February 20, 2024

There’s an old saying, “The more things change, the more they stay the same.” This might apply to the Oklahoma/Texas, U.S., and world wheat situation. The biggest change caused by COVID and the Russian/Ukraine war may have been the price of wheat. There are signs that this price situation is getting back to normal.

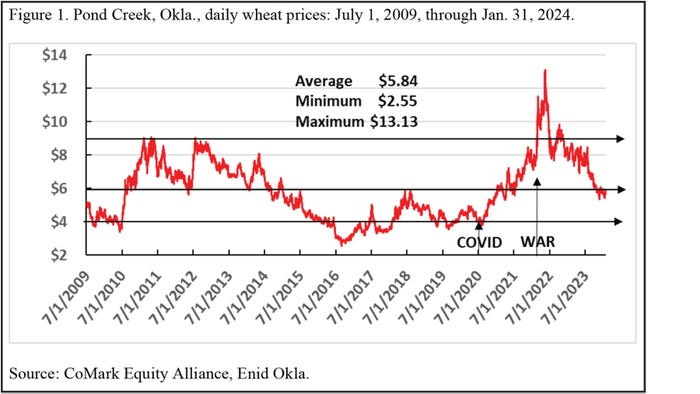

After COVID hit (2019), Oklahoma and Texas wheat prices went from just above $4 to $8 (Figure 1). After Russia invaded Ukraine (2022), Oklahoma wheat prices rose from about $8 to just over $13.

The average June 1, 2009, through Jan. 31, 2024, Pond Creek daily wheat price was $5.84. The highest price during the period of June 2009 through January 2024 was $13.13 (May 17, 2022), and the lowest price was $2.55 (Aug. 30, 2016).

The Oklahoma average monthly June 2009 through December 2023 price was $5.78, and the monthly average June, July, and August (harvest) price was $5.83. The lowest average monthly harvest price was $3.43 (2016), and the highest average monthly harvest price was $8.78 (2022).

At this writing, the Pond Creek, Okla., and the Perryton, Texas, 2024 wheat harvest forward contract price is $5.50 (KEN24 - $0.55). The 2024 wheat harvest forward contract price is about $0.30 below the average price and about $1.20 above the average February 2019 price.

COVID and the war also caused higher production input prices. In February 2019, the fertilizer price index was 85. The index peaked in April 2022 at 294. The January 2024 fertilizer price index was 116.

In February 2019, the retail price of diesel ultra-low sulfur was $3 per gallon. Diesel prices peaked at $5.75 in June 2022. The 2009 through 2023 average diesel price was $3.33. The average January 2024 diesel price was $3.85.

The Russian/Ukraine war has also altered world wheat production and exports. Russia captured about 20% of Ukraine’s crop land. The result is higher wheat production and exports for Russia and lower production and exports for Ukraine. The net result for Russia and Ukraine is slightly, but probably insignificant, lower production and exports. Russian 2024 wheat production is projected to be the second highest on record due to above-average yields and an increase in harvested acres.

Ukraine’s wheat production and exports are projected to be below average this year because fewer acres were harvested due to a shortage of production inputs.

The United States’ 2023/24 hard red winter (HRW) wheat stocks-to-use ratio is projected to be 48% this year compared to 33% last year and a 15-year average of 48%. The world’s 2023/24 wheat stocks-to-use ratio is projected to be 33% compared to a 15-year average of 34%.

Current Oklahoma and Texas wheat prices ($5.69) may be slightly below normal because Russia and Ukraine are aggressively exporting wheat stocks that were built up during the last two years. Many believe that Russia and Ukraine determine the world price of wheat.

Market signals indicate that the world wheat market has recovered from COVID and that it has adjusted to the Russia/Ukraine situation. This may imply a return of below-average prices for the next few years.

About the Author(s)

You May Also Like