Heading into early spring, agricultural trade is focused on weather in Brazil, specifically regarding the safrinha corn crop, the upcoming March WASDE report, and the U.S. Prospective Planting acreage report at the end of this month.

While these absolutely are important factors for grain fundamentals and prices, do not ignore the potential impact of outside market influences.

What’s happened

Nearly two years ago, at the height of the bull market for corn and soybeans, I alerted you watch outside market influences that might grip agricultural market prices, and ultimately send them lower.

I did a muted sound of the alarm in the article, suggesting the bull run might be coming to an end.

Since then, corn and soybean prices trickled lower and now may be finding price support at lower values. In the coming weeks, we will be watching the important supply and demand fundamentals outlined above, and also two outside market influences that may continue to affect grain prices in 2024: the Federal Reserve’s influence regarding interest rates, and the Goldman Sachs Commodity Index.

From a marketing perspective

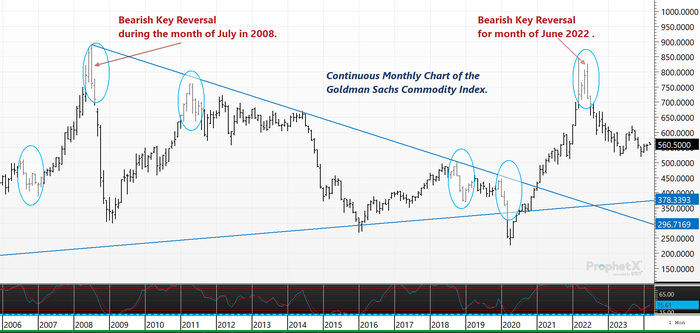

I’ve written before about the GSCI, and if you’re heard me give speeches across the Midwest, I often incorporate a chart image of this index into my presentations. This index is important because it measures the value of 24 different commodities, all into one index number. The metric is a mix of precious metals, energies, grains, livestock, and softs (i.e., cotton, sugar, coffee and cocoa).

While past performance is not indicative of future results, it is interesting to note the pattern that has occurred in years past when the GSCI flashes “topping signals.”

Over the last 18 years, the index has flashed this potential topping signal six times:

August 2006: The price setback lasted for five months.

July 2008: The infamous 2008 commodity sell-off when the market peaked, then crashed for seven months.

May 2011: The index then fell lower for five months.

October 2018: A bearish technical signal led to a three-month fall.

January 2020: The reality of Covid-19 was beginning to awaken the globe and the index fell for four months. This was also when we learned that commodity prices could indeed trade negative – with crude oil futures walloping lower into a negative price abyss.

June 2022: The sell-off has lasted for one year, with the index now entering a sideways, consolidation pattern.

I look at this chart and focus on the current consolidation pattern. It makes sense that the index seems to be in a holding pattern as supply and demand fundamentals shift around the world following the 2022 bull market. Looking at the rest of 2024 and the GSCI chart, commodity prices either have the potential for a nice recovery bounce in summer months or a return to the trough of lower prices that were seen during 2015.

Commodity prices and traders will also be watching the Fed for more clues regarding interest rates and hopes that the Fed may lower them in 2024. Earlier this week, Fed Chairman Jerome Powell told Congress he believed that rate cuts could still begin this year (although there will not likely be as many cuts and they will not begin as quickly as many hoped).

Prepare yourself

Grain marketing seems to get harder and harder every year. And this comes from someone who has been in the industry for over two decades. There is no magical formula for success, nor any artificial intelligence computer that automatically knows the highs or lows for any market.

You have to constantly have a pulse on the industry, current supply and demand fundamentals from a domestic and global perspective, and understand the workings of outside market influences and factors.

For grain farmers, this can be nerve-wracking, as they just want to grow a good crop and not have to deal with the intertwined intricacies that now is American agriculture. It can be hard enough to muster the strength to plant a crop when you’re facing the year planting without a profit, or are unsure what the weather will bring, or witness crops in the field wither from a flash drought.

I can tell you this – I take heed of GSCI chart posting potential mixed signals. Is this a low finally forming with a recovery rally to follow? Or will commodity prices push lower into the end of 2024? Be ready for anything.

Reach Naomi Blohm at 800-334-9779, on X (previously Twitter): @naomiblohm, and at [email protected].

Disclaimer: The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Individuals acting on this information are responsible for their own actions. Commodity trading may not be suitable for all recipients of this report. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Examples of seasonal price moves or extreme market conditions are not meant to imply that such moves or conditions are common occurrences or likely to occur. Futures prices have already factored in the seasonal aspects of supply and demand. No representation is being made that scenario planning, strategy or discipline will guarantee success or profits. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing. Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services, LLC is an insurance agency and an equal opportunity provider. Stewart-Peterson Inc. is a publishing company. A customer may have relationships with all three companies. SP Risk Services LLC and Stewart-Peterson Inc. are wholly owned by Stewart-Peterson Group Inc. unless otherwise noted, services referenced are services of Stewart-Peterson Group Inc. Presented for solicitation.

About the Author(s)

You May Also Like