Markets depend on questions to thrive. But in 35 years of talking about trading I’ve never seen a market so battered and bruised by uncertainty.

Still, whether you look at crude or corn, soybeans or stocks, these markets aren’t crazy. Volatile? For sure! But futures appear to be expressing the best guess about the meaning of the numbers and news flow.

Not that assessing this reality is easy.

Take the Federal Reserve – (Please! As the old joke goes). Few farmers, especially those who survived the 1980s, would ever feel sorry for the suits who raised interest rates above 22% to bury inflation. But members of the Federal Open Market Committee face a daunting task when they meet March 15-16.

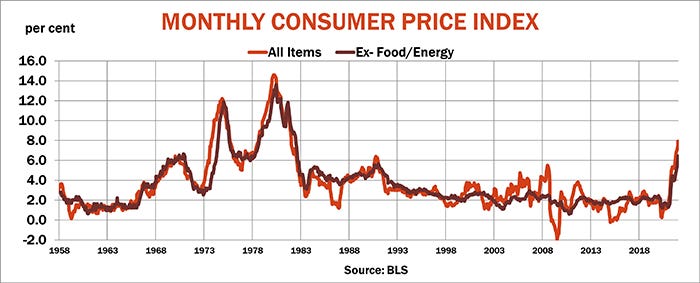

Inflation is raging at a 7.9% annualized rate, according to the Consumer Price Index released last week. The print wasn’t a surprise, and not long ago the debate was not whether the Fed would raise its target for short-term interest rates at this March meeting, but by how much. Many believed a 50-basis-point hike – ½ of 1% – was in the cards with another 1.5% likely into 2023. But after Russia’s invasion of Ukraine, only a 25-point hike is on the table, according to the near-unanimous opinion of traders betting on Federal Funds futures.

The Fed, in short, is caught between a rock and a hard place. While it must tighten credit to start attacking inflation, price stability is only half the central bank’s mandate. It also must promote policies that achieve full employment.

The second part of that dual mandate isn’t a problem, at least now. The jobless rate fell to 3.8% last month as employers continue struggling to fill jobs after the pandemic. But inflation and fallout from the Ukraine war threaten to derail the global economy’s remarkable turnaround over the past two years. So, by raising interest rates and ending its bond-purchase program, the Fed could push growth off a cliff.

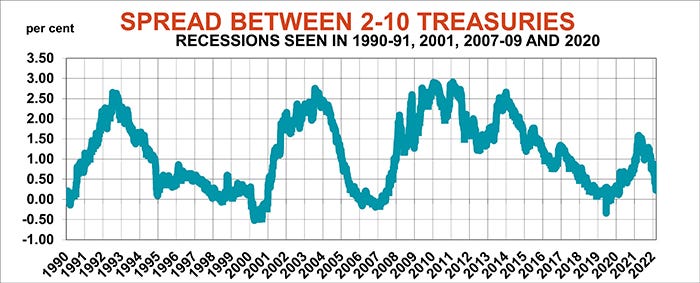

Such moves always carry risk of triggering a recession. And even when they don’t, fear they will often sends prices south into bear markets anyway.

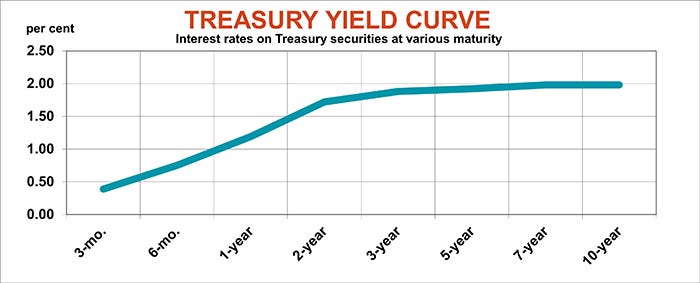

Those concerns are amplified by the Treasury yield curve. Rates on different maturities for government debt have flattened the spread between the 2- and 10-Year instruments, in the past a decent harbinger of recession.

Farmers may not despise the Fed like they did in the days of Paul Volcker. But winds swirling through financial markets are the same ones buffeting grain prices headed into spring.

U.S. stocks have lost more than 10% of their value, enough to qualify as a correction. A 20% pullback into official bear market territory would just take the S&P 500 Index back to the average for 2022 predicted by my models of current supply and demand fundamentals, including a stab at impacts on growth from the war. And given recent implied volatility in the options market, even the all-time closing high reached at the start of January is within the trading range forecast for the year.

Yields on the 10-Year Treasury Note and the value of the dollar are trading close to where they should be according to the data. Even crude oil and the rest of the petroleum market are performing rationally, trading within projected ranges despite the irrational times that caused prices to make hyperbolic gains.

Volatility goes both ways

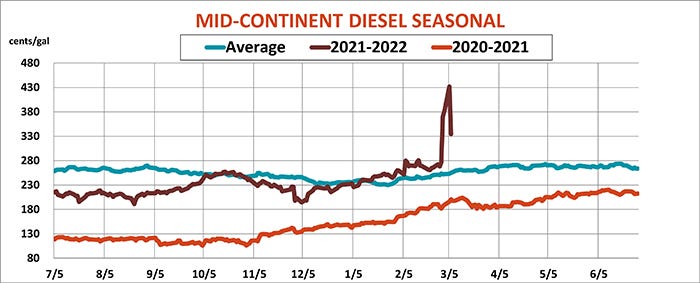

But volatility also means those trends can reverse quickly. An example for farmers right now is diesel. Chicago wholesale cash ULSD jumped 63% in the days after the war began, then dropped nearly a dollar in a single day.

Fuel is still expensive at well over $3 a gallon, but the pullback wasn’t exceptional. Chicago wheat’s move was almost as dramatic, surging 55% and then falling more than $2.75 a bushel in just two days.

These declines don’t necessarily mean the party – or pain, depending on your market and your position – is over. It could be the pause that refreshes. Indeed, some traders believe crude well north of $150 is needed to ration demand.

China stored wheat deteriorating

And, while no one knows what will happen with wheat in Ukraine and Russia once harvest starts this summer, uncertainty is alive and well elsewhere too. Winter wheat conditions in China, the world’s biggest individual producer, are reportedly deteriorating. China has massive stocks to fall back on – nearly a year’s worth of supply. But the condition of that inventory and even its exact size is unknown, which could send the country in search of supplies, particularly higher quality wheat.

Moves by corn and soybeans pale by comparison. But, as I’ve written about recently, prices are trading within the ranges forecast by my pricing models given current conditions. (See here, here and here.)

Of course, those ranges could change depending on how much farmers plant in the U.S., and whether growers are able to sow and reap much of anything in Ukraine. Fertilizer prices jumped higher again last week. In some local markets DAP topped $1,000 and potash neared $900 a ton or more as sanctions bite on supplies from Belarus and Russia.

So, volatility – yes, there’s plenty of that. But this March madness isn’t crazy.

Knorr writes from Chicago, Ill. Email him at [email protected]

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like