Corn market rallies need a spark, and around Independence Day ignition usually takes forecasts for hot, dry conditions as pollination begins.

While little of the Midwest is officially suffering from drought, some dry areas persist and weather models are starting to call for above average temperatures, and perhaps, below average precipitation, too. These outlooks helped trigger sharp gains in corn futures Monday. The rally continued today, despite improving nationwide crop ratings reported after the close Monday by USDA, thanks to bullish acreage numbers.

But weather models, just like nature, can be fickle, with sudden shifts dousing rally hopes. So how do you tell if a bullish forecast is the real deal?

Traders use lots of methods to judge potential, primarily patterns on price charts. The market has another gauge of sentiment that helps show whether bulls are really putting their money where their mouth is. The relative cost of options offers clues.

Price insurance

Options are often described as price insurance. Buyers pay a premium for the opportunity to buy or sell a futures contract at a preestablished strike price. The more sellers of these policies demand – or that buyers are willing to pay – is an indication of just how nervous traders are about protecting their positions.

In volatile markets, of course, prices move up and down a lot. Historical volatility looks at what prices have done in the past. But rather than looking backwards, implied volatility offers a glimpse of what traders think about the future. It uses the price of an option to measure just how uncertain the market is about what could happen ahead.

The math used to calculate this is fairly complex, taking into account the price of the option and how long it lasts. The CME Group, parent of the Chicago Board of Trade, has a tool called QuikStrike that analyzes volatility, which is also reported on some futures price systems.

Fear factor

In the stock market this volatility has long had its own measurement, the VIX. It’s often called the “fear factor,” because it soars when investors panic over falling prices on Wall Street. Put options offer protection against down markets, and the VIX is highest when fear grips investors, as it has for much of 2020 due to the coronavirus pandemic.

There’s a VIX for the corn market, but it works a bit differently. Volatility in grain options is normally highest when traders fear rising prices, so call options are key.

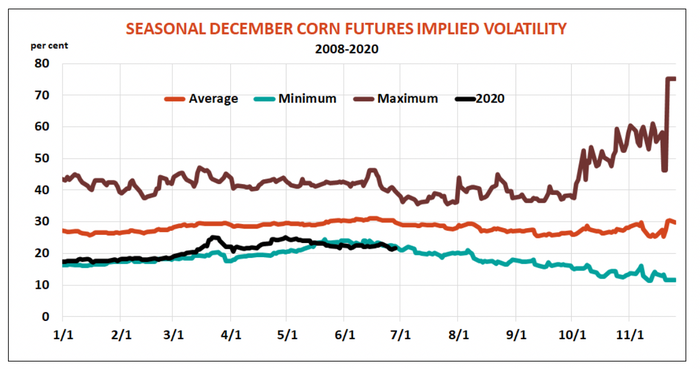

The relative price for December corn options on average peaks in mid- to late June, when forecasts begin peering into the window for pollination. Most years the crop gets through this period of vulnerability just fine, and implied volatility falls into July, rebounding briefly ahead of USDA’s August crop report, when the agency releases its first production survey of farmers and their fields.

In bearish years, which is most of the time, the market keeps fading until December options expire after Thanksgiving. The exception comes in years when yields suffer and damage is confirmed as combines roll in the fall. These bull market years can see rising volatility as the options get ready to go off the board.

What about this year?

So far in 2020, implied volatility for December corn options followed the pattern typical of years with plentiful supplies and prospects for big production. The December corn VIX stayed just above the lowest levels seen in in more than a decade until uncertainty over COVID-19’s impact caused a little concern this spring. Those fears quickly dissipated in June due to good crop ratings that took the VIX to its lowest seasonal level since at least 2008.

USDA’s surprising cut in corn acreage today should make the market even more sensitive to weather gyrations. Initial momentum should continue to come from short covering as speculators rush to buy back more of their large bearish bets. This in turn should take some of the carry out of the market, tightening spreads between December 2020, and say, July 2021 futures. But until traders are willing to pay more for options – and pay up for a while -- any rallies are suspect.

Knorr writes from Chicago, Ill. Email him at [email protected]

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like