If you’re going to plant cotton in 2024, you will have to deal with the risk of good weather. According to the Climate Prediction Center, U.S. cotton producers in some regions have 50:50 odds of normal precipitation and 30% to 70% odds of above-normal precipitation in other areas. This is a forecast, so anything can happen. But it is the best moisture forecast we’ve had for the last several years, and it is on top of improving soil moisture conditions.

So, why do I describe this in terms of risk? Because if you’re going to plant cotton, and I think many of you are, price risk may be more influential than production risk this season.

Many Texas and Oklahoma growers will likely maintain their recent cotton acreage levels, ensuring their 2024 crop with a planting time base price in the upper 70s or low 80s, plus the implied lint value of the cottonseed endorsement.

All good and well, but if the forecast of above-normal precipitation plays out, then there are several implications. The first is that, in the aggregate, higher U.S. production may weaken ICE cotton futures before harvest-time, assuming demand doesn’t improve.

At the farm level, better growing conditions suggest that it is less likely to trigger crop insurance policies like yield protection. The more revenue protection policies could still trigger from potential declines in price. But with yield loss less likely, it would take a really large price decline to trigger a 75% revenue protection policy, e.g., a decline in Dec’24 down below 60 cents. Further down from there lies Uncle Sam’s “free” put option in the form of the loan rate. But let’s all hope that sub-60 cent futures are not in our future.

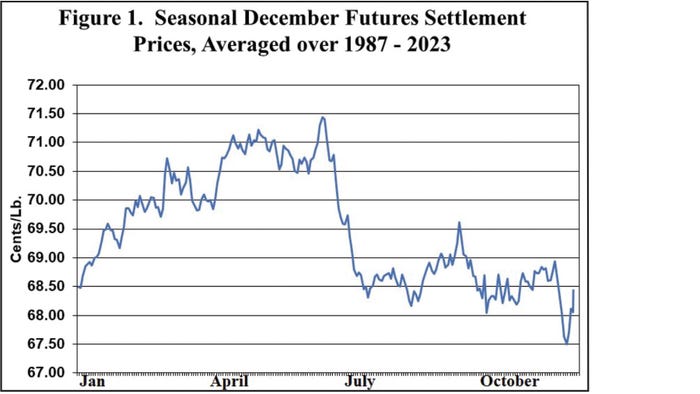

It goes without saying that a major rally in Dec’24 cotton futures in February would be timely as it would set the bar higher for the revenue insurance safety net. However, the average seasonal pattern is for rallies in December futures to happen between April and July (see Figure 1). Thus, the seasonal pattern may happen later than the price discovery window for crop insurance. Further the seasonal pattern reflected in Figure 1 shows historical price weakness during the late summer and fall seasons. This could leave the Dec’24 contract muddling around somewhere in the 70s by harvest time. Such an outcome implies only minimal support from safety net programs like PLC.

As shown by the average seasonal pattern in Figure 1, in-season prices rally to the highs during the second quarter, before weakening to the harvest-time lows. The straightforward way to capture this value is by reaching out and grabbing those higher prices – either through some cash-forward contracting or hedging.

For additional thoughts on these and other cotton marketing topics, please visit my weekly on-line newsletter at http://agrilife.org/cottonmarketing/.

About the Author(s)

You May Also Like