*This is the tenth article in our 2024 Southwest Economic Outlook series. Hear from Oklahoma State University and OSU Extension Service, and Texas A&M University and TAMU AgriLife Extension Service economists about the 2024 outlook.

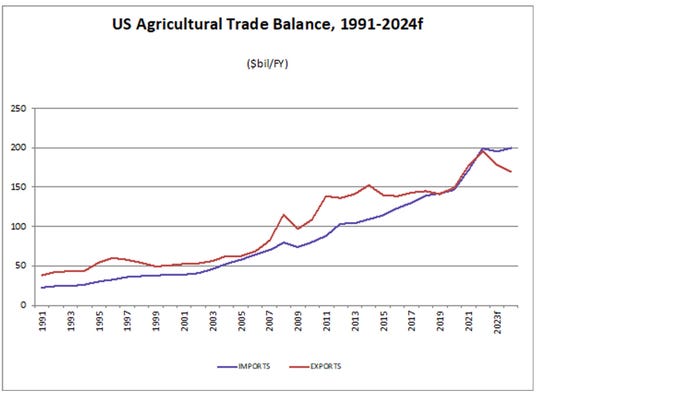

U.S. agricultural exports have experienced a seven-year expansion run from 2015 to 2022, going from $137.2 billion to $195.9 billion, respectively. This increase of U.S. agricultural exports was accentuated during the COVID-19 pandemic years as total exports increased by 38.8% in value and 8.1% in volume between 2019 and 2022.

The rather large difference between value and volume increases shows a price increase in most commodities, which can be attributed partially to an increase in quantity demanded of U.S. agricultural products, but also to inflation experienced worldwide, as well as the Russia-Ukraine war.

U.S. agricultural imports

In the meantime, U.S. agricultural imports have also increased rapidly, from $114 billion to $199.3 billion, during the same period. Therefore, the U.S. is experiencing an agricultural trade deficit for the second time since the beginning of the 21st century, with 2019 being the only other time when imports surpassed exports.

However, given the latest USDA Outlook for U.S. Agricultural Trade report (November 2023), an even larger agricultural trade deficit trend seems to be on the horizon. The report forecasted exports for 2023 and 2024 at $178.7 and $169.5 billion, respectively.

The export reduction is primarily driven by lower expected exports in grain and feed, and livestock, poultry, and dairy products. On the other hand, imports forecasted for the same period were $195.4 billion and $200 billion, respectively. The main drivers for an increase in the value of imports are a strong U.S. dollar and resilient domestic demand, especially for beef and veal, vegetable oils, and grain products.

Mexican Government Executive Order

A major concern for U.S. corn producers over the last couple of years has been the Mexican Government Executive Order signed in 2020 that required a phaseout of glyphosate and genetically modified (GM) corn by 2024 for domestic production as well as imports.

Mexico was the largest market for U.S. corn in 2020, with a volume of 14.5 million metric tons (MT) valued at $4.9 billion. However, U.S. exports to Mexico increased in 2022 to 15.4 million MT valued at $4.9 billion. Moreover, year-over-year U.S. corn exports to Mexico have increased by 15% in quantity and 9% in value from January to October. This trend will likely continue.

About the Author(s)

You May Also Like