This is part one of four in the Black swan in the Black sea series.

Leading up to Russia’s invasion of Ukraine in late February 2022, Ukraine was the fourth largest corn exporter in the world. In fact, Ukraine corn exports were in peak loading season when Russia invaded which fueled corn price rallies in the days following the war’s onset.

Accessing Ukraine’s 2021 corn crop is rife with challenges. And while Ukrainian corn producers are planning for a corn crop in 2022, it is increasingly clear that the crop volume will only be a fraction of 2021 production. Here is how global corn flows are realigning in the Black Sea crisis era.

Getting Ukraine’s corn out of the country

Corn futures have soared to new heights as global supply availability remains uncertain. Before the war, Ukraine was on track to be the world’s fourth-largest corn exporter in 2021-22. While it still lays claim to that ranking amid the war, accessibility to that corn remains an issue.

Amid the other atrocities and potential war crimes committed by Russian troops, destruction of Ukraine’s infrastructure has been a key priority for Russian President Vladimir Putin. Russian soldiers have shelled grain storage and export loading facilities, planted land mines in farm fields, and destroyed farm equipment in hopes of crippling Ukraine’s food supplies.

“Russia is actively targeting grain silos and food storage facilities,” U.S. Deputy Secretary of State Wendy Sherman told a U.N. Security Council meeting in late March. Also, Ukrainian forces have mined port facilities to prevent a Russian naval invasion.

Ukraine has been able to transport some of its grain to neighboring Poland and Romania via rail, but the volumes don’t come close to its Black Sea loading facilities’ efficiencies. Rail shipments can only transport a tenth of the grain volumes per month than can be shipped through the Black Sea. Plus, its railcars require a wheel change at other countries’ borders, where the more advanced European tracks require smaller wheels than Ukraine’s Soviet-era railways.

In April, Ukrainian grain shipments totaled 1.09 million metric tonnes. As of May 19, approximately 643,00MT of grain had been exported, primarily through rail shipments. Of that total, 617,000MT (24.3M bu.) of corn had been shipped, the largest volume of any ag product shipped out of Ukraine at that time.

Prior to the war, Ukraine could typically ship up to 6MMT of grain per month. USDA expects current year Ukrainian corn shipments to register at 906 million bushels, down from a pre-war estimate of 1.32 billion bushels.

Risk premiums add another level of pain to the process. Shipping costs to the Black Sea before the war were a mere $40 per metric ton. But rail shipments diverted to Black Sea ports in Romania typically charge $133 to $166 per MT — up to a 315% markup.

Soaring insurance costs on hopeful Black Sea shipments is another constraint, as risk of vessel and container damage remains high. At the war’s onset, additional premium rates for seven days of coverage rose from about 0.025% to as high as 5%. That translates into insurance costs in the low- to mid-six digits for a shipment of grain — unfathomable prices for many traders.

Somewhat unsurprisingly, Russia is recalibrating its invasion strategy in Ukraine to focus on controlling the south via eastern Ukraine. This is significant for corn growers because Ukraine’s Odessa port — which once handled most of Ukrainian corn exports — is in southwestern Ukraine along the Black Sea.

Ukrainian export terminals in the Black Sea remain closed amid Russian naval blockades and missile damage to grain loading and storage facilities. Control over Ukraine’s Black Sea exports is a critical military goal for Putin, with the capture of Odessa being his primary objective. While Russian advances have faced steep roadblocks in Mariupol, it has come at a tragic cost to Ukrainian civilians.

Mariupol is not a key corn exporting terminal for Ukraine in the Black Sea. But if Russian aggressions in Mariupol are any indication of what forbodes for Odessa, it is possible that corn prices could continue higher if a long Russian occupation of Odessa occurs.

Ukraine’s planting forecast uncertain

Ukraine’s planting campaign has been riddled with war-related challenges. Fuel and fertilizer shortages compound the pain. Ukrainian agricultural consultancy APK-Inform expects Ukraine will harvest 38.9 million metric tons of grain this year, a 55% decrease from 2021.

Unofficial estimates for this year’s Ukrainian corn crop vary from 39% to 55% of 2021 acreage. Official estimates from the Ukrainian government are not likely to be forecasted until the war has stabilized. Export challenges have reduced the domestic demand for more corn acres as Ukrainian farmers attempt to plant more small grains to ensure domestic food availability.

Ukraine’s agriculture ministry issued several revisions to 2022 sowing forecasts, though the numbers were highly dependent upon clearing Russian land mines from fields and did not provide specific crop allocations. The latest forecast for spring crops, issued in mid-April, of 34.6 million acres came in at 17% below spring acreage planted in the previous year.

As of May 9, Ukrainian farmers had successfully planted 17.3 million acres, with Ukrainian Agriculture Minister Mykola Solskyi estimating planting paces to be 20%-30% behind last year’s paces due to wartime disturbances.

USDA’s first estimates for 2022/23 Ukrainian corn production were released in early May and point to a 54% annual production loss for the country’s corn crop. The crop is forecast at 790 million bushels after registering at 1.66 billion bushels last year.

While the harvest sizes for both corn and wheat are substantial, ongoing drought concerns plus harvest, storage, and logistic challenges could prevent crop sizes from expanding further this year.

USDA expects Ukraine will barely ship 40% of 2021/22 corn export volumes in 2022/23, causing global corn usage rates to contract for the first time since the U.S.’s crop shortfall in the 2019/20 marketing year.

Global corn trade shifts

Ukraine is the smallest of the world’s four largest corn exporters, following the U.S., Brazil and Argentina. Brazil’s safrinha crop is off to a good start. Timely rains early in the growing season point to a record year for Brazilian export volumes, which will help loosen global supply constraints once harvest begins in June.

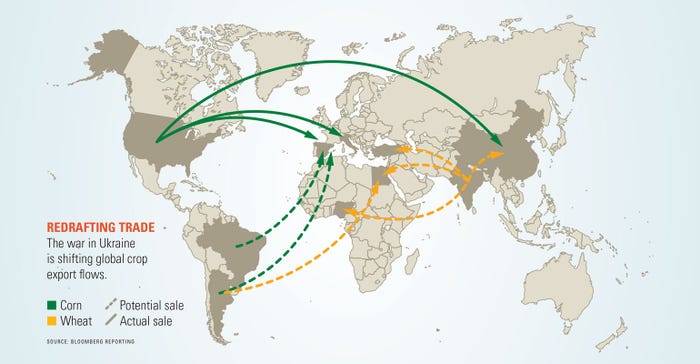

Ukraine’s former No. 2 corn buyer, Spain, eased restrictions on herbicide traces in GMO corn imports to allow access to South American and U.S. corn supplies for feed in mid-March. Ukraine previously supplied about half of the European Union’s non-GMO corn imports, which are largely used for livestock consumption.

To ensure adequate feedstocks, the odds are increasing that the EU could relax its stringent GMO rules, creating potential for U.S. corn exporters previously locked out of EU feed markets. USDA has already raised projected 2021-22 U.S. corn exports to 2.5 billion bushels, a 50 million-bushel increase from year-ago estimates, on strong anticipated corn shipments this spring.

Top buyer China increased shipping paces of U.S. corn by 16% in the five weeks following Russia’s invasion of Ukraine. Prior to the war, Ukraine’s non-GMO corn supplies were among the most optimal for Chinese buyers. As of mid-May, China’s buying spree for U.S. corn slowed considerably as traders opt to wait for Brazil’s safrinha crop — and the potential price discounts that could accompany it.

Expectations for a smaller U.S. corn crop in 2022 will not help ease global supply concerns, especially if cool spring weather causes planting delays. Trend-line yields are not guaranteed this year with La Niña-induced drought conditions likely to take a toll on what acreage remains in corn across the Plains and Upper Midwest.

Corn markets will likely fluctuate wildly this summer with North and South American weather forecasts. If Ukrainian farmers can somehow find a way to grow and ship corn supplies, then some of the wind might shift out of corn’s sails. But those chances seem low based on the devastation inflicted by Russian troops.

This is part one of four in the Black swan in the Black sea series. Tomorrow’s installment (part two) will examine how wheat trade flows have shifted and could further shift due to the Black Sea conflict. It includes updated production information from the latest USDA-World Agricultural Supply and Demands Estimate report issued in early May on Ukrainian production and updated Russian export forecasts.

Read more:

Black swan in the Black Sea: wheat

Black swan in the Black Sea: fertilizer

Black swan in the Black Sea: What next?

About the Author(s)

You May Also Like