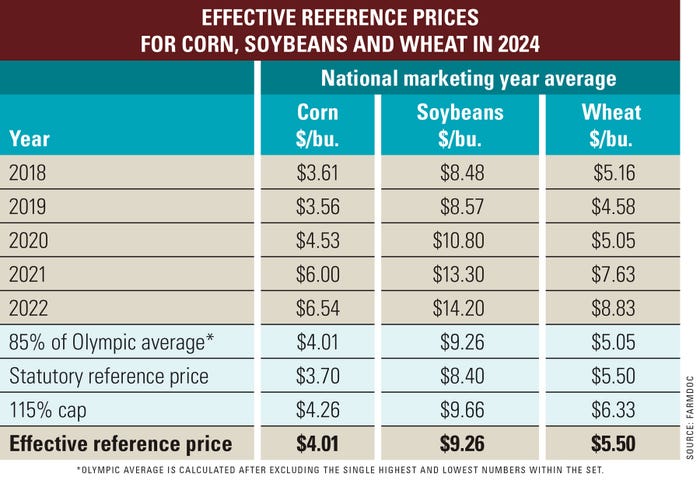

Coming off three consecutive years of high prices, the marketing year averages for corn and soybean prices exceed the statutory reference prices for these commodities, as outlined in the farm bill, for the first time ever.

The 2024 effective reference prices are $4.01 for corn, up 31 cents, and $9.26 for soybeans, up 86 cents. Wheat stayed the same, holding at $5.50.

These numbers are important for farmers who enroll in Agriculture Risk Coverage, which includes options for payments based on farm-level (IC) and county-level (CO) farm revenues, and/or Price Loss Coverage programs. The deadline to enroll and finalize acreage with the Farm Service Agency is March 15.

Nuts and bolts

ARC and PLC calculations use the higher of an Olympic average (in a set of five numbers, remove top and bottom numbers, and average the remaining three) for national marketing year average prices, or the statutory reference prices.

In 2023, MYA prices for wheat soared to a record high of $8.83 per bushel, while MYA prices per bushel for corn at $6.54 and soybeans at $14.20 trailed 2012 prices as the second highest on record. Since 2018, MYA prices for all three commodities have been in the top 16 highest for each commodity.

Because the Olympic average of recent MYA prices are so high, this year will be the first time that 85% of the Olympic average of MYA prices will be used as the effective reference price for corn and soybeans, instead of the statutory reference price.

That means that if producers sign up for an ARC or PLC program this year, and if ag commodity prices continue to drift lower, farmers are more likely to receive payouts from these insurance programs than in the past few years when prices have been high.

Exposed risk

ARC payments typically occur when there is a widespread yield loss, though they also include a revenue component using the effective reference prices. PLC payments are paid when prices dip below the effective reference price.

Through early January, ARC-CO policies appeared to have the best chance of payouts, though PLC could offer coverage if commodity prices drop at a precipitous rate. Corn revenues are at highest risk here, especially if Brazil can salvage a decent safrinha corn crop in the coming months.

All said, however, neither of these tools offers a high likelihood of payout this year without catastrophic weather or market events.

Read more about:

Federal Crop Insurance ProgramAbout the Author(s)

You May Also Like