Total world grain and oilseed production is expected to rise this year, one reason why prices for fuel and fertilizer will likely remain stubbornly high for the foreseeable future.

Global output for grains and oilseeds is expected to rise by nearly 106 million metric tonnes (3.2%) from last year to 3.423 billion metric tonnes of output in 2021/22. China, Ukraine, South America, and the U.S. are leading the ongoing global acreage expansion, which is expected to top 2.03 billion acres in 2021/22 for wheat, coarse grain, and major oilseed production. Global acreage for the crop mix has risen 3.2% since 2019/20, according to USDA-Foreign Agriculture Service data, increasing global demand for fertilizers and fuel.

USDA’s Economic Research service will update its 2021 production forecasts at the beginning of summer, which are likely to provide more insights to nationwide trends in fertilizer, chemical, and input costs. Finalized 2020 data released in May saw average operating costs (inputs, fuel, repairs, irrigation, operating interest) across the U.S. fall 1% from 2019.

But in today’s era of soaring commodity prices, global acreage expansions, and rising inflation, it is not likely that operating costs will decrease in 2021. Nutrien expects U.S. and Canadian growers to increase crop input expenditures between 4% - 7% this year on acreage expansions. A rebound in the Brazilian real is likely to increase Brazilian farmers’ crop expenditures by 12%-14% this year.

Here is a quick look at fertilizer, fuel, and input pricing dynamics as spring planting season begins to wind down.

Natural Gas

At first glance natural gas price fluctuations do not seem inherently relevant to grain production. But natural gas accounts for 40% of U.S. electricity generation and is a key fuel source for agricultural processing plants. It is a necessary ingredient for fertilizer production.

Because natural gas prices can be a leading indicator of rising input prices – and farmers will be extra reliant on yields this year to overcome rising costs – it is worth a deep dive into natural gas pricing to see if farmers can strategize a hedge against shrinking profit margins.

Natural gas consumption for electricity in the U.S. is expected to drop this summer in response to higher prices. The U.S. Energy Information Administration (EIA) expects natural gas prices to be 46% higher this summer compared to last.

The nation’s electric grid will rely on cheaper coal-generated electricity and increasing renewable solar and wind energy capacity to survive the summer – or until natural gas prices become more affordable. If natural gas prices fall in July or August, farmers could start to see lower production costs for fertilizers.

Anhydrous Ammonia

Nitrogen supplies were readily available in 2020, with many supplies ordered for the 2019 crop year left over to satisfy demand. But with global acreage estimates on the rise in 2021, last year’s supply glut of nitrogen is no more.

In its quarterly earnings call in May, ag retailer Nutrien cited higher natural gas prices as contributing to higher production costs during the first quarter of 2021. Global nitrogen production has struggled to keep up with rapidly expanding acres, especially following the lags from last year’s supply glut and subsequent pandemic-related production delays.

Retailers were forced to pass on the increased costs to farmers in the form of higher anhydrous costs. Nutrien’s net realized selling price rose 13% in Q1 of 2021 from the previous year as a result.

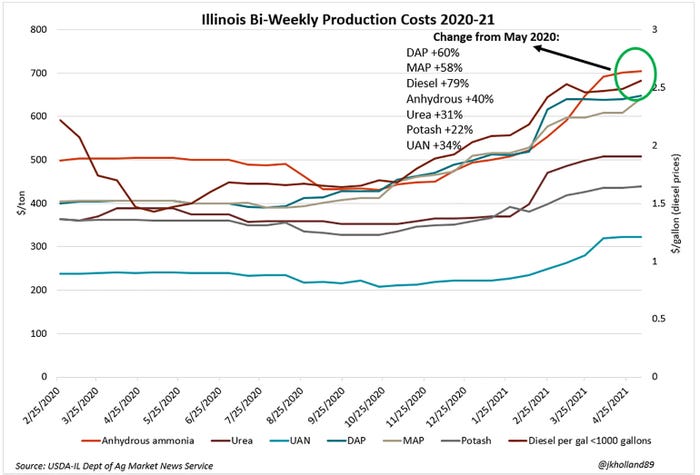

In Illinois, anhydrous ammonia prices are 40% higher than a year ago, ranging between $650-$740/ton with an average price of $704/ton. Prices leveled off just over the $700/ton benchmark as planting activity slowed and demand calmed. Falling natural gas consumption and costs over the summer could create pricing opportunities as crops are pollinating in late July and early August.

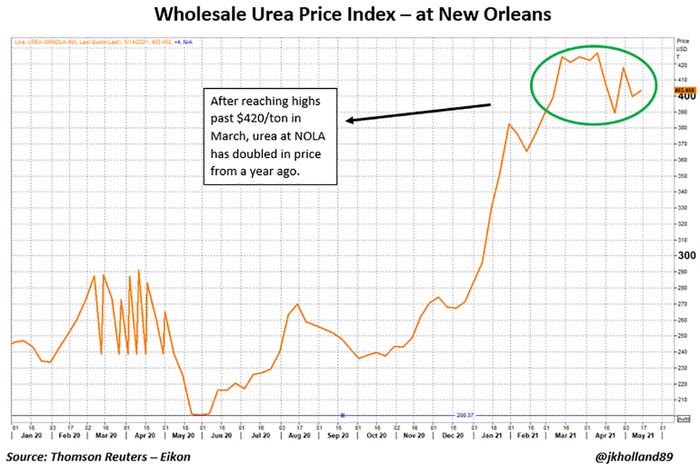

Urea

Urea prices saw wide fluctuations over the past couple months as markets awaited Indian purchasing prospects to play out in the international market.

India, one of the world’s largest urea importers, approved a subsidy to use urea from gasified coal production for cleaner electricity generation and additional crop nutrient output. The new policy will lead to the construction of a coal gasification plant that churns out 1.27 million tonnes of urea per year.

India has also struggled with rising COVID-19 cases this spring. While fertilizer and energy facilities are expected to remain open during any lockdown, construction on the coal-urea plant has faced pandemic-related delays. India’s drive to create more urea capacity this year will largely depend on its ability to overcome the COVID-19 pandemic.

China’s 2021 urea exports could match those of 2020 by year end, reaching 5.5 million tonnes. It is a more optimistic outlook for Chinese urea output following production disruptions over the winter due to natural gas shortages. China is the world’s largest urea producer.

Acreage increases in North and South America will likely contribute to higher urea prices this summer. But the overwhelming sentiment for global urea prices remains tied to India’s level of usage in 2021 and rising global production capacity.

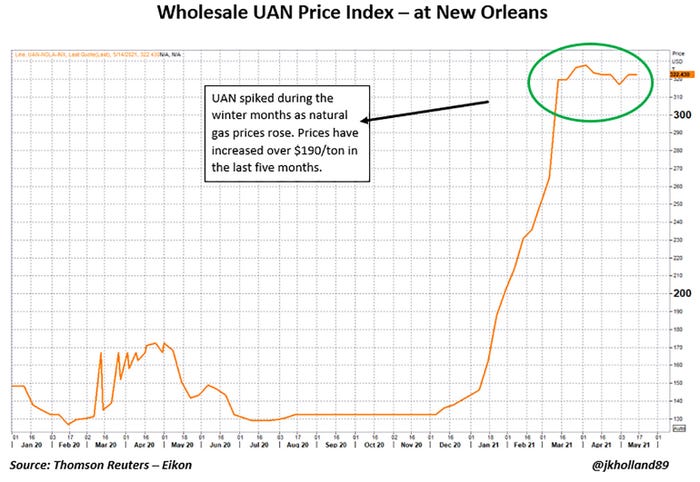

UAN

Wholesale UAN prices at the U.S. Gulf steadied between $320-$327/ton during the second quarter of 2021, after rising 2.5 times its value between December 2020 and April 2021. Completed planting activity and a recovery from February’s winter storms helped slow down UAN’s rise – for now.

Expect the UAN complex to closely track urea’s in the coming months. If more urea production is brought online over the summer, UAN prices could track slightly lower leading into fall harvest season.

As farmers look to fall fertilizer applications, it is prudent to consider other nitrogen fertilizer options over higher priced anhydrous ammonia and urea. Depending on how market dynamics shake out, UAN could provide farmers an affordable alternative for nitrogen applications.

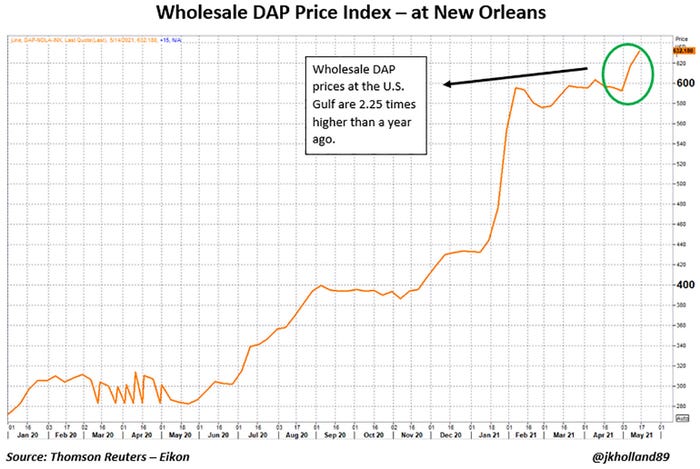

Phosphate

In its early May 2021 earnings call to address first quarter 2021 results, ag retailer Mosaic cited increased international acreage as driving higher global phosphate demand and subsequently prices. As raw material prices increased this spring, Mosaic expects wholesale phosphate prices to rise $30 to $35 per metric tonne as spring planting season draws to a close.

U.S. MAP and DAP supplies are likely to remain tight, according to guidance from Nutrien, especially as countervailing tariffs keep supplies from top producers Russia and Morocco from replenishing U.S. stockpiles. Global supply chains are not currently operating at efficient enough capacities to adequately supply U.S. growers with phosphate stocks.

Mosaic expects prices for sulfur (sulfuric acid), the main ingredient for phosphate production, to double by the end of June from the first quarter of 2021. Phosphate production slowdowns earlier this year in the U.S. Gulf due to pandemic-related issues have tightened sulfur supplies, and the shortages are likely to continue through early summer. The added costs will be passed down to farm-level pricing.

Retail prices for MAP and DAP steadied in Illinois as planting season wound down. But tight supplies and rising production costs will continue to loom large over the phosphate complex as the summer months drag on.

Potash

The rise in acreage in North America this spring was a key factor driving potash prices higher, Nutrien explained in a first quarter 2021 earnings call in May. Nutrien reported near record levels of potash sales in the first quarter of 2021 on increasing global potassium demand.

Potash was one of the more affordable inputs for farmers this spring. Potash prices in Illinois only rose 22% over the past year, the lowest of the bundle of inputs tracked by the USDA’s Illinois Department of Ag Market News Service. But strong global demand, particularly from China and India, looms in the shadows of potash demand and could overpower prices if growing production capacity or logistics issues cannot match usage rates.

Mosaic pointed to unfavorable foreign exchange rates and high natural gas prices as chief drivers of rising potash prices earlier this spring. But could high prices cure high prices? Perhaps for Mosaic.

The company announced the reopening of a mine is Saskatchewan over the course of the next year or two, which would increase global potassium production capacity. It will likely do little to help pricing for Harvest 2021 but could provide some relief to farmers by the time decisions are being made for the 2022 crop.

Fuel

As the world’s economies reopen – rapidly in the U.S. but slower elsewhere – the overarching outlook for energy prices is higher demand and prices as production recalibrates to usage rates in the post-pandemic era. Of course, heightened volatility is expected to loom large over the energy sector in the near future, which makes the outlook less clear.

Rising COVID-19 vaccination rates in the U.S. boosted oil demand as consumers increased economic activity. But don’t expect oil demand to recover uniformly around the globe. India’s recent surge in COVID-19 cases led to declining oil usage rates as lockdown measures were re-enacted, potentially offsetting higher usage rates in the U.S. in regard to oil pricing.

The U.S. Energy Information Administration (EIA) expects summer 2021 gasoline consumption levels, projected at nearly 9.0 million barrels/day during April to September in the U.S., to top summer 2020 rates. And while that is good news, it still does not mean demand is fully recovered. The EIA does not anticipate 2021 summer gasoline demand to match 2019 levels, falling short to the tune of 0.6 million barrels/day.

Even so, expect oil supplies to remain plentiful in the coming months. Current West Texas Intermediate (WTI) crude prices have traded in a range of $61.65-$66.27/barrel over the past few weeks. U.S. oil drillers typically seek expansion opportunities when WTI crude prices top $55/barrel.

Expansion projects in the Gulf of Mexico are likely to cushion current inventory levels, which should help keep fuel prices from fluctuating too rapidly, barring any unexpected refinery shut downs or any additional cyberattacks on energy infrastructure.

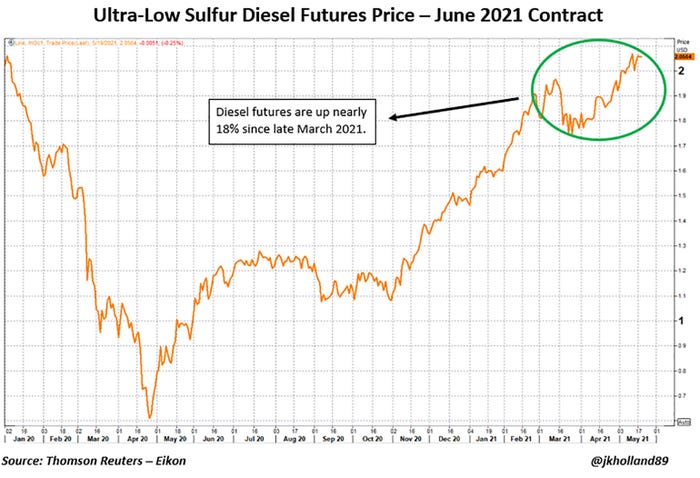

Diesel prices in Illinois have risen a staggering 79% from last year’s lows as increased energy demand trickles down to farmer-level markets. National average diesel prices sat at $3.249/gallon according to EIA data released earlier this week, marking a third straight week of rising prices. The latest on highway diesel fuel price is over a quarter higher than EIA’s expected average for diesel prices in 2021.

Farmers will need to compete for diesel with freight companies frantically trying to restore order to supply chains in the post-pandemic world. With volatility as the only certainty in the world right now, diesel prices will likely remain at the mercy of shipping capacity in the post-pandemic world.

Increased fuel production will provide the biggest opportunity for better diesel pricing over the summer. But expect those opportunities to be few and far between. Capitalize on them when they come along.

“But is it inflation?”

Inflation, by definition, is the measure of rising prices of goods and services in an economy. It is caused by rising production costs or rapid demand increases. Economists and analysts continue to argue about its impact and how long the current uptick in inflation will last, though the Federal Reserve maintains its stance that the recent surge is likely to be temporary.

In terms of fertilizer prices, the latest price increases are justified by both driving forces of inflation. Higher raw material prices and shortages, increased transportation costs, labor shortages, and import delays all increase production costs for fertilizers. Combined with rising global fertilizer demand and subsequent rises in commodity prices, there is strong fundamental support for higher input prices.

The more relevant response to this question is not whether or not it is inflation, but rather how long the higher prices will last. Tight crop supplies through the next marketing year are likely to justify higher revenues, which make lower input costs less likely over the next year.

But the outlook for the journey to the post-pandemic world remains somewhat foggy. Keep an eye on continued Federal Reserve guidance about inflationary pressures as well as supply chain dynamics, to gauge the likelihood of lower fuel and fertilizer prices. And buckle in – if the last year is any indicator of the next year to come, the wild ride is likely to continue into the post-pandemic era.

Supply chain snafus and outlook

As the world enters a post-pandemic era, it will take a while for business operations to return back to “normal.” Rising farm input prices are likely to remain high through the summer as supply chains are recalibrated and consumer demand evens out.

Freight prices and shipping delays are likely to remain high during this period. Rabobank expects wholesale prices for chemicals atrazine, glufosinate, and glyphosate to remain 40%-50% higher this year relative to last due to high shipping costs from primary producer China, where production backlogs stemming from last year’s pandemic closures continue to delay orders.

Through the second quarter of 2021, we expect farm input prices to remain high. Production costs and global demand for agricultural fertilizers, chemicals, inputs, and fuel are going through a period of growth in response to supply shortages, acreage expansions, and high commodity prices.

As companies readjust production capacity to meet demand, farmers are likely to bear the burden of these higher production costs passed down by ag retailers. University of Illinois extension expects these increases to tighten 2021/22 profit margins for corn producers who purchased anhydrous ammonia this spring and not last fall. Yield gains will remain top focus for producers looking to maintain profit margins going into the 2022/23 marketing year in this era of higher costs.

There may be some relief in Q3, but the window will not likely remain open for long before fall fertilizer applications begin. So, if farmers see pricing opportunities that align with marketing plans and operational strategies this summer, it would be wise to capitalize on those before harvest demand drives prices back up.

About the Author(s)

You May Also Like