Record farmland sales have been the source of trending headlines frequently this year. The value of farmland continues to rise, due in part to low interest rates, government support and higher-than-normal farm incomes.

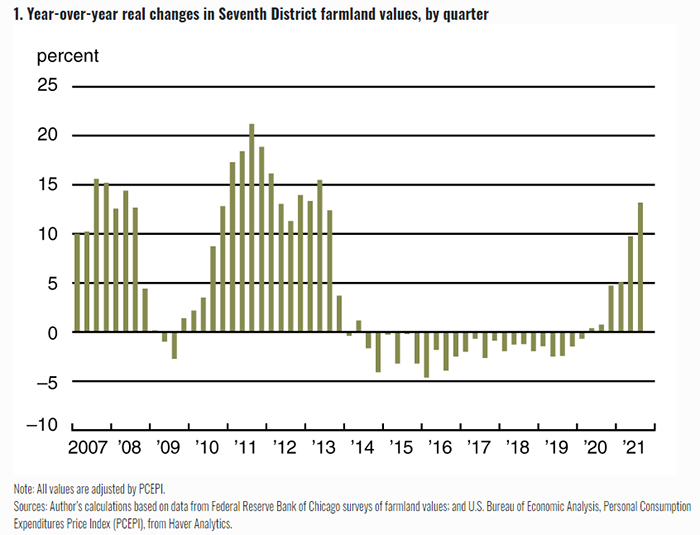

The Chicago Fed's AgLetter reports that farmland values for the Seventh Federal Reserve District in the 3rd quarter of 2021 were 18% higher than a year ago. This is the largest year-over-year gain in over nine years.

Values for “good” agricultural land in the 3rd quarter of 2021 were 6% higher than in the 2nd quarter, signaling that farmland values are still on the rise.

Of the respondents surveyed for the report, 68% anticipate District farmland values to rise in the final quarter of 2021, and the remaining 32% anticipate values to stay stable.

The Federal Reserve Bank of Kansas City reports similar conditions in the Tenth District, with farmland real estate values about 15% higher than just one year ago.

Farm income and loan repayment rates continue to increase in the Tenth District. However, the pace of increase was slower in areas impacted by drought.

Interest rates

Farm loan interest rates remain historically low. The average fixed rate on all loan types reached another all-time low this quarter in the Tenth District, and average variable rates also declined from the 2nd quarter.

Input cost concerns

While most ag lenders remain optimistic about the outlook for agriculture, concerns linger about rising input costs. Still, the ag sector will be well positioned heading into 2022 with strong commodity prices and double-digit land value gains, according to the Kansas City report.

An Iowa banker noted that 2021 had “given most farm customers their best returns to income in years,” but added that “concern will shift next year to higher input costs and high land prices.”

Source: Federal Reserve Bank of Chicago and Federal Reserve Bank of Kansas City, which are solely responsible for the information provided and is wholly owned by the source. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

About the Author(s)

You May Also Like