I have 63 students in my Commodity Marketing class this semester. On the first day of class, I told them (via zoom, of course) that if they want to understand grain markets, they must understand carrying charges – what they are and what they tell us about the bullish or bearish tone of a market. Does it sound like I know what I am talking about? Well, recent trends in the market have the professor wondering if he understands the corn market.

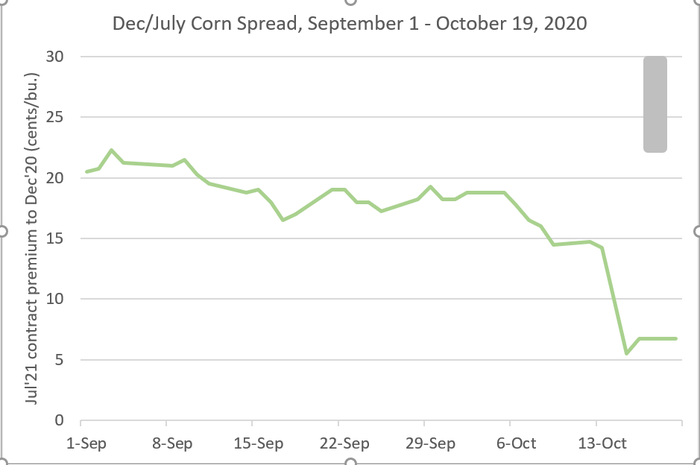

Here is what has me stumped. Crop size and stocks in corn are comparable to the past four years, a time when low prices and large carrying charges were the norm. However, as harvest started this year, carrying charges narrowed quickly (see chart below), signaling a fundamental change from bear to bull market.

Let’s review carrying charges – maybe then you will understand my puzzled demeanor.

Carrying charges are the price differences between futures contracts in different delivery months, e.g., January and May soybeans, or December and July corn. In fact, much of my carry analysis in corn focuses on the December/July futures spread. I find this spread interesting because it is a full view of the crop year – the December contract represents the first true new crop contract in corn, while July is the last true old crop contract for the same crop year.

Carrying charges are market-determined storage costs. When grain supplies are large, carrying charges are positive, i.e., deferred contracts trade at a premium to the nearby contracts. When grain supplies are small, carrying charges are small or negative, i.e., deferred contracts trade at a discount to the nearby contracts (aka an inverted market). Corn, of course, is our largest crop – positive and large carrying charges are the norm.

My carrying charges spiel in short: Big crops and large stocks mean lower prices and large, positive carrying charges.

So where do we stand this year concerning crop size? Despite a destructive derecho in August, our country will harvest 14.7 billion bushels, second only to 2016 in size. This is a big crop. And what is happening to stocks? Despite an active export market, ending corn stocks are projected to remain over 2 billion bushels, at the same comfortable level seen in the past four years.

As of mid-October, the Dec’20/Jul’21 corn carry is trading close to 7 cents/bushel. This is the second smallest harvest time carry in the past 20 years. Only the drought year of 2012 - when the Dec’12/Jul’13 spread inverted - was smaller.

These are not idle thoughts. The small carry from December to July is messing with my post-harvest marketing plans. In each of the last four years, a large carrying charge from December to July directed my actions. I “sold the carry,” i.e., placed harvested corn in storage and sold the July contract. That large carry and basis improvement ended up in my pocket.

This year, I have no large carry to sell. Should I hold corn in storage unpriced? Prices are up 20% or more since early August, and back to pre-pandemic prices. Am I that confident of continued export sales and LA Nina hurting crops in South America?

Here is my compromise. I will store as much corn as possible on farm. On two-thirds of the corn in storage, I will buy time and sell the March contract at a modest 4 cent premium to December. Maybe the spreads to May and July will widen in the next few months, and I can roll the hedge forward (buy back March and sell May or July). The balance will be held unpriced. Stumped or not, I cannot ignore a powerful market signal.

From 2016-2019, the Dec/July spread traded in a range, 22-30 cents positive carry (see the shaded box). The corn crop is large and ending stocks are projected comparable to the past four years. Why the small carry in 2020? Data source: CME Group. Chart by Edward Usset

Read more about:

MarketsAbout the Author(s)

You May Also Like