Corn futures have rallied nearly 40 cents since the February price low. While many producers likely took advantage of that price jump and made some old crop cash sales recently, there is probably more corn in the bin that needs to get sold in the coming weeks and months.

What’s happened

Heading into the March 28 Prospective Plantings and Quarterly Stocks report, corn futures look to likely trade in a sideways consolidation pattern, waiting for fresh news on the report to dictate either a price breakout to the upside, or potentially lower prices ahead.

So, what should a farmer holding old crop corn do? Hold out hope for a rally? And if there is a rally, when might it occur?

From a marketing perspective

My recollection of this report over the decade is that it provides a muted market price response, and limited surprises in most years.

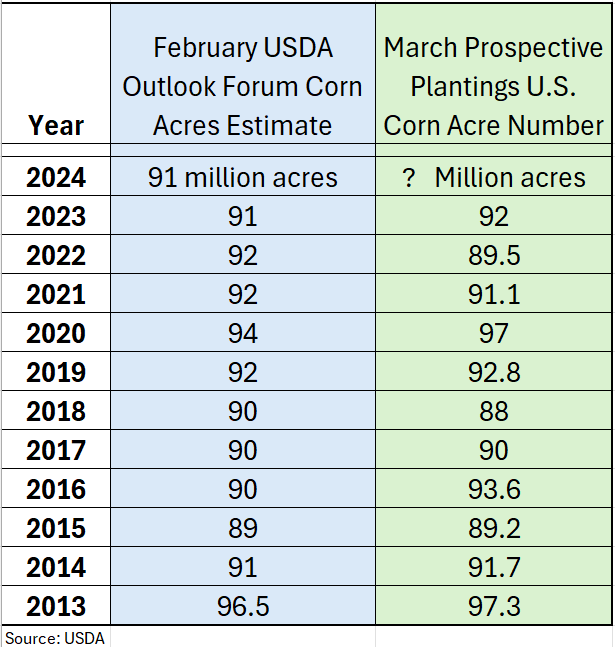

Regarding planted acres, the USDA already offered us a first glimpse of their impressions and expectations back in February during the USDA Outlook Forum. At the forum, the USDA suggested that U.S. spring 2024 planted corn acres would likely be at 91 million acres, down from the 2023 planted acres number of 94.6 million.

Below is a look at the past decade to show what the USDA pegged for acreage at the February Outlook Forum, and how that compares to the March Prospective Planting numbers, which is based off farmer surveys.

Regarding quarterly stocks, the market now has a decent pulse of the trend of ending stocks heading into this report, so again, not many surprises are expected.

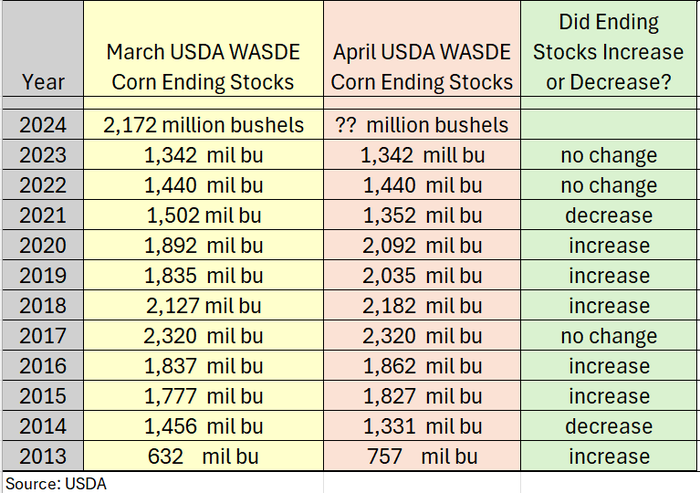

Looking for further “evidence” of potential price direction ahead, instead I chose to compare corn ending stocks from the March monthly WASDE report to the April monthly WASDE report for the past decade as well. Alas, no big smoking gun to report.

Most of the time over the past decade, in years where ending stocks were trending lower into the March WASDE report, there were no big changes to ending stocks between the March and April WASDE reports.

In years where ending stocks were trending larger into the March report, the ending stocks on the April report had a slight tendency to be higher than the March report.

Why should you care about ending stocks? Because the market and prices tend to trade on perception. If the perception is that ending stocks are getting larger, then prices have a tendency to trade sideways to lower. If the perception is that ending stocks are getting smaller, then prices have a tendency to trade sideways to higher.

Bottom line is that current corn carryout is a historically large 2.172 billion bushels, and likely will not change much on the April WASDE report.

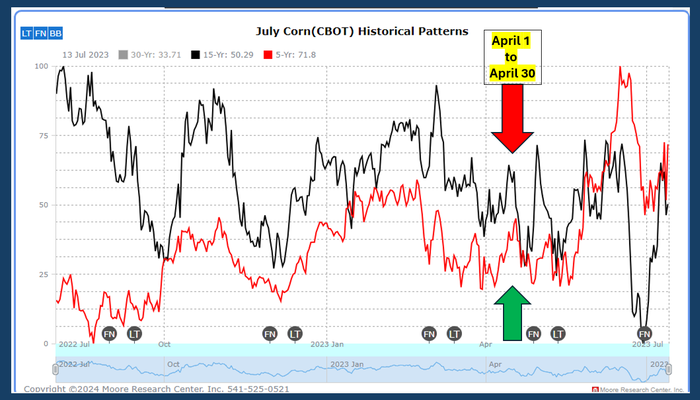

This may be one of those times that July corn futures trade in a quiet lull pattern during the month of April as we wait for weather news in Brazil on the safrinha corn crop, and spring planting conditions here in the United States.

Looking at historical seasonals, both the 5-year and 15-year price patterns agree that sideways, choppy trade may be likely during the month of April barring any weather surprises.

Prepare yourself

Some of you may need – or opt to – price corn in the bin sooner than later due to bills being due, interest rates being high, or quite frankly, that you have the time now to move grain before planting season begins.

And some of you may opt to hold out and hope for higher prices in the May/June timeframe. Whatever you decide, be strategic with your marketing.

Should you make cash sales, consider whether a re-ownership strategy with a call option may be appropriate for you, to capture upside price potential should a bigger price rally occur later this summer. And on the flip side, if you are not making cash sales, then purchasing a short term put option may have some merit.

While anything can happen in these markets at any time, corn futures prices may stay in the price doldrums for just a touch longer before any potential summer price rally down the road.

Reach Naomi Blohm at 800-334-9779, on X (previously Twitter): @naomiblohm, and at [email protected].

Disclaimer: The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Individuals acting on this information are responsible for their own actions. Commodity trading may not be suitable for all recipients of this report. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Examples of seasonal price moves or extreme market conditions are not meant to imply that such moves or conditions are common occurrences or likely to occur. Futures prices have already factored in the seasonal aspects of supply and demand. No representation is being made that scenario planning, strategy or discipline will guarantee success or profits. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing. Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services, LLC is an insurance agency and an equal opportunity provider. Stewart-Peterson Inc. is a publishing company. A customer may have relationships with all three companies. SP Risk Services LLC and Stewart-Peterson Inc. are wholly owned by Stewart-Peterson Group Inc. unless otherwise noted, services referenced are services of Stewart-Peterson Group Inc. Presented for solicitation.

About the Author(s)

You May Also Like