Many farmers are crossing their fingers hoping for a corn rally in the coming weeks. While it is possible, there are many factors currently weighing on the market.

What’s happened

May 2024 corn futures have enjoyed a nearly 40-cent price rally since late February, with prices currently testing short-term technical resistance levels on daily charts near $4.45.

In the coming days, corn prices may struggle to find reason to climb through this short-term price ceiling as the current 2.1-billion-bushel carryout for the 2023-24 crop year weighs on prices.

That noted, I’m watching three factors for corn that may provide for price rally incentives later this spring.

From a marketing perspective

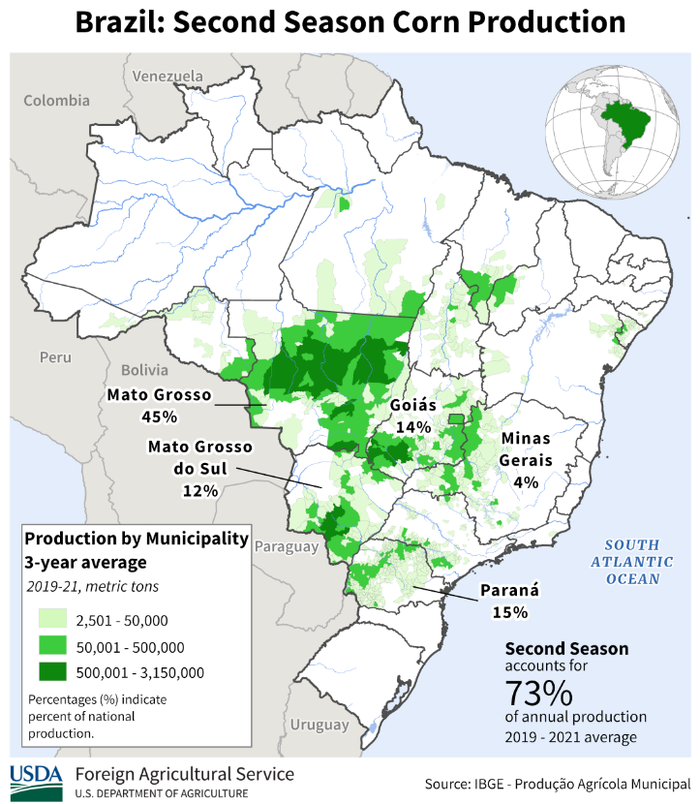

Weather watching for second crop corn growing in Brazil will be the first factor that might come into play quite soon. Remember, approximately 75% of Brazil’s total corn crop is being planted now with current industry estimates suggesting that the safrinha crop is nearly 90% planted.

The pollination time window begins in mid-April and there is no room for error in production. According to the most current USDA WASDE report, total corn production in Brazil is expected to be near 124 mmt. Brazil demand for corn is pegged at a whopping 130.5 mmt (78.5 mmt for domestic demand with exports at 52 mmt). Interesting to note is that earlier this week, Brazil's Conab lowered their 2023-24 total corn crop forecast to 112.7 mmt, well below the current USDA figure.

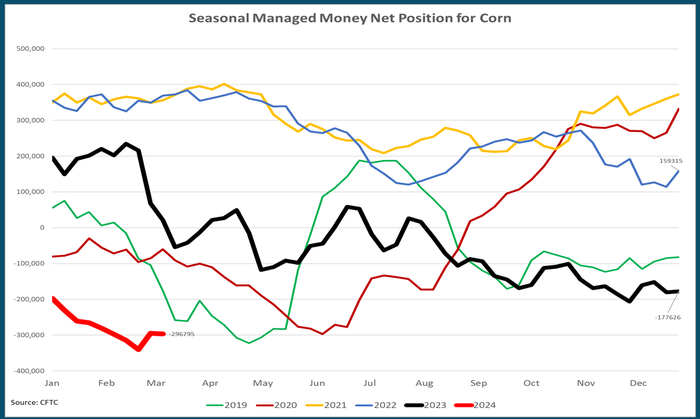

The next factor I’m watching is fund trading activity. In February, managed money in corn futures traded at a record short level reaching nearly 340,000 contracts! Since then, they have exited (bought back) approximately 45,000 contracts. Looking at the chart, they have plenty of room to continue exiting short positions in the coming weeks, but a fundamental catalyst will be needed. Will that fundamental catalyst be something from weather in Brazil? Or perhaps a surprise on the March 28 Prospective Planting and Quarterly Grain Stocks report?

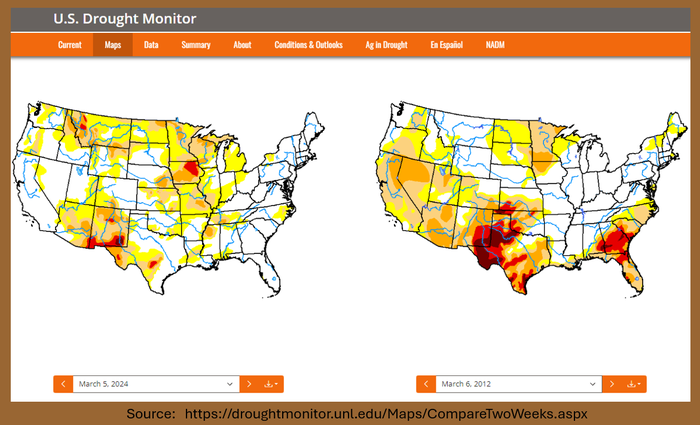

Lastly, my thoughts turn again toward the weather. This time weather in the United States. I live in Wisconsin, and this February was quite mild. So mild, that by the end of February, ice was gone, lakes opened up, the robins and other songbirds returned early, and my tulips were already two inches from the ground. Normally these things occur in Wisconsin in late March, not late February. The last time this happened was in 2012, when the Midwest suffered a disastrous drought later in the summer.

Obviously, Mother Nature is in charge and things can change, but take note that much of the Midwest is already in a mild drought and Iowa is in severe drought. Below is a chart that compares the first week of March 2024 to the first week of March back in 2012.

Prepare yourself

Be ready for anything. The funds do hold a hefty net short position and current market perception continues to be mostly negative due to current hefty corn supplies in the U.S. This reality may keep corn prices in a monotone price pattern in the coming weeks.

However, a glimmer of friendly from any of the above factors could spur further short covering by the funds and a significant price rally could occur.

Many price scenarios can unfold this spring. Manage your risk. Be ready for any surprise in the coming weeks.

Reach Naomi Blohm at 800-334-9779, on X (previously Twitter): @naomiblohm, and at [email protected].

Disclaimer: The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Individuals acting on this information are responsible for their own actions. Commodity trading may not be suitable for all recipients of this report. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Examples of seasonal price moves or extreme market conditions are not meant to imply that such moves or conditions are common occurrences or likely to occur. Futures prices have already factored in the seasonal aspects of supply and demand. No representation is being made that scenario planning, strategy or discipline will guarantee success or profits. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing. Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services, LLC is an insurance agency and an equal opportunity provider. Stewart-Peterson Inc. is a publishing company. A customer may have relationships with all three companies. SP Risk Services LLC and Stewart-Peterson Inc. are wholly owned by Stewart-Peterson Group Inc. unless otherwise noted, services referenced are services of Stewart-Peterson Group Inc. Presented for solicitation.

About the Author(s)

You May Also Like