We all have those friends who like to poke fun at farmers for not paying their fair share in taxes, but I will argue most farmers pay more than their fair share in taxes. I saw this firsthand a few weeks ago when I met Gary, 85 years old, and bless his heart is still actively engaged in farming.

I met Gary thanks to the article: Why you should consider investing in off-farm real estate, in the last edition of Farm Futures magazine. In fact, Gary is one of several farmers across the country for whom that article hit home. In it I was quoted as saying that for most farmers income taxes are a bigger problem than estate taxes. Income taxes are a huge component in transition planning and the strategies implemented for entering, exiting, and retiring from the business.

We also see a lot of missed opportunities when it comes to taxes. In Gary’s case, he likely will move from paying 32% in income taxes and 15.3% in self-employment contributions to paying taxes in the 12% bracket with no self-employment taxes.

Not everyone will be able to cash in quite like Gary, but his story is what prompted me to write a five-part series focused on the commonly overlooked tax strategies available to you right in the IRS tax law codes.

The first part of this series is about reestablishing the cost basis in certain assets, and re-depreciating them for income tax purposes.

Depreciation

Retired farm CPA specialist, Paul Neiffer, has been quoted as saying: “One of the largest deductions for farmers is depreciation, which can be misunderstood in how it works.” The tax code allows taxpayers to use depreciation to offset income taxes. Depreciation is typically produced by purchasing or investing in assets, something the government wants us to do to help stimulate the economy.

Like many farmers, Gary has been using section 179 and bonus depreciation from the purchase and reinvestment in farm equipment for many years. However, this year he told his tax advisor he’s done buying equipment which is why this issue of taxes has come even more to the limelight.

One commonly overlooked opportunity is you can reestablish the cost basis in assets you inherit, even between two spouses. This came to mind after Gary shared with me he lost his wife a few years ago and like many married couples they jointly owned much of their farm assets, including their farm real estate.

Most are familiar with the concept of a “step-up in basis” for land. One disadvantage of land is it’s not depreciable. However, you can allocate value from a land appraisal to the farm’s depreciable assets such as fence, tile, buildings, and even residual soil fertility. These can all be re-depreciated for income tax purposes.

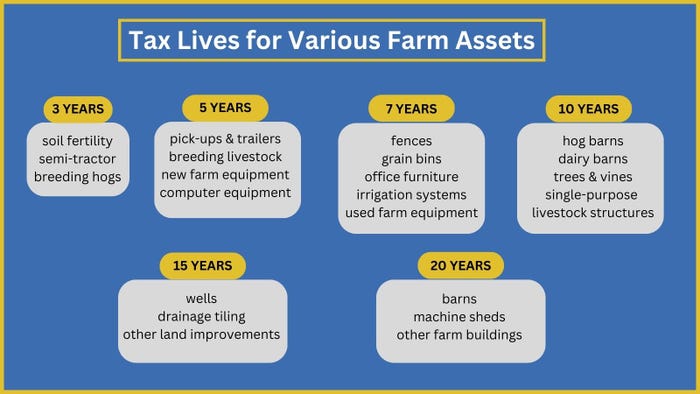

Here’s a table showing how most tax advisors would allocate the depreciation of these type of assets:

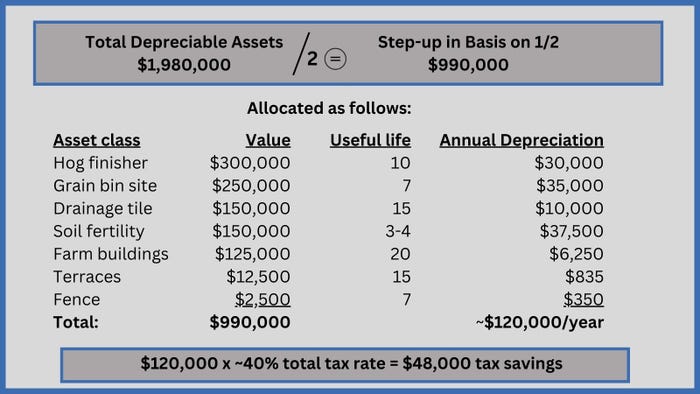

Gary and I made a “back-of-the-napkin” calculation for his and his wife’s farm. It looked like this.

Once Gary realized the potential tax savings from this new depreciation, he immediately engaged a land appraiser to go back and appraise the farm at his wife’s date of death. We then worked with his tax advisor to substantiate the value of those depreciable assets.

I am not a certified tax professional, so it’s important you work with yours as I’ve seen different interpretations of how this depreciation should be handled.

Step-up in basis

What else might help you by getting a new step-up in cost basis?

A farm’s hot assets – including grain, livestock, and farm machinery – are ripe for a new cost basis. This can create strategies for a surviving spouse or your heirs to gift, sell, or redepreciate these under a much more tax friendly basis.

A new cost basis also can be applied to stock of a corporation and membership “units” of entities like limited liability companies. It’s important to understand the underlying assets of a corporation do not get a new basis, only the stock does. However, a corporation with a new stock basis presents other opportunities to pull the assets out and restructure them under a much more tax-friendly basis.

As we begin a new year, I hope this series will spur some thought for your own situation and present some opportunities. Please join me next week as we dive deeper into the strategy Gary implemented for saving on self-employment taxes.

This is part five in a series. Read the other articles here:

Downey has been helping farmers and landowners for the last 23 years with their family farm transition, estate planning, leasing strategies, and general farm advising. He is the co-owner of Next Gen Ag Advocates and an associate of Farm Financial Strategies. Reach Mike at [email protected].

Read more about:

TaxesAbout the Author(s)

You May Also Like