Oh boy, I’m about to do it again. I’m about to put the kiss of death on a robust wheat market. I should not discuss it. Let me explain.

Every baseball fan knows that when a pitcher has a no-hitter going, you do not say the words “no-hitter.” Radio and television announcers find creative ways to let you know that no batter has a hit. They might refer to a lot of zeros on the scoreboard, or that no batter has hit safely. Like the fans at the game or listening at home, the announcers know it’s a jinx to say “no-hitter.” Don’t say it!

A similar legend exists with the Sports Illustrated cover. Your favorite team is red hot and Sports Illustrated features them with a picture on the cover, after which their season falls apart. It’s the cover jinx. Don’t show my team on the cover!

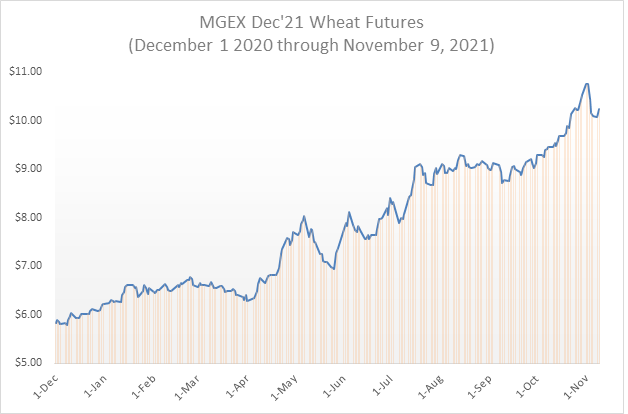

So let’s talk about a soaring wheat market. The butt-kicking drought in the Northern Plains and Canada was well-documented and discussed throughout the growing season. By my estimate, North Dakota spring wheat yields at 33.5 bushels per acre were 31% below trend. Relative to trend, this was the worst year since 1988. Canadian wheat yields were equally bad. December spring wheat futures rose $3 per bushel from early April until harvest at the end of August. This was a powerful move, but given the intensity of the drought, it was not surprising.

What is surprising is the strength of the market over the past two months, after the end of harvest. Did we learn something new about the U.S. or Canadian spring wheat crops? Not really, but Dec’21 MGEX futures soared another $2 from early September to early November. The soft red and hard red winter wheat markets are also strong, setting life-of-contract highs in late October and early November.

Wheat may be leading grain markets, but corn and soybeans are reluctant followers. Corn enjoyed a nice rally from mid-October to early November, gaining 75 cents per bushel. Nice move, but prices are still far short of LOC highs set back in May. Soybeans? The November WASDE report gave soybeans a boost but look hard at a chart of January soybeans – this market has been trending lower since mid-July.

What does a strong market mean to wheat marketers? I hope it has you looking ahead to 2022 pricing opportunities. We have not seen new crop pricing opportunities in wheat (all classes) this good and this early since 2013. Pay attention to the opportunity.

I’ve put the kiss of death on wheat before. As the spring wheat market neared $8 per bushel in late-July of 2017, I wrote a column for CSD titled, “Grains Find a Leader.” That leader, by the way, was wheat. By the time the issue hit mailboxes in mid-August, the market had already peaked. By year-end, wheat prices were trading nearly $2 lower.

Wheat is the leader. Just don’t say it out loud.

Data source: MGEX closing prices. I understand the rise in prices through the late-August/early-September harvest. Drought! How do I explain the last $2 of the move?

Ed Usset will be speaking at the Farm Futures Business Summit about grain marketing. The event is set for Jan. 20-21 in Coralville, Iowa.

Read more about:

ManagementAbout the Author(s)

You May Also Like