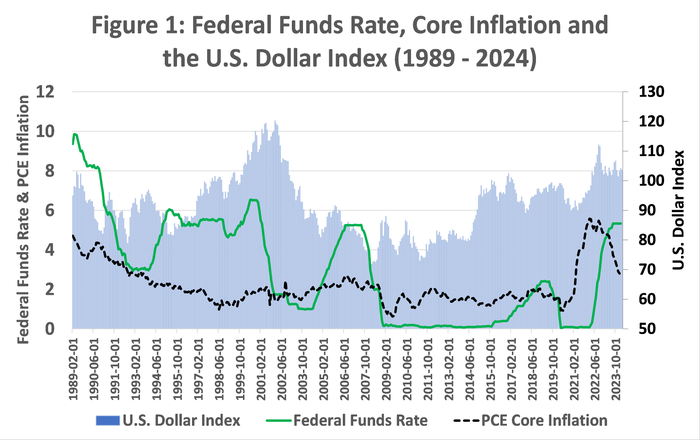

After two years of interest rate hikes, everyone from farmers to consumers is looking for some relief in the cost of money. But ag bank economists say it’s no surprise the Federal Reserve decided not to lower interest rates at their quarterly meeting this week.

Source: Board of Governors of the Federal Reserve System, Bureau of Economic Analysis, MarketWatch

“Inflation data came in slightly higher than expected for February and the Fed needs more evidence that inflation is easing. If we get some good inflation data and inflation gets closer to 2% moving forward, it’s possible to get a cut sometime this summer. The Federal Reserve also tends to stay on the sidelines during an election year, so I wouldn’t expect much activity leading up to the election,” says Matt Erickson, economic adviser with Farm Credit Services of America.

Farm Credit economic adviser Matt Erickson expects to see two or three interest rate cuts in the second half of the year. Credit: Mike Wilson

Roland Fumasi, ag economist and head of RaboResearch Food & Agribusiness - North America, agrees.

“We’ve been telling people for months not to expect the federal reserve to start dropping rates until June 2024 or later,” he says.

The Federal Reserve is in a precarious place in history. If it holds rates higher for too long, it could tip the economy into recession. If it drops rates too fast, an overheated economy could spark inflation, even worse than before.

While inflation is off its highs, it has not come down at the rate the Fed expected when it made its December 2023 projections. Meanwhile the labor market continues strong, with low unemployment.

“The labor market is just too hot,” says Erickson. “Unemployment is 3.9% and wages remain strong.”

A year ago, markets expected a series of interest rates cuts, with the Fed’s benchmark short-term Federal Funds Rate falling near 4% this year and 3% in 2025.

Erickson expects rate cuts to happen at just 25 basis points at a time.

“We could see just two or three rate cuts in the second part of the year,” he predicts. “We’re not expecting the fed to be super aggressive with interest rate reductions. It could take 2 to 3 years, once it starts, for the fed to get the fund rate down to the 2.5% to 3% range.”

Fumasi expects rates to come down the second half of the year and continue to come down, barring some major economic surprise.

“There’s a tremendous amount of geopolitical risk globally right now,” he says. “Over 50% of the global population is going through some major election this year, so there will be a lot of changes, not just in the U.S. but globally. That creates a lot of uncertainty and could impact trade flows. It creates risk, which means volatility --positive or negative.”

Lower interest rates could cut farm costs for everything from inputs to equipment to land. That would be welcome relief, especially if lower commodity prices continue under the weight of high world grain supplies.

Even so, the Fed is being patient for a good reason, argues Erickson.

“The last thing the Fed wants is to relive what farmers experienced before the ‘80s,” he says. “If we want to be serious about the future of the economy and farming, we have to get inflation down to 2% even if it means keeping interest rates higher longer.”

About the Author(s)

You May Also Like