Seven years ago, I was only interested in talking about the crop side of ag production. I couldn’t help it at the time – I’m an Illinois farm girl and up to that point, cows and corn were my life.

But around that time, I started working in food manufacturing. I quickly realized how critical other parts of the supply chain were to farm producers – even though I still preferred to talk about cows and corn if given the chance.

A lot of uncertainty remains about what the world will look like by May. Tightening corn and soybean supplies will provide a floor to prices through planting season, but other areas of the ag supply chain deserve a watchful eye from the planter this year. So, I’m deviating from corn and beans slightly this week to analyze the cost portion of the farmer’s profit equation. But bear with me – I promise it’s worth it.

Rising costs

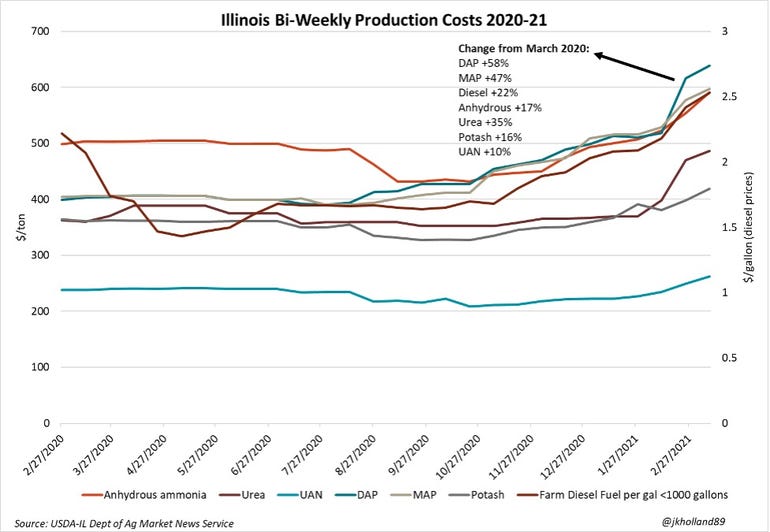

Quite frankly, fertilizer and chemical costs have done nothing but go up since harvest wrapped up last fall. In its February 2021 forecast, USDA’s Economic Research Service (ERS) projected a 2.5% annual increase in 2021 production expenses for farmers. Fuel, fertilizer, pesticides, and electricity costs are slated to increase 4.3% from 2020 prices.

Natural gas costs have eased off winter 2020-2021 highs. Natural gas is a key component of fertilizer production, so tracking its price could be a leading indicator of potential price shifts in the fertilizer and chemical market.

In four of the last five years, natural gas prices have increased during April and May. Prices in the natural gas market have been more volatile over the past year than the previous four, with a lot of the added noise due to pandemic recovery. At last glance, natural gas futures were trading near late Fall 2020 prices.

A stimulus bonus?

But an analysis from AI firm Toggle suggests this season may be an anomaly for natural gas price patterns. Toggle looked at the five largest fiscal policy and stimulus packages passed over the past two decades and analyzed the impacts to markets following each fiscal measure being signed into law

The report finds that natural gas prices fell an average 2.21% in the two weeks following the last five stimulus bills being signed. This makes sense: as consumers receive their stimulus checks, they are more likely to spend that money – and time – away from home

And this round of stimulus could exacerbate that trend. It will coincide with increasing vaccination rates and potentially booming economic activity as more consumers venture out in public while the pandemic begins to wind down.

That means less time will be spent at home so heat and electric demand, which is largely powered by natural gas, could decline.

Looking ahead

If the stars align, fertilizer and chemical costs could ease slightly this spring as natural gas costs abate. As of mid-March 2021, fertilizer and chemical costs in Illinois have surged nearly a third higher than the same time a year ago amid a recovering global economy, rising energy prices, worldwide acreage expansions this spring, and a phosphate trade dispute with Russia and Morocco.

Of course, farmers will also need to watch for rising costs of other energy products as well during planting. The Toggle report averages a 7.08%-increase in energy prices in the three months following the passage of new stimulus measures.

Farm cash receipts are expected to rise on higher commodity prices this year, so farmers are going to need to be more diligent than ever in executing a sound marketing plan to ensure their revenues outpace rising costs. High commodity prices increase profit potential, but cost management strategies will need to see tightened discipline to ensure 2021 profits are maintained.

USDA hinted at tight corn and soybean supplies in 2021/22 at its February 2021 Annual Outlook Forum, which would support another year of high commodity prices. So, if farmers end up seeing easing input costs while running the planter this spring and the profit margins pencil out, it may be a smart move to look at booking some inputs for fall fieldwork.

About the Author(s)

You May Also Like