Soybean futures are on a tear, rallying last week to the highest level in more than four years. Cash prices topping $10 a bushel give farmers the chance to sell their crop at a nice profit as the U.S. harvest wraps up.

Most of the market’s focus is on red-hot demand, thanks to aggressive buying from China as it tries to meet commitments under the Phase One trade deal. Over the next few weeks look for South American weather to take center stage as the rally tries to maintain its hyperbolic rise.

The only store in town

To be sure, hot, dry conditions in Brazil already played a supporting role in the move, delaying planting that normally begins in mid-September. At a minimum, a late crop could steer even more business to the U.S., which is the only store in town for end users who can’t wait for the Brazilian harvest to begin.

Most years beans hit the international pipeline from Brazil by January. That movement likely won’t begin until February 2021.

In addition, while China accounts for 55% of the 1.67 billion U.S. soybean sales and shipments to date, other buyers aren’t sitting on their hands. Their commitments are up 63% from last year.

And if threatening conditions continue, soybeans could be ready to extend their move. La Nina warming of the equatorial Pacific is associated with lower yields in Argentina, where planting is also slower than normal.

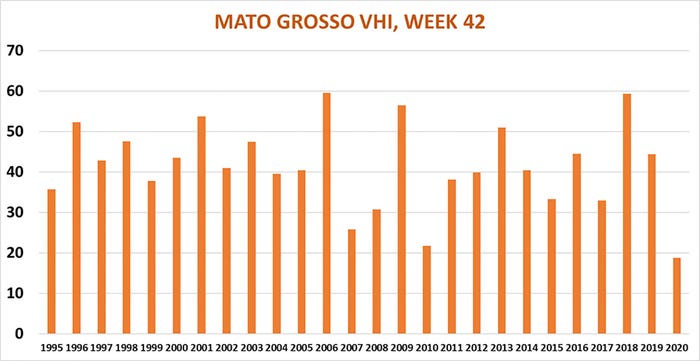

Brazil’s soybean ground received less than half its normal precipitation over the last 30 days, stress that’s visible on Vegetation Health Index maps. The latest VHI reading for the big state of Mato Grosso is just 18.7, the lowest on record for the week and down from average levels around 44 on the 1 to 100 scale. So far, that translates into yields that could be off by more than 10%.

Still, a dry start to the Brazilian growing season doesn’t always mean a disaster. Early conditions were almost as bad in 2010, but improved rapidly into November and December, resulting in then-record yields.

Returning rains?

Indeed, there are hints at rains returning after the extended dry season. Better showers were seen last week with a good system moving north after benefiting Argentina over the weekend. Weather models for next week aren’t so optimistic, with temperatures topping 100 degrees persisting in some areas.

Some Brazilian growers dusted in their crops ahead of those rains. They’ve got plenty of incentive to roll the dice. While U.S prices are good, in Brazil they’re at astronomical levels

Average benchmark prices hit $29.23 a bushel last week, up 65% since mid-March, convincing farmers to aggressively forward price their expected new crop production. While many Brazilian growers traditionally price their crop in dollars, they’re also reaping a bonanza when the sales are converted back to the local currency. The Brazilian real was already at historically weak levels compared to the dollar even before the pandemic began, thanks to years of political and economic turmoil. COVID-19 punished the currency more in hard-hit Brazil, lopping another 14% of the real. This sent soybeans to nearly 75 reais a bushel when converted from dollars, nearly double their spring value.

Argentine turmoil

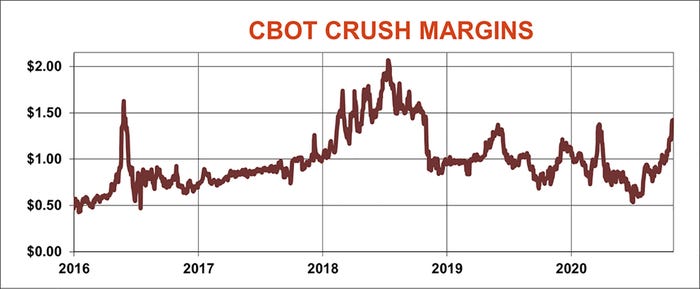

Argentina continues to be a basket case. Inflation there fell to “just 36.6%” in October, down from 53.8% in December, but the peso is trading 80 to 1 against the dollar. Five years ago it was 10 to 1. The previous government’s economic reforms failed to halt the country’s decline, and farmers are once again hoarding soybeans as their only hedge against inflation. That could lower crush in the world’s leading soy product exporter by 10%, opening the door again for U.S. sales. CBOT crush margins hit their highest level in two years last week as a result.

Average U.S. soybean basis for October is the strongest since 2013, making sales now more attractive than usual. Growers who are still bullish could consider a basis contract covered by a put option or selling cash and buying a call. Implied volatilities for July options are still running around average October levels despite the big rally on the board.

Knorr writes from Chicago, Ill. Email him at [email protected]

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like