Saying “things are different” in 2020 is to state the obvious about the impact of COVID-19 on just about everything. But there may be one corner of the grain market where the cliché is more nuanced, and that could impact your storage decision for corn as harvest begins to head down the home stretch.

Despite a big crop here in the U.S. and more than ample supplies, average basis levels are surprisingly decent. Even more noticeable for hedgers: Carry in the futures market is at very low levels. That’s making it more difficult for farmers to protect inventory they’ll store on farm into 2021 by selling futures or hedge-to-arrive contracts while they wait for the cash market to strengthen.

Average corn basis ended last week about 25 cents under December futures, which closed above $4 a bushel for the first time since January. But the July 2021 contract settled just 7.25 cents about the nearby, after nearing only a nickel on Thursday. The lack of carry for commercial traders – it’s less than the storage fees for a month of corn in a deliverable position – was a tip-off that something indeed is up.

The combination of carry plus basis appreciation on the nearby combine for anticipated storage returns from a hedge, after accounting for depreciation on bins and paying interest on unsold grain and fees for storage, handling and trades. Tight carry at harvest doesn’t make it impossible to turn a profit on a storage hedge. But small spreads between December and contracts for delivery in the spring and summer make it harder for this strategy to pay off.

The change in the carry trade has been dramatic. In early September, December-July traded for as much as 21.5 cents. But after a surprisingly bullish Sept. 1 stocks report at the end of the month, a rally sucked two-thirds of the carry out of the market in just two weeks.

The 50-cent gains by front end December certainly played a role in the spread evaporation. When the nearby moves, speculators often bull-spread the market, buying the nearby and selling deferreds as a surrogate for buying the board outright.

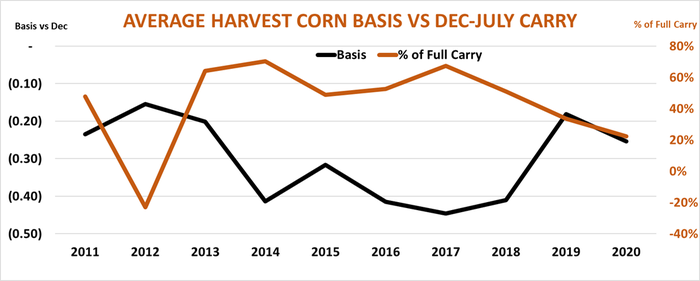

End users also turn to bull spreading to help manage risk, hoping that gains from the trade will help offset strengthening basis they must pay in the cash market. Average nearby harvest basis shows a statistically significant correlation with the percentage of full commercial carry; the stronger the basis, the less carry tends to be. The average for this percentage in October project right to the 25-under basis reading in the cash market currently nationally.

But harvest basis shows an even stronger correlation with supply and demand, as measured by the ratio of projected ending stocks to usage for the marketing year. Based on this metric, the current projected stocks to usage ratio of nearly 15% translates into average harvest basis of 38 under, considerably weaker than the current market.

Of course, the 2020 crop may not be as big as USDA forecasts. The last condition report for the season out Monday continues to suggest potential for lower yields. COVID also may account for some of the discrepancy between basis and stocks. While total supplies of corn are good, the amount of grain available at the moment may be less than immediate demand. Disruptions caused by the pandemic kept some end users from receiving shipments, while ‘exporters like the U.S. were also stymied. So, part of the market is playing catch-up. China has also begun buying U.S. corn as part of the phase one trade deal. While amounts of Chinese purchases aren’t huge, when China talks even a little, folks listen.

China is also buying wheat and, most of all, soybeans. And after disappointing 2019 harvests, new crop must get into position for exporters. Shippers are scrambling for railcars to the Gulf and Pacific Northwest, sending the cost of shipping corn from Minneapolis to the West Coast up by almost 25 cents a bushel.

Closure of key locks on the Illinois River, where deliveries against futures focus, may also be working into the equation. While most of the repairs are done, the need for empty barges sent October barges on the Illinois River to their most expensive level since 2015. Low water on the lower Mississippi River is also tying up traffic and increasing congestion, limiting availability of empties. Bull-spreading makes sense for users who must complete with Gulf corn basis trading nearly double its five-year average.

The tight carry market does have one benefit for farmers. Those without on-farm storage, or who need to raise cash, may find it a little easier to move grain now and replace it with deferred futures or options. Buying an at-the-money July 2021 corn call still isn’t cheap: the $4.10 strike closed at 24.25 cents last week. But overall modest implied volatility and lack of carry make the calls a little bit better value, even if the Farm Futures storage strategy study shows the odds of a profit are slim.

Still, growers with stronger harvest basis than they anticipated may want to take a look at just selling some off the combine. According to the National Corn Index of 3,175 elevators at the Minneapolis Grain Exchange, the average corn price Friday was $3.78. That’s just three cents a bushel away from the full economic cost of production based on USDA’s Oct. 9 yield projection. And if more realistic costs for machinery are used, current price net a cash return of 40 cents a bushel.

Knorr writes from Chicago, Ill. Email him at [email protected]

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like