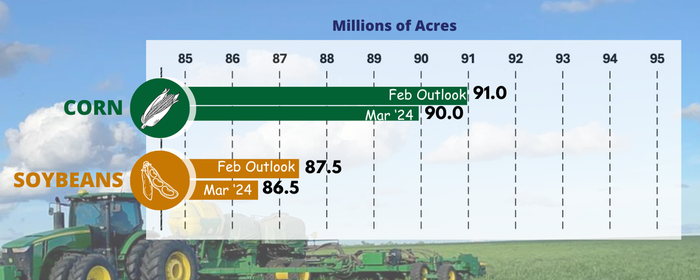

Farmers planted too many corn acres last year and the USDA says they intend to begin correcting this mistake in the 2024/25 crop. In its March 28 acreage report, the USDA set corn acres at 90 million compared to the average trade guess of 91.8 million.

This led the corn market sharply higher Thursday, trading up 21 cents at one point for the day. While this is market friendly news and we look for additional follow through next week, the long-term trend may still remain unchanged. Planting 90 million acres of corn still leaves our carryout slightly higher than last year when using trendline yields. Using February’s estimate of 91 million acres and a trendline yield of 181 bushels per acre, the ending stocks could have theoretically increased to 2.6 billion bushels. Shaving off 1 million acres certainly helps, as does an increase in consumption, which is reflected in lower quarterly stocks. Even so, at 90 million acres the carry-out increases to roughly 2.3 billion bushels, 200 million more than last year.

Watch for weather rallies

A lot can still change between now and the end of the season. Focus will now turn to weather which can easily lead to short -term rallies. Significant portions of the Midwest are still experiencing some portion of drought. We also see exports improving as our corn is competitively priced with that of Brazil. Brazil is out of corn and their second crop corn harvest won’t begin reaching ports until July. Excluding war-ravaged Ukraine, the United States is the only game in town for the next three months or so.

Remember: This is a forecast

That being said, we need to remind ourselves that this report is just a place holder. It shows planting intentions rather than what was actually planted. Meaning things can still change. Remember, last year the USDA said we were going to plant 92 million acres, a number that increased to nearly 96 million in June. Much of that likely had to do with higher crop insurance guarantees, which is not the case this year. But there is nothing to say that the USDA cannot still mess with these numbers yet.

Look for soybeans to rebound

The soybean acreage update was neutral. As soybean acres for next season were pegged at 86.5 million, dead on with what the average trade guess had estimated and nearly 3 million more than last year. We still think soybeans have short-term upside potential as all of the uncertainty of the report is now behind us.

Beans were getting beat up pretty hard leading into the report, which generally means they could rebound despite the lack of bullish news. Planting 1 million less acres than what was estimated at the USDA February Forum also helps keep a lid on soybean ending stocks.

Assuming our exports to China don’t fall apart, it is possible the carryover will stay in the 275-million-bushel range. While this is higher than in previous years, it is still considered relatively tight historically.

With the reports behind us, the market can hopefully let seasonal rallies begin to take hold. Supplies are still tight enough that weather can still be a significant market mover. Good luck on the 2024 planting season!

Matthew Kruse is president of Commstock Investments. Subscribe to their report at www.commstock.com

Futures trading involves risk. The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that CommStock Investments believes to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

About the Author(s)

You May Also Like