In part one of this two part series we shared why some farmers were ready to capture profits when opportunity came along during last summer’s rally. Here are two more reasons why 2016 was the ‘year of the hedge.’

It’s a habit

While the last 15 years saw some years of record prices, the market also stunk for large periods of time. Yet in all but one of those years, Farm Futures research shows profitable hedging opportunities were available for corn. Only two years were completely in the red for soybeans.

Little wonder, then, that the high-profit farmers we surveyed this summer were more likely than other growers to say they had priced about the same amount of corn and soybeans as they normally did. In other words, hedging was a habit — in this case, a good one.

Those high-profit farms rank in the top 5% of all producers, based on income and return on equity. Other growers who weren’t yet in this top group made the same leap by forward-pricing more than usual. By August, they had hedged 50% of their corn and 62% of their soybeans, and were more likely than average to be looking at higher income for 2016.

Jason Rogers, who farms and runs a trucking business near Ottumwa, Iowa, learned the necessity of both knowing his costs and selling when prices move above them.

“This spring when we had those rallies that were unexpected, I was already hedged at 125 bushels per acre on my corn crop, which is what I try to have every year before planting,” he says. “During those rallies, we sold some more corn. I pushed that number to about 150, because by May and June, I had a pretty good idea of what my corn crop looked like.”

With an expected yield at or more than 200 bushels, Rogers used basis contracts in August to lock in more of the crop with the rest sold off the combine or on the spot market out of the bin.

“This is going to be one of the better years I have had regarding profits,” he says.

A plan helped

In hindsight, selling looks easy. It’s not.

There’s the psychological pressure of wondering what happens if prices keep rising after you sell. Those fears intensify if the rally comes from adverse growing-season conditions that threaten yields. A sale of $10 soybeans that’s profitable with 55-bushel yields could bleed red ink if production falls 10% or 20%.

Crop insurance and the government’s Agriculture Risk Coverage (ARC) program provide some protection. But both come with built-in deductibles that leave growers on the hook for a significant chunk of the losses.

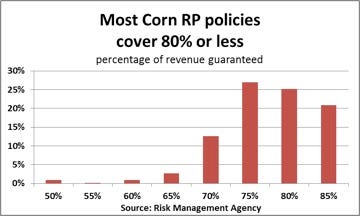

Consider popular Revenue Protection (RP) insurance. Growers are routinely advised to take coverage to guarantee 85% of revenues, based on the average futures price in February. But those policies are pricey, too, costing more than $21 an acre in 2016, even after subsidies. As a result, most RP policies covered 75% or less of revenues.

In pricing recommendations published in our email newsletter, Farm Futures Daily, we suggested two ways to deal with this problem. For corn, we recommended covering 50% of expected sales with a call option spread that provided $1 of additional upside protection on some of the revenues at risk if prices rose and yields suffered.

For both corn and soybeans, we recommended holding sales off until futures reached profitable levels, outside of some cheap out-of-the-money soybean puts.

Record U.S. corn and soybean yields lowered production costs to around $9.50 for soybeans and $3.90 for corn. ARC payments should help with additional revenues for corn, so we recommended more sales of both crops on the postharvest rally.

For all but the most vulnerable producers who have high debt and negative income, this type of patient approach likely will be prudent again in 2017 to balance risk and reward.

It won’t be a sure bet, and there’s no guarantee of success. Hedging isn’t easy, but it works.

About the Author(s)

You May Also Like