Your clock is ticking – and not just because it’s time for most growers to turn it forward an hour to start daylight savings time. March 15 is the deadline to sign up for the 2024 farm program and crop insurance, a key date on the risk management calendar.

These two choices combine to form the backbone for corn and soybean marketing plans no matter how you eventually sell crops going into the ground this spring. While these safety nets won’t come close to guaranteeing a profit for the average grower, differences in protection could easily run into the hundreds of dollars per acre.

The last piece of that puzzle – and it indeed is a puzzle – came with the extra day in February for leap year. Average new crop corn and soybean futures price for last month determined the spring price guarantees for Revenue Protection. The $4.66 for corn and $11.55 for soybeans dropped considerably from the whopping $5.91 and $13.76 levels set last year. Lower guarantees mean lower premiums, though an increase in market volatility readings used in the calculations should moderate the decline somewhat.

The farm bill also appears to be alive and well, at least through September, thanks to the extension approved last fall. But ARC-County, selected on 65% of 2023 corn and 84% of soybean acres, could have a little more competition from PLC, especially for corn. Reference prices went up above statutory minimums for the first time. The corn backstop of $4.01 could be in play, while soybeans could be a little safer at $9.26 depending on average cash prices for the marketing years beginning Sept. 1.

So here’s what the landscape looks like for corn.

Red ink flows

The average grower with average costs and no forward pricing done so far can expect plenty of red ink to show up on income projections, regardless of these decisions, unless prices mount a decisive comeback. That’s a big departure from last year, when higher crop insurance guarantees limited loss potential unless yields rose sharply enough to offset lower prices – an unlikely combination.

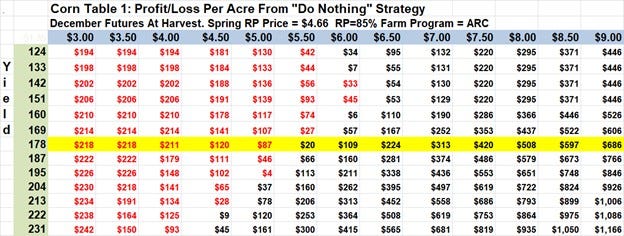

Table 1 below shows what happens to a farmer with an expected yield matching the statistical trend yield for corn this year of 178 bushels per acre, who selects ARC for the farm program and Revenue Protection insuring 85% of yields. December corn futures need to rally around a buck a bushel by harvest with that expected yield, and yields must hold up too, to avoid a lot of triple digit losses per acre. In other words, it’s not pretty.

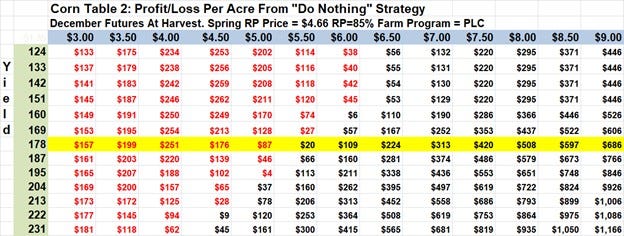

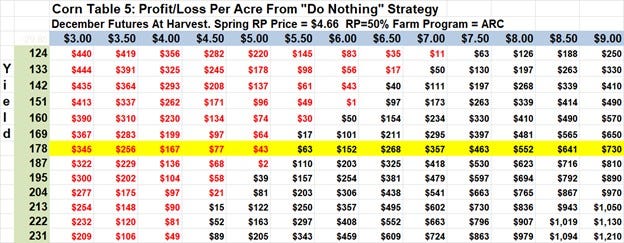

Selecting PLC along with 85% RP keeps the ink red in most of the boxes in Table 2. Turning a profit will still take sharply higher prices and yields for those who have done no forward pricing yet of their new crop corn.

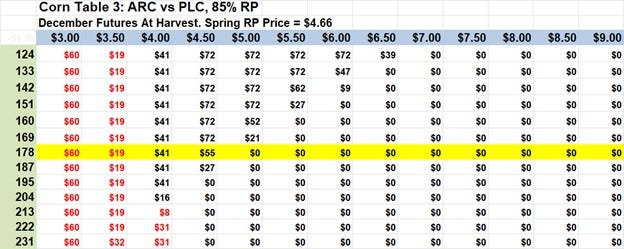

ARC and PLC both offer downside protection, but that benefit differs. PLC is based strictly on prices, so if the average cash price is below the reference price, the programs pay off. That why the change in reference prices for 2024 could make this plan worth a second look for growers who have stuck with ARC. Odds of prices falling below the statutory minimum of $3 weren’t too much of a threat previously – the average cash price stayed above that level over the past 20 years, even though futures at times breeched that barrier.

But harvest futures below $4 could ultimately give PLC an edge, unless the market recovers later in the marketing year. Otherwise, ARC nets more under some scenarios, though its benefits are only slightly more than its disadvantage the other way. Like RP, ARC is based on revenue -- price times yield -- and can pay off even with higher prices if yields fall enough.

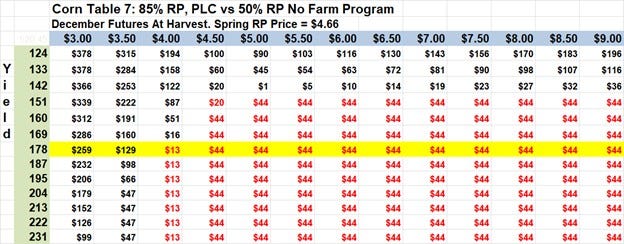

Table 3 compares the two program alternatives.

No thanks Uncle Sam

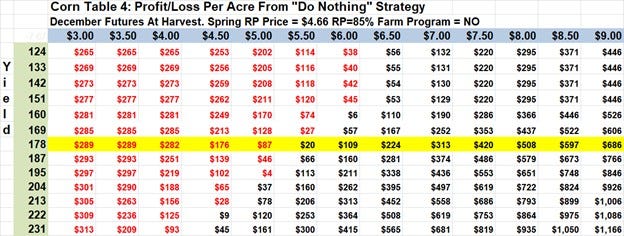

Of course, some growers won’t sign up for a program, due to neglect, political belief or economic judgment. Those with consistently good yields who don’t feel crop insurance is worth the cost may face less risk, if they can withstand the impact of low prices, due to significantly lower production costs or previous hedges made when the market was higher. Otherwise, potential losses could be greater under some scenarios.

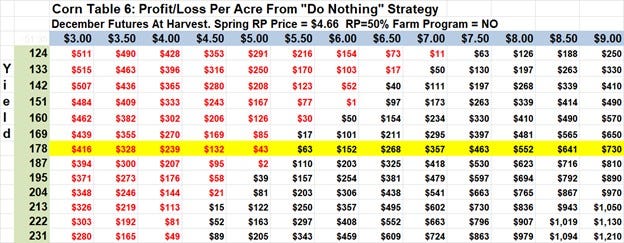

Table 4 shows the impact from forgoing farm program participation, while Table 5 presents what happens with only 50% crop insurance coverage, essentially bypassing this program.

Finally, Table 6 illustrates potential outcomes from opting out of both. Potential losses per acre under extremely low yields or sharply lower prices are the worst of any of the alternatives. Table 7 compares cost or benefit from bypassing crop insurance protection and farm program participation. The only benefit for our average producer is saving crop insurance premiums – at the cost of downside protection.

Past and present

What a difference a year makes!

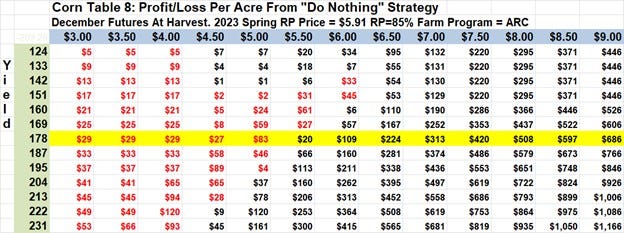

High spring price guarantees a year ago were an invitation for growers to “let ‘er rip,” and that’s exactly what they did. The risk of losing money wasn’t eliminated, but the threat of big losses was certainly limited, as demonstrated by Table 8.

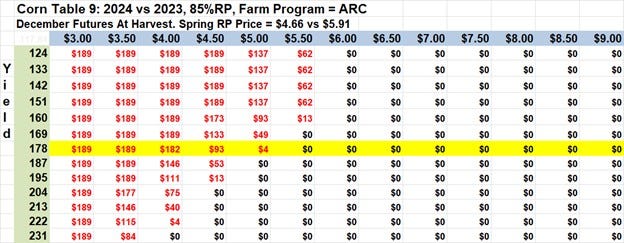

And, as seen in Table 9, the comparison between the two years’ projections isn’t even close, with last year winning or earning a tie on all combinations of yields and harvest prices.

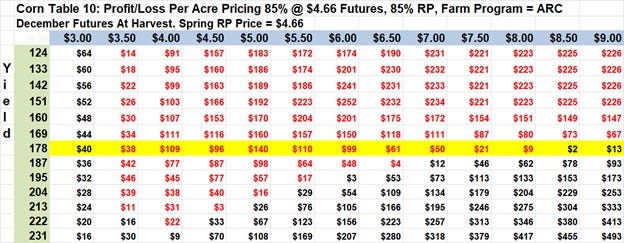

Unfortunately, growers wanting to improve their potential must play a waiting game for now. Potential profits from hedging the spring crop insurance price of $4.66 – above Friday’s close – are limited to either extremely high or low harvest prices. Those outcomes are the definition of outliers.

The alphabet soup of decisions involved with the Ides of March deadlines for crop insurance and the farm program is daunting. Choices are not limited to ARC or PLC, and if you sign up for PLC, SCO is also available. Your farm’s location also factors into the equation, since county-level data is often considered.

Base acres and yields are even more location specific, since every farm’s history varies.

That’s also true for crop insurance, and units used, like basic or enterprise, must also be selected. And every year some counties may be eligible for pilot programs.

In other words, averages used in this analysis likely don’t match your farm’s characteristics, which also include payment limits, production costs and tolerance for risk. Red ink on a table is hypothetical – unless it could seriously put your business survival at risk.

About the Author(s)

You May Also Like