Crop prices hit a sour note at harvest in 2023, far removed from the $8 corn and nearly $18 soybeans of the previous year that were triggered by inflation and the Ukraine war. But some growers sang a different song – if they hedged during the summer in line with time-tested seasonal patterns.

Selling corn in late June and soybeans in mid-July earned prices $1 a bushel higher than harvest for both crops, easing the pain from the downturn markets suffered in the second half of the year.

Targeting those windows for action was no accident. December corn futures on average over the past 50 years peaked the fourth week of June with November soybeans topping out three weeks later, ahead of crucial periods of reproduction.

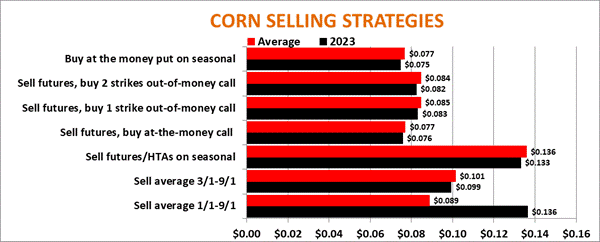

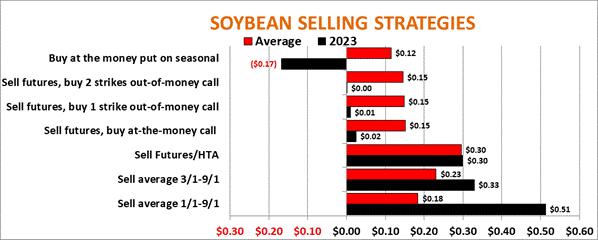

Indeed, 2023 followed the script documented by Farm Futures long-term study of selling strategies dating back to the 1985 crop year, when options trading resumed following a decades-long ban. The study also looks at sales made the second week of April and third week of May, in addition to the summer windows. The average of these gains from sales of futures or hedge-to-arrive cash contracts compared to harvest matched long-term results. Corn averaged 13 cents a bushel above the harvest at the 11 locations included in the research, and soybeans earned 30 cents at 9 markets around the Midwest.

The study compares futures and options strategies using cash prices and options data for as realistic an assessment as possible, varying harvest dates at each location according to harvest progress there. While the growing season may seem far away, some of the strategies involve taking actions now, well before planters start rolling in most areas.

Start your engines

Why get started pre-plant? That has to do with the nature of options.

One impediment to selling during the growing season is uncertainty over yields, which can turn hedges upside down if production falls sharply and futures take off. Options are one alternative, but they come with a price tag that hinders efficiency and premiums that must be paid in full up front, which are lost if the market rallies.

Premiums are relatively higher during the growing season when uncertainty peaks, allowing those who sell them to farmers to command a higher price.

One potential solution is to purchase options when the market usually is calm and lower. Both corn and soybeans on average bottom in February. This can decrease the cost of call options that give the owner the right to buy futures. Calls tend to increase in value if the market takes off, so owning calls can give growers profits to add to sales made when prices were lower.

Puts fare worse

Combining ownership of a call with a contract to sell is known as a synthetic put because it mimics performance of the other type of option. Puts give growers the right to sell futures at a fixed strike price and gain value if the market falls enough. If prices rise instead, the grower is free to sell for a higher price.

Because this risk insurance costs more during the growing season, put options continue to be the worst performer for both corn and soybeans in the Farm Futures study. Corn puts earned a profit over harvest prices only half the time in the study, with soybeans faring even worse.

By contrast, protecting sales by purchasing calls during times of seasonal weakness captured higher long-term returns, in line with what options theory says they should be. Selling December corn futures/HTAs covered by an “at-the-money” call, the right to buy futures for about where they’re trading, netted about half the gains compared to selling futures outright.

That math didn’t work for soybeans last year. The synthetic put strategy barely broke even for November soybeans, while at-the-money puts lost 17 cents on average.

The winner

The surprising winners for soybeans among all strategies were average price contracts, which are offered by many elevators and some brokers. The contract using average prices from January through August made 51 cents – 21 cents more than the average of three sales made with futures/HTAs – and also was fractionally higher for corn.

Farm location also mattered with 2023 crops. States with above average yields tended to have weaker than average basis, while those with disappointing yields saw stronger cash markets, because buyers were forced to bid up prices to fulfill needs. This created something of a “natural hedge,” helping to even out returns.

About the Author(s)

You May Also Like