With corn harvest now complete in the United States, farmer grain bin doors are closed as farmers await higher prices before the next round of selling.

The next question producers ponder is when will corn prices rally and how high can they go?

What’s happened

With the increase of planted corn acres in 2023 and decent yields across the Midwest this summer, corn production for 2023/24 is currently pegged at 15.234 billion bushels, with ending stocks at a stubbornly large 2.13 billion bushels.

From a marketing perspective

Farmers enjoyed two years of bull markets in 2021 and 2022, however, now that corn carryout is over 2 billion bushels, any significant price rally in the coming months will be difficult.

It would take a combination of an influx of increased U.S. export demand, terrible weather in Brazil for their Safrinha corn crop, and a drought here in the United States this summer in order to see $6.00 corn again.

However, history suggests that corn futures prices do have a tendency to rally into the New Year.

If this sounds familiar, I did write about this topic last year.

Seasonals

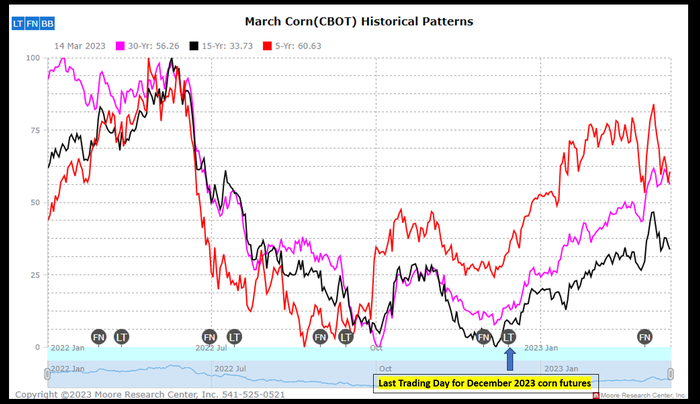

While past performance is not indicative of future results, the 5-year, 15-year, and 30-year price pattern for March corn futures suggests a rally after the December USDA WASDE report into the New Year.

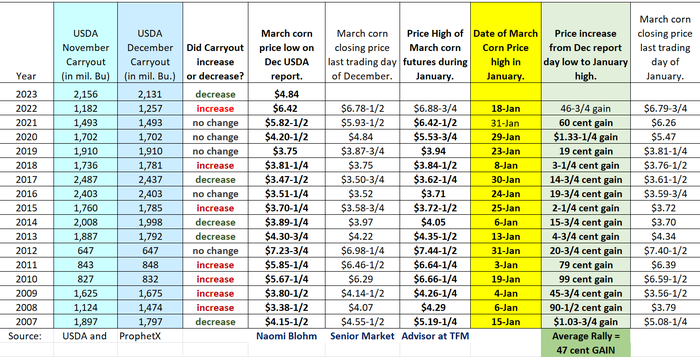

In fact, 16 out of the past 16 years, there has been a price increase for March corn futures into January.

Average March corn futures price rally is 47 cents

The information is black and white. I looked at what the price low for March corn futures was on the day of the December USDA report, compared it to the price of March corn on the last trading day of December, and then looked to see what the price high of March corn futures was during the month of January.

Sixteen out of sixteen years, March corn prices are higher in January than the price low of the December USDA report.

Prepare yourself

While the odds of some sort or price rally seem likely in the coming weeks, here is where I’m going to blatantly remind farmers: A 2-billion-bushel corn carryout does not justify $6.00 corn. Expectations for sky high prices rallies need to be kept in check.

In fact, when you look at the chart above, years where corn carryout is near 2 billion bushels, the rallies are less than the 47-cent average. So while there are odds of a price rally in the coming weeks, it may be a muted rally due to the high ending stocks number.

Whatever the price rally, (should one occur), use it to your advantage with cash sales. There will likely be many producers ready to sell corn early in the new year (also the new tax year).

Remember, for a significant price rally, it would take a combination of stronger than expected U.S. corn exports, a poor Safrinha crop in Brazil, and a poor U.S. crop this summer. Again, past performance is not indicative of future results, but the past 16 years tell a significant story for corn price history heading into the new year.

Reach Naomi Blohm at 800-334-9779, on X (previously Twitter): @naomiblohm, and at [email protected].

Disclaimer: The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Individuals acting on this information are responsible for their own actions. Commodity trading may not be suitable for all recipients of this report. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Examples of seasonal price moves or extreme market conditions are not meant to imply that such moves or conditions are common occurrences or likely to occur. Futures prices have already factored in the seasonal aspects of supply and demand. No representation is being made that scenario planning, strategy or discipline will guarantee success or profits. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing. Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services, LLC is an insurance agency and an equal opportunity provider. Stewart-Peterson Inc. is a publishing company. A customer may have relationships with all three companies. SP Risk Services LLC and Stewart-Peterson Inc. are wholly owned by Stewart-Peterson Group Inc. unless otherwise noted, services referenced are services of Stewart-Peterson Group Inc. Presented for solicitation.

About the Author(s)

You May Also Like