*This is the eleventh article in our 2024 Southwest Economic Outlook series. Hear from Oklahoma State University and OSU Extension Service, and Texas A&M University and TAMU AgriLife Extension Service economists about the 2024 outlook.

Since the implementation of the Renewable Fuel Standard in 2005, fuel use has increased dramatically as a share of total grain and oilseed use. Recent trends and emerging developments in the fuel sector for soybeans will be a primary driver of market supply and demand fundamentals and market prices.

In particular, soybean crushings are on the rise. Soybean crush set new record highs in each of the last three years. An estimated 2.3 billion bushels of soybeans will be crushed during the 2023/24 marketing year. In USDA’s Long-term Projections released in early November, soybean crush will increase every year for the next 10 years.

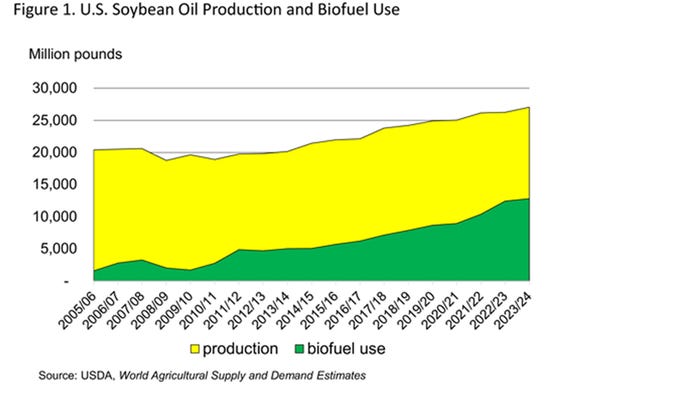

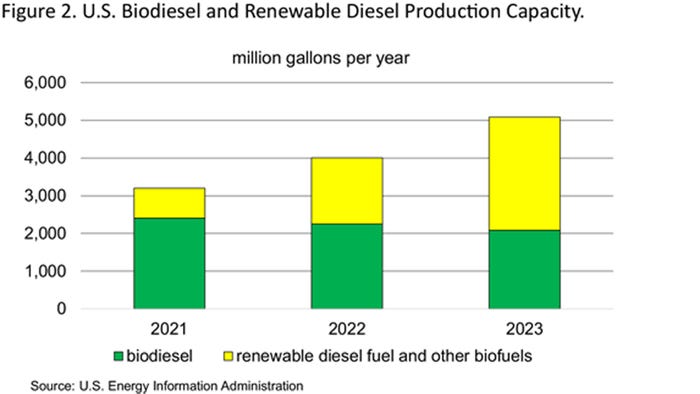

Soybean oil use has increased in the biofuel era from 20.4 billion pounds in 2005/06 to 27 billion in 2023/24. Soybean oil for biofuels has increased over this period from 1.6 billion pounds to 12.8 billion pounds (Figure 1). As a share of total soybean oil production, oil for biofuels has increased from 8% to 47%. In addition, combined U.S. biodiesel and renewable biodiesel production capacity has increased in the last three years, from 3.2 billion gallons per year to 5.1 billion gallons. Biodiesel capacity is down 323 million gallons per year while renewable diesel is up 2.2 billion gallons (Figure 2).

According to the Energy Information Administration, the drivers for expanded renewable diesel capacity are 1) increasing state and federal renewable fuel program targets and 2) the extension of biomass-based diesel tax credits. If industry announced production projects are completed as scheduled, renewable diesel production could double by 2025.

Soybeans relative to corn

In response to demand growth in the soybean sector, the price of soybeans has strengthened relative to corn. The soybean-to-corn price ratio, an important market signal influencing farmers’ planting decisions, was relatively low for the 2022/23 marketing year ($14.20 soybeans/$6.54 corn: 2.2 ratio). The average ratio of season average farm prices since 2005/06 is 2.5. Consistent with a relatively strong corn price compared to soybeans, U.S. corn acres increased in 2023 by 6.3 million acres and soybeans were down 3.9 million.

Currently, the ratio of season average farm prices for soybeans and corn is 2.7 ($12.90 soybeans/$4.85 corn). Relatively stronger soybean prices point to an increase in soybean acres for 2024.

Early season crop budgets from the University of Illinois show a per acre profit advantage for soybeans over corn of $60 to $70 per acre. Soybeans gain the advantage over other crops with a higher relative output price and significantly lower production costs.

Soybean exports

Exports are a major use category for U.S. soybeans, normally accounting for 40% to 50% of total soybean use. With Brazil the primary competitor for export market share, South American production levels have significant price impacts. Soybean acres continue to set records in Brazil so weather will be a key factor to watch. An El Niño weather pattern is normally associated with drier and warmer weather in Northern Brazil.

The U.S. soybean outlook is a mix of strong domestic use, increased supply (higher acreage and yields with normal weather), and potentially strong export competition. The price outlook for soybeans, as for other grains, is lower than the last several seasons. But with favorable yields and efficient input management, soybeans may be a bright spot of potential profit in 2024.

About the Author(s)

You May Also Like