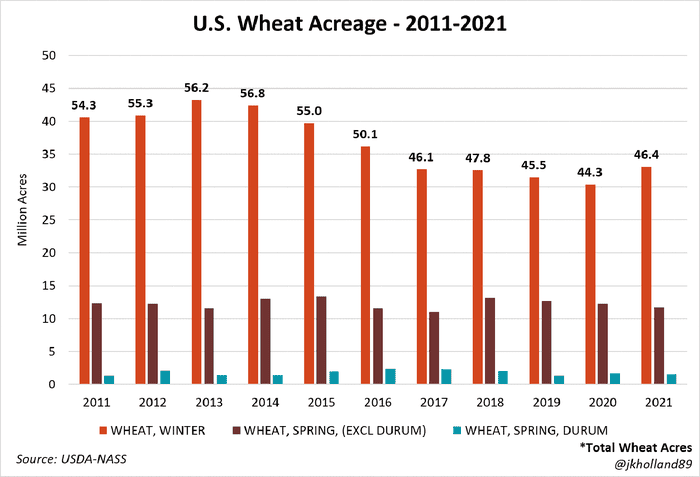

You can’t start a conversation about wheat in 2021 without bringing up the infamous “Acreage Debate.” Corn and soybeans largely stole the show in the March 31 Prospective Plantings report from USDA, but wheat made some substantial plays in the first official 2021 acreage forecasts.

USDA increased 2021 U.S. winter wheat acreage by 3.4% from its December 1, 2020 estimates to 33.1 million acres. It was a 2.7-million-acre, or 8.8%, increase from 2020 acreage – the largest expansion in winter wheat acreage since 2011 (winter wheat acres planted in Fall 2010).

Strong competing profit projections from other crops in the Northern Plains (corn, soybeans, sorghum, canola, barley) shifted both spring wheat and durum wheat acreage forecasts lower on the year. USDA projects 11.7 million acres of spring wheat will be planted in 2021, a 510,000-acre decrease from 2020 sowings. Since 2018, the U.S. has decreased spring wheat plantings by 1.5 million acres.

Durum acres also took an 8% hit on the year, falling to 1.5 million acres. Durum stocks are expected to shrink by nearly 42% since 2018/19 to 32 million bushels driven in large part by an identical increase to domestic usage rates between 2020 and 2019. The uptick in durum usage rates is largely attributed to increasing consumer preferences for pasta, produced by semolina flour from durum milling, during the pandemic.

This pushed 2021 total U.S. wheat acres to 46.4 million acres, the largest U.S. wheat acreage since 2018. Of course, wheat acreage remains at record low levels. The latest 2021 wheat sowings estimate will be the fourth smallest acreage on record. Last year’s wheat acreage of 44.3 million acres tops the charts as the smallest U.S. wheat acreage in history.

The June 2021 acreage report will provide further insights on how the 2021 acreage battle played out. There are many profitable commodity options for farmers to produce this year, so if spring wheat acres have any hopes of gaining a piece of the total U.S. crop acreage, planting paces will have little tolerance for rain delays, especially after cool and dry early spring weather.

Domestic supply forecast

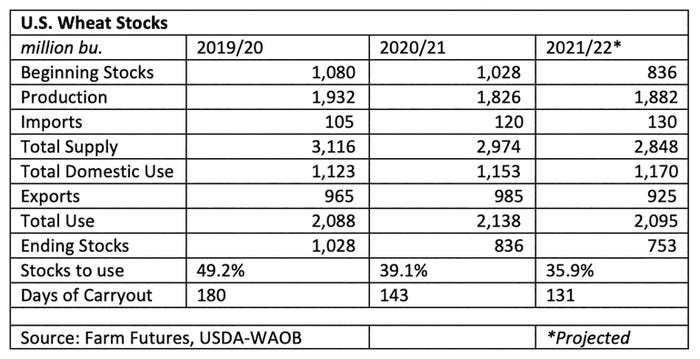

The acreage estimates suggest the U.S. will likely produce 1.88 billion bu. of wheat in 2021. The total, while not necessarily remarkable relative to past U.S. wheat crops, will likely be 55.8 million bu. higher than 2020 crop, provided trendline yields hold.

At this point, the likelihood of above average yields remains largely unknown after the mid-February 2021 cold snap sent temperatures in the Southern Plains plunging below freezing for several days. Winterkill estimates at the time spanned between 10% - 15% for the winter wheat crop, which was already under stress due to dry soil conditions in the region.

But USDA’s first Crop Progress report of the 2021 growing season indicated that 53% of U.S. winter wheat was in good to excellent condition, with jointing progress largely on track despite the February cold snap. Final yield damage will not be known until combines start rolling, but for now the crop appears to be in good shape, provided drought conditions do not further deteriorate.

Early estimates suggest 2021/22 ending wheat stocks could shrink to the tightest levels since 2013/14. USDA will not likely release updated new crop demand estimates until the May 2021 World Agricultural Supply and Demand Estimates (WASDE) report, but preliminary forecasts released at the February 2021 USDA Ag Outlook indicate that increased domestic feed usage will be a driving force behind shrinking stocks.

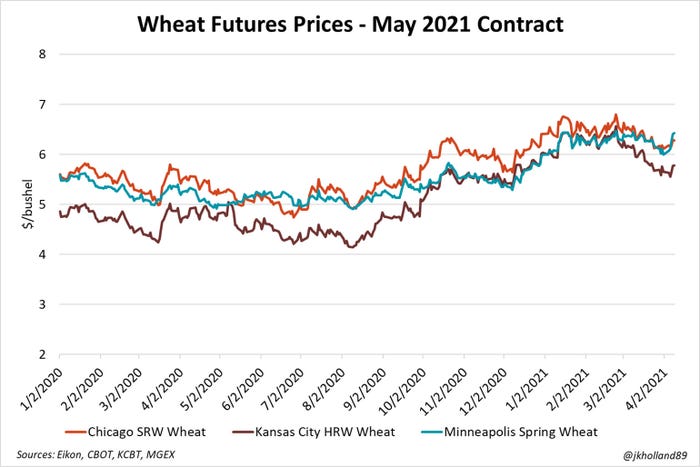

Despite smaller stocks, supplies are expected to remain plentiful through the 2021/22 marketing year, especially compared to corn and soybean ending stocks. Large supplies – both domestic and global – have been the most bearish factor impacting wheat prices this spring. The likelihood of bullish opportunities for the wheat complex will largely bank on gains in the corn and soybean complex as futures prices for both commodities continue to climb higher.

Around the globe

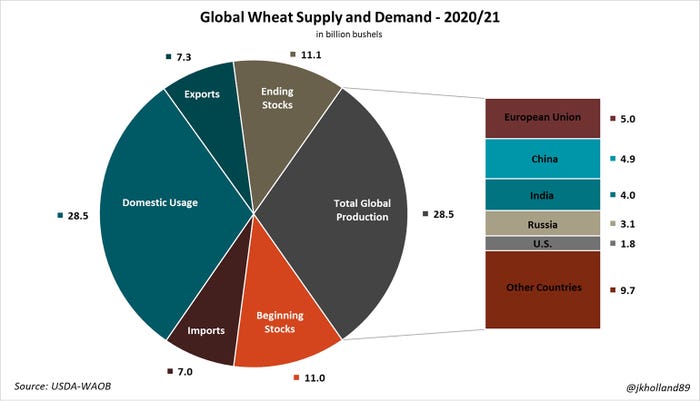

Global wheat output in 2020 notched a new record high of 28.5 million bu. But the output could have been higher – a wet planting season limited winter wheat sowings in the European Union (EU) and Russia and dry growing conditions due to a La Niña weather pattern stunted crop development. The smaller crop limited exportable supplies across Russia, Ukraine, and France through the 2020/21 marketing season.

The 2021 growing season started off on a much higher note. Weather conditions were largely improved for planting last fall and the prospect of higher wheat prices relative to previous years increased planted acres. Timely snow and rains across Europe and Russia this winter and spring provided adequate soil moisture for dormant and jointing winter wheat plants.

Early forecasts peg the 2021/22 Russian crop at 2.887 billion bu. thanks to the favorable growing conditions. Trade estimates range between 2.517 billion and 3.434 billion bu. Final Russian output will largely depend on how persistent dry conditions in the country’s Central District remain through the growing season, though early indicators point to another bumper wheat crop for Russia.

France, the EU’s largest wheat producer, also continues to see enviable weather conditions for its soft wheat crop. As of late March, 87% of French soft wheat acres were in good to excellent condition. Favorable growing weather in Ukraine, the world’s sixth largest wheat exporter, could see Ukrainian wheat production top 1.084 billion bu. in 2021, a 16% increase from 2020.

Again, the prospect of increasing global supplies in 2021 will take its toll on futures prices. Expect Russia, Ukraine, and EU wheat export paces to pick up this summer as more supply comes available. Russia’s export tax will likely slow export flows until its crop is harvested this summer.

Russia could export a smaller crop in 2020/21, according to a new forecast from Russian agricultural consultancy, Sovecon. After doubling its wheat export tax on March 1 to $1.606/bushel, Russia is likely to export nearly 1% fewer bu. of wheat, bringing its likely total to 1.43 billion bu. according to Sovecon’s latest estimates.

Russia will introduce a new floating export tax in June that could help wheat exports in June, but it would likely come at the expense of other crops, including barley and corn. "The domestic market is adjusting to the new taxes more slowly than expected," Sovecon said in a note last week.

Livestock demand soars to new heights

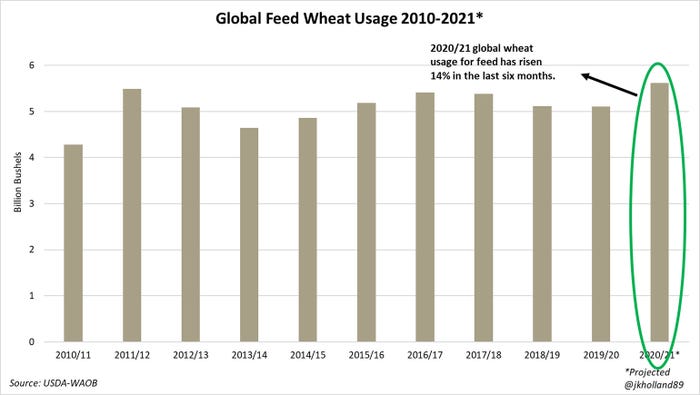

Rising livestock feed demand for wheat is the largest demand factor providing support to bullish wheat price rallies over the past few months. High corn and soybean prices have driven livestock and poultry feeders to the wheat market for cheap feed alternatives to maintain profitable feeding margins.

March 2021 WASDE forecasts place 2020/21 global livestock consumption at 5.6 billion bu. That figure has increased 12% since last June’s WASDE report.

China’s hog herd is the driving force behind increased global wheat feedings. In the same time period, Chinese domestic feed consumption in 2020/21 has risen by 551.1 million bu., or 75%, to a staggering 1.29 billion bu. as the nation bulks up rations for its rapidly recovering hog herd.

But the resurgence of African swine fever (ASF) across China this winter put the brakes on rising feed demand. Over half of the Chinese hog herd was decimated when the virus spread across the country between 2018 and 2019.

A government-sponsored pig herd rebuilding policy has helped swine supplies climb within striking distance of pre-ASF volumes. Faulty vaccines and other winter diseases slowed the recovery this winter, however. Meat demand in China continues to grow, so any rebuilding setbacks are likely to be temporary.

Rapid importing paces and rapid auctions of state wheat reserves have provided some relief to Chinese hog feeders. State auctions supplied nearly 618 million bu. of wheat to Chinese livestock feeders in the second half of 2020. Since January 1, 2021, the Chinese government has auctioned off 957 million bu. of state-owned wheat to livestock producers in need of feed supplies.

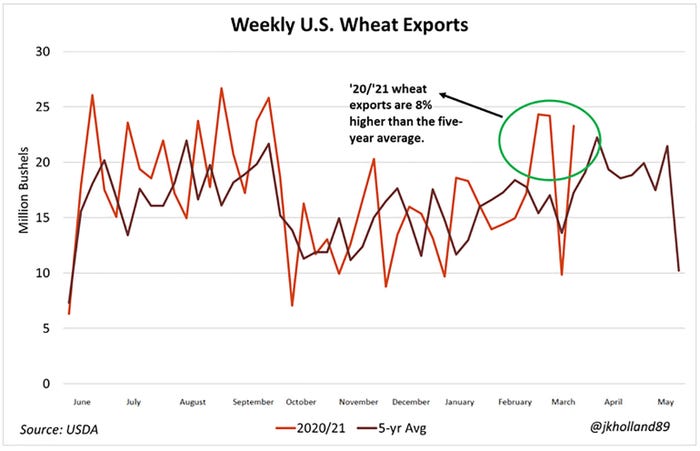

Exports heat up

Of course, the U.S. has been a significant source of wheat for China during the 2020/21 marketing year. Marketing year-to-date U.S. wheat shipments to China are nearly four times higher than total 2019/20 export volumes as China scrambles to source feedstuffs for its growing hog herd.

China has not been a large buyer of U.S. wheat in recent years, snapping up 20.2 million bu. in 2019/20, 1.5 million bu. in 2018/19, and 33.2 million bu. in 2018/17. But the world’s second largest economy has already procured 79.2 million bu. of U.S. wheat in 2020/21.

With less than a quarter of the 2020/21 marketing year remaining for U.S. wheat exports, shipping paces are largely in line with last year’s export loading volumes. Chinese demand has largely offset a 12% decline in U.S. wheat shipments to Mexico over the past year. Mexico is historically one of the top destinations for U.S. wheat.

Keep an eye on wheat export volumes over the next two months. USDA’s current export target of 985 million bu. remains in striking distance, with 74% of that goal (728.8 million bu.) already shipped out of U.S. export terminals. Nearly 200 million bu. of export sales remain outstanding in the final two months of the 2020/21 export season.

U.S. wheat exporters will need to ship all of that – plus around 50 million more bu. – to meet USDA’s demand targets. It’s certainly feasible as U.S. wheat export season ramps up and Black Sea exportable supplies remain constricted.

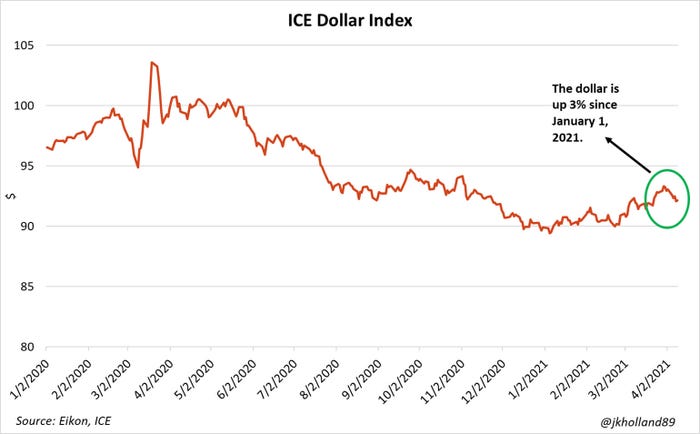

Dollar volatility

The dollar will also play a significant role in wheat export loading paces through the remaining marketing year. Due to the large scale of global wheat production, wheat prices are more likely to be impacted by currency fluctuations. And the dollar has had nothing short of a volatile year, dropping to a two-and-a-half-year low at the start of 2021 as the pandemic stalled the global economy.

But as vaccines roll out and the economy begins to reopen, the dollar has been on a tear in 2021. Since New Year’s, the Ice Dollar Index has strengthened 3% as stimulus measures supported early signs of an economic recovery.

The trend has surprised many market watchers, who expected the dollar to weaken as other countries recover from the economic fallout of the pandemic. But the U.S. currently leads the world in vaccination rates and is on track to restore more normalcy to economic activity much faster than other nations.

It’s not all wine and roses, however. The $1.9-trillion stimulus package passed earlier this year adds to a rising mound of public debt that has not been addressed for over a decade. A rapid reopening in the U.S. could release a sea of pent-up demand that could drive inflation rates higher faster than Federal Reserve officials are expecting.

Farmers are going to want to keep an eye on rising inflation rates because it strongly correlates to a weakening dollar. A stronger dollar relative to other world currencies makes U.S. wheat a more expensive sourcing option on the global market, as most commodities are traded in dollars.

What it means to you

Dollar volatility. International demand is highly dependent upon the dynamics of the dollar in the post-pandemic era. Keep an eye on financial markets – rising inflation from rapid economic reopening could send the dollar of the value lower.

Corn, soy rallies could support wheat. Global supplies are likely to remain high but expect complementary price support from any rallies in the corn and soybean market. U.S. supplies will be largely determined by weather conditions in the Plains in the coming weeks.

Export opportunities. As soybean exports to China dwindle, U.S. export terminals will likely have more capacity to handle increased wheat export demand. The timing of Russian sales as the current export tax is scaled back when the new crop comes to market will have a significant impact on U.S. export paces.

Watch shipping rates. Producers’ best opportunity for profits will be highly dependent on shipping rates over the next two months. While some price support will rely heavily on corn and soybean prices, farmers may want to consider establishing price floors through options strategies ahead of the 2021 harvest season

Stay safe in the fields this spring!

Download a complete version of the outlook with extensive charts and analysis using the Download button at the end of this report.

About the Author(s)

You May Also Like