When I met Gary, he was giving his kids and grandkids a generous gift of cash every year. This is great, and he will likely continue to do so. However, this doesn’t help him much from a tax perspective, and Gary’s heavy tax burden from income and self-employment taxes is what originally led him to me.

I am not a certified tax professional, but since this topic is such an important part of the transition planning process, it is very common for me to brainstorm these type of tax related strategies with our clients and their respected tax advisors.

Gifting rules

Gary’s gifts of cash are in fact tax-free, not only for him to make, but also for his family to receive.

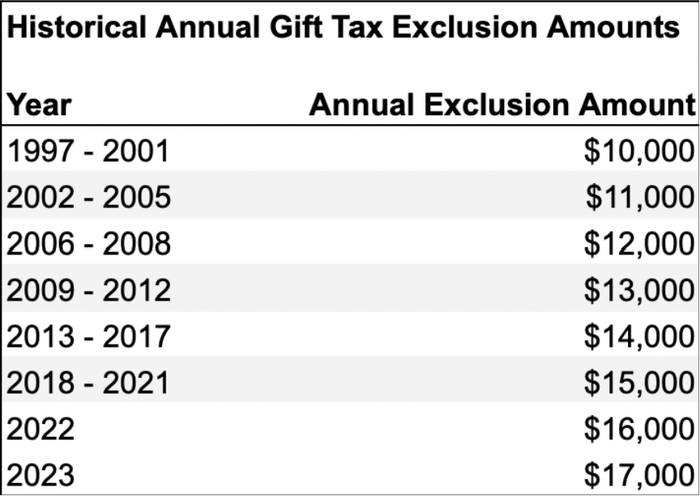

Most are familiar with the annual gift exclusion which is $18,000 per person per year beginning in 2024.

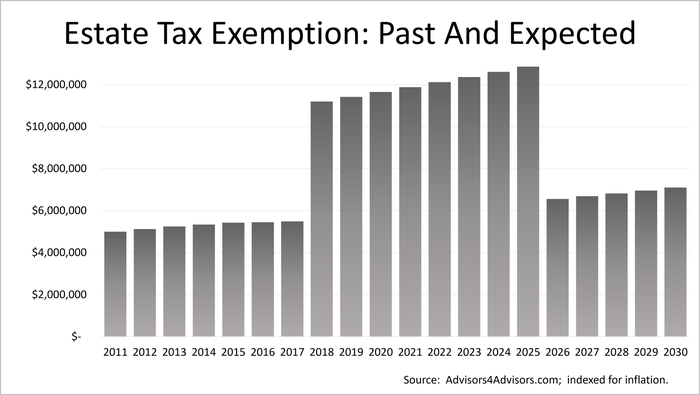

There is also a second level of gifting in the form of your lifetime gift exemption. This amount is coupled with what many think of as the death tax exemption, which is $13,610,000 million per individual in 2024 ($27,220,000 for a married couple). As an extreme example, a married couple could give away $27.22 million tax-free, but would need to file a gift tax return to notify the IRS they are using their lifetime estate exemption now, in the form of a lifetime gift.

Gifting cash

When you think about the gift of cash, you’re essentially giving away monies you’ve already recognized income tax on – after-tax dollars. This can help individuals from an estate tax perspective who have a very high net worth. Gary, however, does not have an estate tax issue. Rather, as a single individual, he is paying income tax at the 32% bracket and maxing out his self-employment contributions of 15.3% from this farm income.

This led to a discussion about where his sources of income are coming from.

Sources of income

Gary’s sources of income are like others I work with, being primarily from the farm, social security, and distributions from he and his late wife’s retirement accounts. For retirement monies, some have considered gifting their required minimum distributions (RMD’s) to a charity or church. This could help reduce taxable income.

Most are also familiar with the concept of gifting commodities like grain to a church or charity. Commodities can also be given to individuals, just like cash. In Gary’s case, the income from his grain was not only subject to 32% federal income tax but also to 15.3% self-employment taxes, for a total tax rate of 47%!

For his real estate, last week we discussed how Gary restructured the ownership to a land entity so more income from the farm will funnel to him as passive income, not subject to self-employment tax. Passive rental income is still subject to income tax though, but he deflected some of this by gifting ownership “units” of the entity to his children.

There are also some more advanced planning strategies Gary and his wife could have incorporated into their estate planning to give Gary flexibility to “sprinkle” income from his late wife’s half of the real estate to the kids or grandkids. However, in this case Gary inherited all the assets outright.

Gifting income

The concept of gifting income, and particularly his grain hit home most for Gary. He will use his annual gift exclusion to give $18,000 of grain to his three kids and seven grandchildren, tax-free. Instead of giving approximately one-half of this back to Uncle Sam in taxes, he will keep this in his pocket.

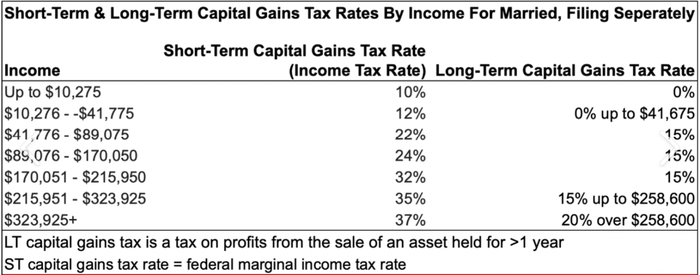

For his children, the income from the grain will be subject to their income tax filing levels. For the grandchildren, it will likely be treated as short-term capital gains based on their parent’s tax bracket.

However, if the grain is held for at least one year from the time of harvest, it will qualify for long-term capital gains treatment. As the chart indicates above, the long-term capital gain rate may very well be zero for some of Gary’s children and grandchildren.

As always, please consult with your tax advisor for your specific situation. Hopefully, this will give you some ideas if you are struggling to find a more tax friendly exit from farming.

This is part five in a series. Read the other articles here:

Downey has been helping farmers and landowners for the last 23 years with their family farm transition, estate planning, leasing strategies, and general farm advising. He is the co-owner of Next Gen Ag Advocates and an associate of Farm Financial Strategies. Reach Mike at [email protected].

Read more about:

TaxesAbout the Author(s)

You May Also Like