income through monthly distributions.

Here’s a diagram to help illustrate the tax savings Gary will realize from such an investment:

Some could say it appears Gary is stepping off one tax-deferral treadmill and stepping onto another. But, for Gary he liked the fact he was building another investment bucket in his portfolio to pass down as a legacy to his children one day.

Next week, join me as I share the final part of this series: equipment. What to do with the equipment? We’ll look at equipment that is fully depreciated and subject to income tax from depreciation recapture.

This is part five in a series. Read the other articles here:

Downey has been helping farmers and landowners for the last 23 years with their family farm transition, estate planning, leasing strategies, and general farm advising. He is the co-owner of Next Gen Ag Advocates and founder of Farm Raised Capital. Reach Mike at [email protected].

About the Author(s)

You May Also Like