USDA’s Jan. 12 reports contained plenty of surprises for corn and soybeans. Unfortunately for growers, those surprises were bearish, sending prices into the dumpster.

Optimists may think the move to the lowest corn prices in four years – three for soybeans – may mean futures are finally setting up a turnaround to move higher. But picking bottoms can be every bit as difficult as picking tops, with confirmation assured only in hindsight.

Of course, in the depths of the Great Depression, a popular Fred Astaire song told folks to “pick yourself up, dust yourself off, start all over again.” But life is anything but a bowl of cherries for those with old crop inventory to price.

For starters, USDA increased its estimate of 2023 production of both crops, increasing forecasts for how much of that supply will be left over at the end of the marketing year Aug. 31.

What would it take for grain prices to start singing and dancing again like an old-time movie musical?

Corn’s tall task

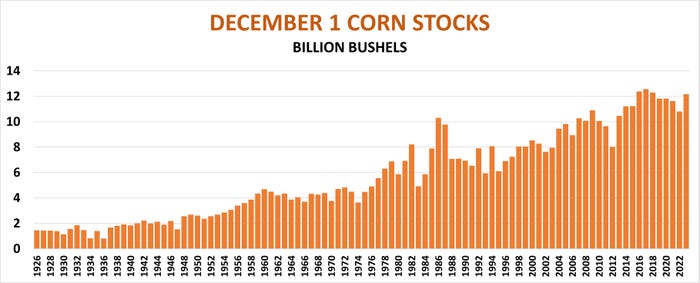

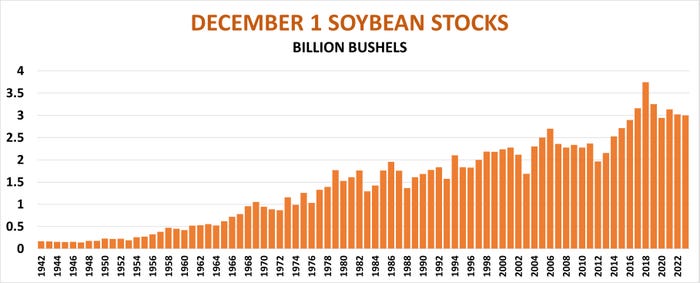

Corn faces the most daunting odds, at least on paper. While Dec. 1, 2023, soybean inventories actually fell compared to 2022, the nation’s corn pile as winter began jumped 12.5% to the most since 2018. Over the past 30 years stocks increased to new highs – and prices foundered – after similar rebounds.

Larger Dec. 1 inventories aren’t in and of themselves bad for prices – if strong demand eventually whittles down the surplus. Otherwise, supply isn’t likely to change much if at all until the government publishes its final estimate of production at the end of the marketing year in its end of September update.

Out in the field

Some relatively minor adjustment could be made because farmers reported 831,000 acres still out in the field when the government surveyed producers in December, 576,000 more than a year ago. But even if all that ground was unharvested, total production might fall by barely 100 million bushels, not enough to sway the needle.

Demand shoulders burden

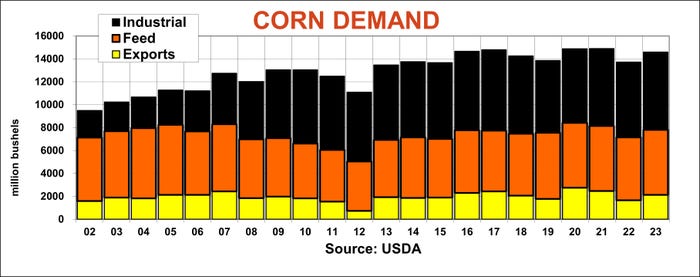

That puts the burden of proof for rallies squarely on the shoulders of demand. In its latest World Agricultural Supply And Demand Estimates, USDA did boost its forecast for usage by 75 million bushels to 14.565 billion, up 859 million from the 2022-2023 marketing year. But with supply up 106 million from December and 1.36 billion from 2022-2023, projected ending stocks rose 31 million bushels to 2.162 billion, nearly 60% more than the previous year, enough to push the average cash price received by growers to $4.80 a bushel, down 27% from 2022-23.

USDA could be low-balling demand for livestock feed, ethanol plants and exports. But without some fairly dramatic improvement, the agency could also be overstating how much end users want, keeping the price outlook gloomy.

Looking for bargains

Lower prices do tend to entice buyers, but only if they fear shortages down the road or feel today’s offers are a deal they can’t refuse. Data so far isn’t encouraging.

Total usage for exports and usage at ethanol plants during the first quarter of the marketing year from September through November was previously reported by various USDA departments. Feed demand as usual is only an estimate because statisticians have no way of knowing how much really walks off the farm. But apparent feeding during the first quarter appeared to be around 2.29 billion bushels. That’s the least since 2018, and less than indicated by USDA’s WASDE forecast for the entire crop year, which went up 25 million bushels Jan. 12 to 5.675 billion

Feed usage could be stronger than normal from the winter through the spring, if animal herds expand, livestock prices surge or bitter cold weather lasts. Competing rations likely won’t be an issue – wheat feeding has averaged less than 85 million bushels recently. Food inflation is down to more normal levels, but consumers are still feeling the pinch from higher costs for shelter and energy according to the latest Consumer Price Index out Jan. 11, so wary shoppers may still sit on their wallets in the meat aisle.

Fueling a wild card

USDA’s forecast increase for usage to make ethanol also could turn out too high. Drivers use more biofuel the more they drive. But the price at the pump remains over $3 a gallon, down from the $5 pain at the pump experienced in 2022 but still well above levels enjoyed before war and pandemic disrupted the market.

Ethanol’s discount to gasoline could encourage blenders and drivers to use more, but the U.S. Energy Information Administration continues to forecast less ethanol production and blending than implied by USDA’s forecast.

Crude oil could be another wild card due to the Israel-Hamas war. The U.S.-led attack last week against attacks on shipping raised fears of a larger conflict, boosting crude oil briefly. Crude prices retreated internationally Monday (when U.S. markets were closed) and seem fairly priced around $70 a barrel – hardly a bargain, but not the triple-digit stick many feared.

Factor in export volatility

Exports as usual could be the swing factor of demand – they historically are the most volatile from year to year. USDA made no change to its forecast of that category Jan. 12, keeping the marketing year total at 2.1 billion bushels. Total sales and shipments through the first week of 2024 suggest exports may turn out to be a little better than the government predicts, with the outcome of Brazil’s big second crop looming over the summer selling season.

But nothing so far indicates total demand from any of the usage categories will be enough by itself to give buyers a kick in the pants.

Growing season weather this summer could change those dynamics, but spring and summer are still a hope in the dead of winter. The next potential metric is 2024 acreage. USDA will update its statistical projection at the February 15-16 Outlook Forum, followed by closely watched Prospective Plantings at the end of March.

The current ratio of new crop soybean to corn futures tops 2.49/1, above its long-term average, which could encourage more soybeans and less corn ground. But a shift of 3 million to 4 million acres is already baked into most projections, so the March 31 numbers may have to be a real shocker to move the market much.

Soybeans hold on

Despite potential for a big jump in seedings this spring, soybean prices have fared better than corn, rejecting an attempt last week to test the $12 level. Though USDA increased its forecast for 2023 crop ending stocks last week to 280 million bushels, Dec. 1 inventories of just under 3 billion bushels were down from the two previous marketing years.

The problem for soybeans after the WASDE is due to increased supply, thanks to better yields, which rose from 49.9 to 50.6 bushels per acre. The additional bushels flowed directly to the bottom line of USDA’s balance sheet, knocking 15 cents off USDA’s average price forecast for 2023-2024.

My own supply and demand model is a little more encouraging, projecting better exports but not as big crush compared to the WASDE.

Crush in the first quarter of the marketing year was up 3.3% from the previous year, a good start but less than the government’s 4% forecast. Crush margins are down sharply from the fall, lingering near the bottom of their range over the past five years, hardly an incentive for a biodiesel boom.

Watch South America and China

Export hopes hinge mostly on two factors: South American production and interest from China.

USDA raised prospects for Argentina and its cut to Brazil’s potential was less than some expected though a little more than the country’s Ag Ministry estimate. Vegetation Health Indexes continue to point towards lower yields, despite December rains, as harvest begins to ramp up in the key center-west growing region.

USDA increased its forecast for total Chinese imports though U.S. commitments there so far are down 18% from the start of January 2023. China’s total soybean imports picked up in December, but the total for the first four months of the marketing year are only up 1%, less than the 2.2% USDA expects. A struggling economy and ongoing trade tensions continue to threaten U.S. soybean prospects, leaving the market adrift.

So, while markets aren’t quite singing “Brother, Can You Spare A Dime?” their tune is hardly “Happy Days Are Here Again.”

About the Author(s)

You May Also Like