Crop prices sprung to new highs the past 12 months, and farmers weren’t the only ones who noticed. Landlords did too, and now some of them want a bigger cut of your farm revenue. A recent Illinois farmland appraiser and farm manager survey predicted 11% increases in cash rent for 2022.

That could mean awkward conversations, tense negotiations, hard words – and worst-case scenario, you lose some of your land base. But what if I told you there’s a way to minimize all that headache and fear?

The flexible land lease is a way to keep both parties satisfied as grain prices and revenue move up and down in the ag cycle.

Darin Engelbrecht, Davenport, Iowa, has been converting landlords to flex leases over the past several years. These leases start with an agreed base rent; on one farm, for example, it’s $250 per acre. It’s a known minimum land rent both parties agree to. Then, Engelbrecht averages crop insurance prices set in February and November and provides a bonus rent to the landlord based on those figures plus his yields. He shares yield data off his combine, back checked by grain cart data.

“This way, there’s no elephant in the room when you have to talk to landowners about next year’s lease.”- Iowa farmer Darin Engelbrecht

“This way, there’s no elephant in the room when you have to talk to landowners about next year’s lease.”- Iowa farmer Darin Engelbrecht

It’s fully transparent. Landlords have no reason to ever believe they are being taken advantage of. And you really only need to negotiate this one time. Then both parties have full understanding of who gets what, based on yields and prices.

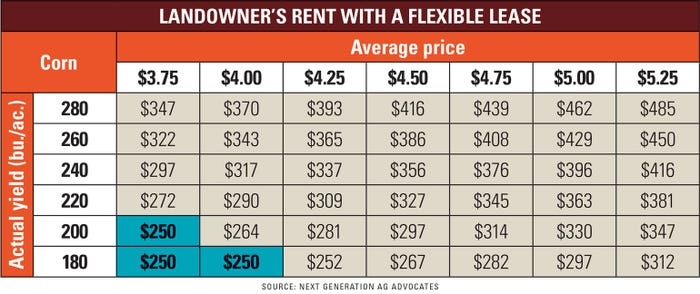

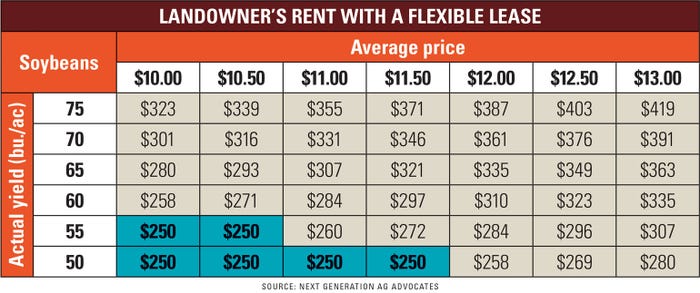

Land consultant Mike Downey, co-owner of Next Gen Ag Advocates, uses $250 per acre or 33% of gross revenue as base rent on corn acres. That 33% figure comes from averaging Iowa cash rent as a percent of gross revenue over the past 12 years.

So, let’s say you have a good year and corn yielded 220 bu. per acre; average price came to $4.25 per bu. Based on an agreed table (see sample), landowner returns would rise from $250 to $309/acre; if your average sale price was $5, landlord makes $363/acre. And so on.

“I looked at a lot of leases and wanted ways to reduce the argument and need to negotiate different numbers,” Engelbrecht says. “This way, there’s no elephant in the room when you have to talk to landowners about next year’s lease. If commodity prices have been low, you don’t have to worry about coming up with a song and dance to try to lower rent.”

I’ve been fielding calls from retired farmers who rent their land out, and want advice on how to approach the lease discussion now that grain prices have gone higher. Many are working with a great operator who takes care of the land and provides good records, so the owners want to keep that relationship going.

When they call me, I tell them, ‘try a flex lease.’

What’s fair?

Because cash rent leases are usually year-to-year with terms based on past performance, both owners and operators grapple with “what’s fair.” When grain prices rocketed higher from 2010 to 2013, tenant farmers made money as cash rents were slow to respond; then, as prices deflated over the past six years, cash rents were slow to respond and landowners made money. Now it’s reversing again.

With cash rent, someone always seems to feel like they’re on the short end of the stick. When there’s a winner and loser that doesn’t facilitate a long-term relationship. A flex lease removes anxiety for both parties and takes the heartburn out of the annual lease discussion.

“These agreements move with what’s happening now instead of basing cash rents on what happened last year,” notes Downey.

A few caveats

A flex lease will only work if both parties trust each other.

“To be successful you have to be transparent with your landlords,” says Engelbrecht. “I open it all up, lay it on the table for everyone to see.”

He’s 47 years old with a lot of farming ahead of him. His reputation is at stake. “I try to treat all farms, even the rented ones, as if they are mine,” he adds. “Some of my neighbors may be looking to rent out their farm someday.”

Engelbrecht started on flex leases after getting frustrated with cash rent on farms that barely broke even. Some landowners demanded more from their lease but didn’t want to reduce payments when prices were down.

Engelbrecht’s landlords who have adopted the flex lease have been pleased, including one who is a retired farmer. “When prices are better he gets a reward, and when prices are tougher, the result is less, but everyone knows what’s going on, so there’s no argument,” says Engelbrecht.

Get started

To start the flex lease discussion, first determine your goal for returns to management – say, 5% to 10%. “Once you pick that number you want to drive all your cost decisions toward accomplishing that figure,” says Engelbrecht. “I’ve got to make money or it’s not worth it.”

Next, work with an advisor like Downey to structure lease parameters. Robb Ewoldt, who also farms near Davenport, has a flex lease set up with a base rent per acre and $100 per acre returns to management (Ewoldt). Any revenue on top of that is split 50-50 between owner and operator.

“I love it when we beat that $100/acre level and write that bonus check to the owner,” Ewoldt says. “It feels like it’s a team effort – we’re both in it together instead of the adversarial role that you usually see.”

Engelbrecht agrees. “The flex lease makes landowners feel more a part of the farm,” he says.

A lease for the future

Another benefit to a flex lease is that next gen landowners – and tenants -- can continue using these same lease parameters as time moves forward. A 25-year-old operator may find herself working with an elderly landlord, or vice versa, but the flex lease helps avoid awkward ‘generation gap’ business disputes.

“I’m trying to set this up so that whoever comes back into this operation can use the lease parameters that are already set,” says Engelbrecht, who has a 16-year-old son waiting in the wings. “In this situation the younger generation will have someone to share the profits in good years and share the risk in the down years. And on the landlord side, when land gets passed on to young adults, you still have that transparency; there’s nothing to argue over.”

Engelbrecht has about half his landlords on flex leases, and he’s pushing hard to get the rest onboard.

“There are landowners who have asked me what flex lease looks like, and they seem interested,” he concludes. “All you can do is be as transparent as possible.”

Downey is holding a one-hour free webinar on 2022 lease strategies at 11 a.m. CST, Sept. 10, 2021. If you want to attend, leave an RSVP at www.nextgenag.us or email Downey at [email protected].

Read more about:

Land LeasesAbout the Author(s)

You May Also Like