While planters are parked and growing season weather won’t be an issue for months, most farmers have already put together some type of marketing plan for 2024 crops – even if it’s little more than a notion to “sell when prices are higher.”

Sure, unprofitable new crop futures may make actually starting those plans seem premature. But seasonally weak corn and soybeans translate into February opportunities for those who use call options to manage risk, according to the Farm Futures long-term study of pre-harvest sales.

Options aren’t the big winners in the study, which tracks results all the way back to the 1985 crop year, when puts and calls resumed trading following a decades-long ban. Indeed, on average, options strategies are the least profitable of the methods evaluated and beat just selling off the combine at harvest less often than other ways of making sales. Alternatives include selling futures or hedge-to-arrive contracts or using average price tools available at many elevators and some brokers.

Those more profitable strategies may earn higher returns. But they can turn upside down if production falls sharply or futures take off after sales are made. Options can reduce that volatility because they provide the right, but not the obligation, to trade futures. This feature gives growers another kick at the can.

The downside that hinders the efficiency of options is their cost, premiums that must be paid in full upfront and eventually are lost if the market rallies. And not all options are created equal. Puts, which offer the right to sell futures, gain in value as prices fall, so they cost more when prices are down. Calls, conveying the right to buy futures, are cheaper, which can make February a good time to start buying.

Puts fare worse

Three main factors influence options premiums:

Time. Premiums are usually higher for contracts offering longer coverage.

Strike price. In-the-money options that can immediately be exercised for a profit have more “intrinsic value."

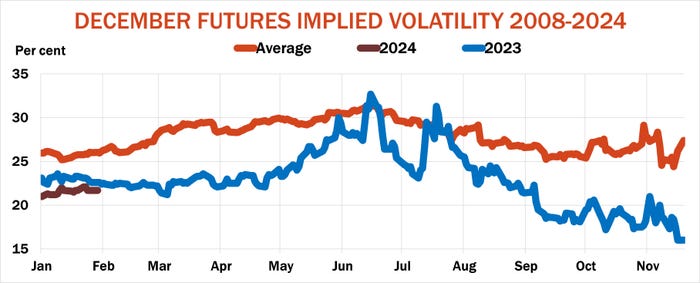

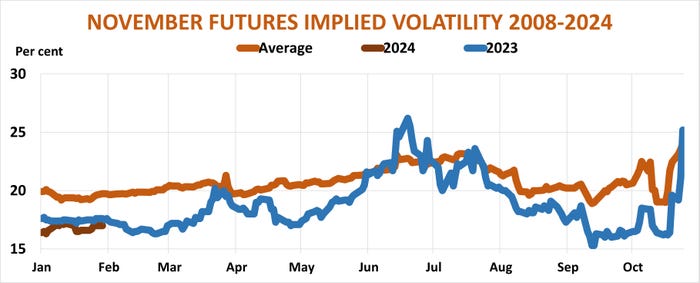

Implied volatility. As uncertainty increases, those who sell options to buyers like farmers face more risk. “Implied volatility” measures this uncertainty and typically rises during the heat of summer, especially during weather markets. So, sellers demand higher premiums for the price insurance they’re providing.

Increased costs associated with buying calls in February, so far in advance of expiration, can be offset by both volatility and futures prices, which typically are lower.

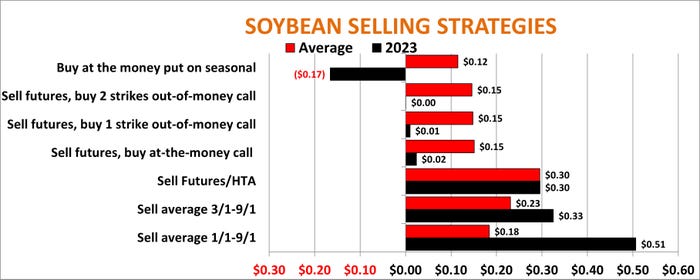

Combining ownership of a call with a contract to sell is known as a synthetic put, because it mimics performance of the other type of option. Puts continue to be the worst performer for both corn and soybeans in the Farm Futures study because risk insurance costs more during the growing season when futures may be higher. Corn puts earned a profit over harvest prices only half the time in the study, with soybeans faring even worse.

By contrast, purchasing calls during times of seasonal weakness – the end of February, April and May – to protect sales made a little later, captured higher long-term returns, in line with what options theory says they should be. Selling December corn futures/HTAs covered by an “at-the-money” call, the right to buy futures for about where they’re trading, netted about half the gains compared to selling futures outright.

That math didn’t work for soybeans last year. The synthetic put strategy barely broke even for November soybeans, while at-the-money puts lost 17 cents on average.

Time of the season

Crop prices hit a sour note at harvest in 2023, far removed from the $8 corn and soybeans near $18 of the previous year that were triggered by inflation and the Ukraine war. But some growers sang a different song – if they hedged during the summer in line with time-tested seasonal patterns.

Selling corn in late June and soybeans in mid-July earned prices $1 a bushel higher than harvest for both crops, easing the pain from the downturn markets suffered in the second half of the year.

Targeting those windows for action was no accident. December corn futures on average over the past 50 years peaked the fourth week of June with November soybeans topping out three weeks later, ahead of crucial periods of reproduction.

Indeed, 2023 followed the script documented by the Farm Futures study, which also looks at sales made the second week of April and third week of May, in addition to the summer windows. The average of these gains from sales of futures or hedge-to-arrive cash contracts compared to harvest matched long-term results. Corn averaged 13 cents a bushel above the harvest at the 11 locations included in the research, and soybeans earned 30 cents at 9 markets around the Midwest.

The study compares futures and options strategies using cash prices and options data for as realistic assessment as possible, varying harvest dates at each location according to the progress of combines there.

The winner

Average price tools were surprising winners for soybeans among all strategies. The contract using average prices from January through August made 51 cents, 21 cents more than the average of three sales made with futures/HTAs, and also was fractionally higher for corn.

Farm location also mattered with 2023 crops. States with above average yields tended to have weaker than average harvest basis, while those with disappointing yields saw stronger cash markets, because buyers were forced to bid up prices to fulfill needs. This created something of a “natural hedge,” helping to even out returns.

For complete results of the study for all years and locations, click the links below.

Central Illinois: Corn | Soybeans

Central Indiana: Corn | Soybeans

Denver: Corn

Evansville: Corn

Garden City, Kansas: Corn | Soybeans

Read more about:

Grain StorageAbout the Author(s)

You May Also Like