A recent comment on social media regarding corn caught my attention this week. In response to the recent corn futures price drop the author said, “Corn is acting as though it has a 2 billion bushel carryout!”

Odd, I thought, as a 2 billion bu. carryout would more likely constitute a corn futures price with a $3.00 handle.

Clearly, the person was venting about the price of corn falling below price support on daily charts, and perhaps they were remorseful about not pricing more corn earlier.

Yet the comment got me thinking. My first curiosity was if USDA traditionally made any dramatic changes to corn ending stocks between the November and December USDA reports. With the December USDA report coming up on Friday, the corn futures market is already technically oversold. Quite frankly, it would take an over-the-top bearish report to justify corn futures prices to crash significantly lower.

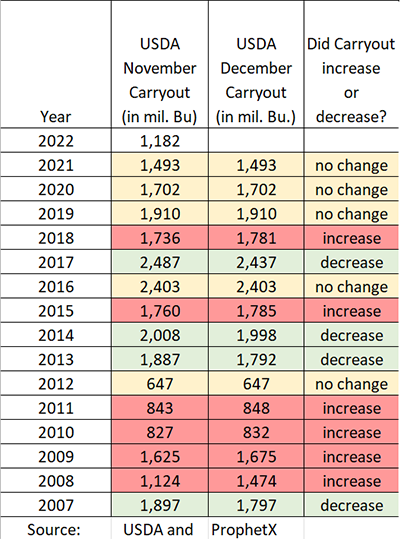

I looked back at the past fifteen years of USDA reports to see if there was any glimmer of USDA history, trickery, or a golden nugget of information that might offer a hint of future corn price action. Unfortunately, the results were not that exciting.

Ending stocks

For the past three years:

USDA has not made any changes to the new crop carryout number from the November report to the December report;

In five out of the past fifteen years, USDA has made no changes to ending stocks from the November report to the December report;

Four out of fifteen years, USDA has decreased carryout;

And six out of the past fifteen years, USDA has increased corn carryout from the November report to the December report.

A quick glance at the amount of the increase or decrease in ending stocks suggested nothing dramatic or overly surprising.

Hmm. With nothing dramatic offered in terms of large increases to carryout, or small decreases to carryout, with the USDA making no changes for the past three years, how did corn prices respond?

Seasonals

Next, my curiosity got me looking at seasonal price patterns for corn futures prices. Do corn prices have a tendency to fall apart into year end? Does it matter if carryout perception is deemed “large” or “small?” With current U.S. corn carryout the smallest it has been in a decade, does that matter to prices? What if the funds keep selling? What if the Feds keep raising interest rates? Will U.S. corn export sales pick up?

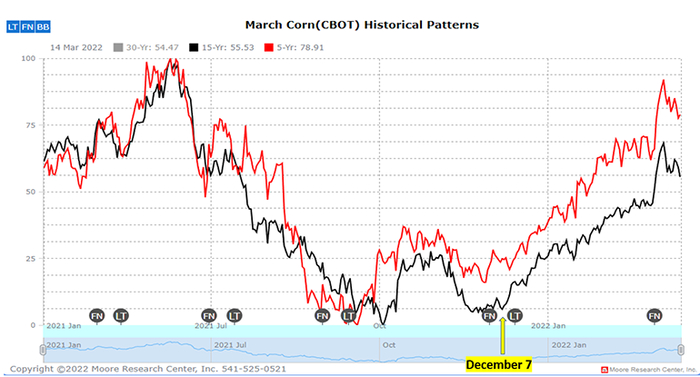

All of these questions are very pertinent, but the quiet confidence of the March corn seasonal chart suggests that corn futures find a low around December 7 and start to trade higher into the New Year and beyond.

Of course, past performance is not indicative of future results, yet this is actually quite a strong seasonal. How strong? I did the deep dive for you.

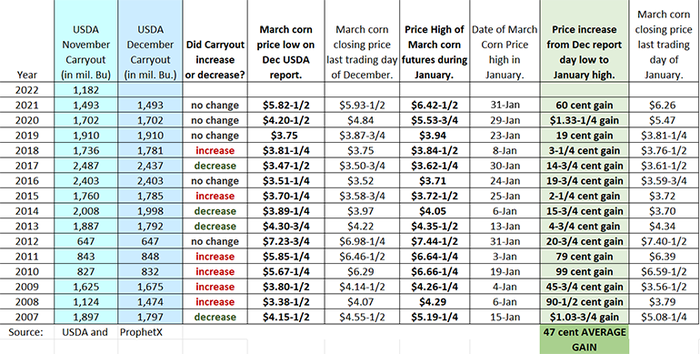

The average March corn futures price rally is 47 cents

The information is black and white. I looked at what the price low for March corn futures was on the day of the December USDA report, compared it to the price of March corn on the last trading day of December, and then looked to see what the price high of March corn futures was during the month of January. Fifteen out of fifteen years, March corn prices are higher in January than the price low of the December USDA report!

Now, do take note that four of those years the price of corn went slightly lower after the December USDA report, before rallying during January. But those were also years when corn carryout was closer to 2 billion bushels, than the 1.182 billion bushel number printed on the November 2022 USDA WASDE report.

Also take note, that the date of the “January high” occurs throughout the month. Also take note that years where carryout were perceived as overall “smaller,” the price rally into January tended to be on the larger side of the spectrum.

This is good news for those storing corn at home. Use it to your advantage. And if by chance you are an end user reading this commentary, consider booking your needs on this recent corrective break.

Again, past performance is not indicative of future results, but the past fifteen years tell a significant story for corn price history heading into the New Year.

Reach Naomi Blohm at 800-334-9779, on Twitter: @naomiblohm, and at [email protected].

Disclaimer: The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Individuals acting on this information are responsible for their own actions. Commodity trading may not be suitable for all recipients of this report. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Examples of seasonal price moves or extreme market conditions are not meant to imply that such moves or conditions are common occurrences or likely to occur. Futures prices have already factored in the seasonal aspects of supply and demand. No representation is being made that scenario planning, strategy or discipline will guarantee success or profits. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing. Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services, LLC is an insurance agency and an equal opportunity provider. Stewart-Peterson Inc. is a publishing company. A customer may have relationships with all three companies. SP Risk Services LLC and Stewart-Peterson Inc. are wholly owned by Stewart-Peterson Group Inc. unless otherwise noted, services referenced are services of Stewart-Peterson Group Inc. Presented for solicitation.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like