Since calendar flipped to 2024, many U.S. corn farmers are holding onto corn in the bins waiting and hoping for a price rally before making cash sales.

The January USDA report left a price wake of destruction after U.S. corn yield was increased, keeping carryout at a stubbornly large 2.1 billion bushel number despite an uptick in U.S. corn demand.

Is there anything on the horizon that could inspire a price rally? Potentially yes, with the answer lying in Brazil’s safrinha corn crop.

What’s happened

A negative January USDA report, showing stubbornly large supplies of U.S. corn supplies has weighed on corn futures prices in early 2024. After all, 2.1 billion bushels of U.S. corn for U.S. carryout is a burdensome supply factor that may weigh on prices for the short term.

What next? Will prices rally? If so, when? What is the next “marketing hope” that corn futures price have?

Why is Brazil’s safrinha crop a market factor?

Global corn production seems likely on the rise. However questions are surfacing in regard to Brazil’s second-crop corn production, known as the safrinha crop.

This safrinha corn is the crop that many nations of the world rely on for import during the month of August, when the U.S. crop is not yet ready to be harvested.

This is the crop that competes against the U.S. export market. If there are production issues for the safrinha crop, that may mean more export opportunities for U.S. farmers, which is especially important now with low corn prices.

Safrinha crop production may already be at risk

This year’s Brazil soybean crop was planted late in many parts of Brazil due to adverse growing conditions. Why does that matter?

The safrinha corn crop is planted in late February and early March, right after the combines harvest soybeans in Brazil.

Note that the bulk of the growing season for that second crop corn is March, April, May, and early June, with harvest beginning mainly in July and August.

A late planted soybean crop in Brazil, means that the soybean crop will then likely be harvested late, which means the second crop corn will be planted later than desired, leaving it to grow in the traditionally dryer parts of the production year cycle.

Odds are already against having a record corn crop in Brazil, and the USDA already agrees with that notion, based on the production reduction shown on the January USDA report.

The safrinha crop is already at risk of late planting, which means it would grow during their dryer weather months, and then may be harvested late.

From a marketing perspective

The question is, can the Brazil corn crop afford to lose any production? Not really. And that matters to global corn production, global ending stocks, a potential increase in U.S corn export demand, and a potential price increase down the road – a rally U.S. farmers are desperately hoping to see.

Understanding Brazil corn supply and demand

Over the past decade, Brazilian farmers have taken advantage of their growing seasons and weather and have discovered the benefit of double-cropping corn behind soybean planting.

Their ability to double crop has created a dramatic increase in their corn production.

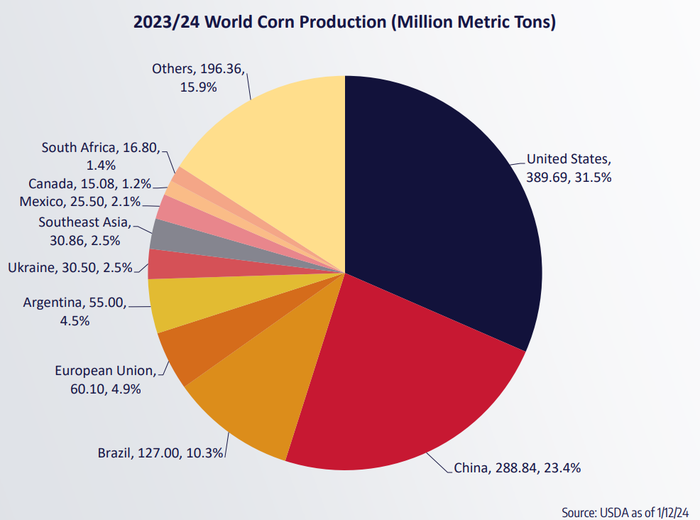

Back in 2011, Brazil corn production was near 75 million metric tons, but now thanks to double-cropping corn, their production ballooned to 137 million metric tons in the 2022/23 growing year.

For the 2023/24 crop year, the USDA already has Brazilian production pegged at 127 million metric tons, slightly smaller number than the year prior.

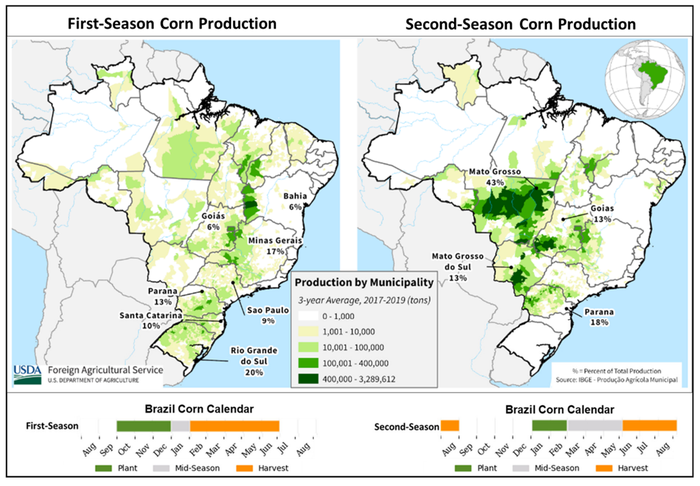

Now the next thing to remember is that Brazilian corn production currently has two primary growing cycles. First crop, and safrinha second crop, and how much corn is produced during each cycle.

Right now, growing in Brazil is first-crop corn, which is expected to be 25% of their total production. So, if the USDA currently is estimating Brazil 2023/24 production to be 127 mmt, that means only 32 mmt of corn is growing in their fields right now as “first-crop” corn. That also means that the remaining 95 mmt of corn of expected Brazil corn production has not yet been planted!

Brazil corn demand

This “first-crop corn” will be harvested in late February and March and primarily is kept in Brazil for their own domestic use.

So get this, according to the USDA, Brazil domestic consumption is pegged at 77.5 mmt, (with 63.5 of that slated for domestic feed). That means what is growing right now in Brazil likely will stay in the country for livestock feed. Additionally, some of that second-crop corn also needs to stay in Brazil to meet further domestic demand.

The USDA pegs Brazil exports (which is the bulk of their second-crop corn) at 54 million metric tons. If Brazil exports 54 million metric tons, and they use 77.5 for domestic consumption, then total demand is slated for 131.50 million metric tons.

And yet, according to the USDA, they are slated to only grow 127 million metric tons, down from the December USDA number of 129 mmt, which is also down from last year’s number of 137 million metric tons).

No room for weather error

Remember, three quarters of Brazil’s total supply of their overall crop hasn’t even been planted yet. And yet all of its demand is spoken for. All. Of. It.

At the moment, Brazil ending stocks for 2023/24 are pegged at 6.97mmt, down from 7.97 mmt in December of 2023, and down from 10.27 mmt in 2022/23 production year. So there is a slight bit of “cushion” if their overall corn crop is lower, but not really that much. Farmers in Brazil are already talking about even lower first-crop corn production that what the USDA is saying.

There is NO room for error in production of the Brazil second crop corn. None.

Get ready

If there is a weather issue in Brazil for the safrinha crop, the market may start to trade that news during the months of March or April.

Regarding your marketing strategy, if you are choosing to sell corn in your bin sooner than later, perhaps consider a corn re-ownership strategy, just in case there is a weather flare up in Brazil in a few months. That would be the friendly fundamental news needed that would likely prompt the funds to exit their hefty short positions.

But also keep in mind that holding out hope for a poor second-corn crop in Brazil is not a great way to market your corn in your bin. What if they end up having “good enough” yields and sufficient production to meet that demand?

Be ready for anything.

Reach Naomi Blohm at 800-334-9779, on X (previously Twitter): @naomiblohm, and at [email protected].

Disclaimer: The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Individuals acting on this information are responsible for their own actions. Commodity trading may not be suitable for all recipients of this report. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Examples of seasonal price moves or extreme market conditions are not meant to imply that such moves or conditions are common occurrences or likely to occur. Futures prices have already factored in the seasonal aspects of supply and demand. No representation is being made that scenario planning, strategy or discipline will guarantee success or profits. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing. Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services, LLC is an insurance agency and an equal opportunity provider. Stewart-Peterson Inc. is a publishing company. A customer may have relationships with all three companies. SP Risk Services LLC and Stewart-Peterson Inc. are wholly owned by Stewart-Peterson Group Inc. unless otherwise noted, services referenced are services of Stewart-Peterson Group Inc. Presented for solicitation.

Read more about:

BrazilAbout the Author(s)

You May Also Like